Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

The FX Businesses of Investment Banks need to both grow revenue and diversify those revenues such that they are less dependent on FX market volatility.

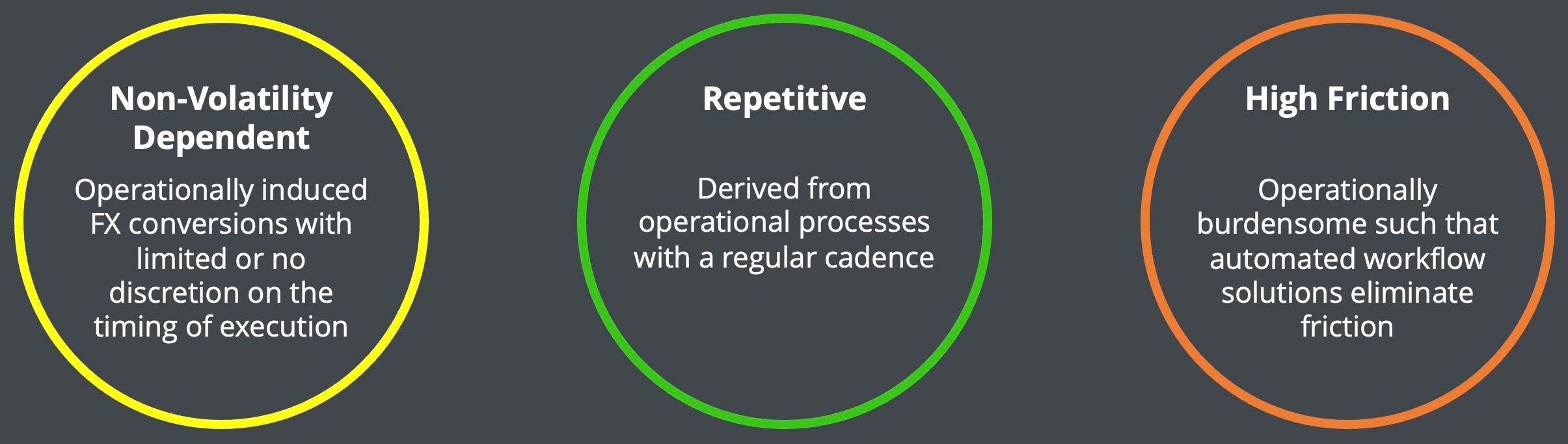

The most attractive source of additional, non-volatility dependent revenue streams arises from transaction flows originating from high friction, operational client flows from non-traditional sources. In particular, transaction flows from clients of the investment bank but not existing clients of the FX business that have people intensive workflows for FX conversions and where automated solutions would be highly valued by the client. For clients, these flows are often at the intersection of payments and hedging and are repetitive, costly and prone to error.

Whilst a number of banks have attempted to build businesses to target such flows, the technology solutions they have built to meet intial client needs has proved inflexible and failed to scale to meet diverse client requirements. Furthermore, success requires cooperation between distribution teams within complex organisations and existing sales credit performance measurement structures create significant disincentives.

To successfully realise the opportunity a new type of technology solution must be built. To build such a solution requires leadership with both deep experience in transacting across all product types and who posses relevant, hands-on technology experience.

Success further requires the proper inter business unit incentives and revenue sharing frameworks. The business therefore requires leadership with experience of building successful cross divisional joint ventures.

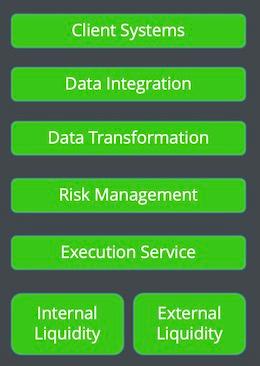

The required tech stack is highly componentised and has a number of critical success factors:

There are a number of benfits for an FX Business that successfully executes on both the technology and joint venture aspects of the opportunity:

The FX Market is a mature market. Margins have declined as technology has enabled clients to source liquidity through multi-bank platforms or find other ways of forcing banks to compete for their business. Reduced margins blunt the effects of increasing the volume of traditional flow business.

A further concern for senior management concerns FX businesses' revenues remaining highly correlated to levels of volatility. As the range of volatility outcomes increases, the value of FX revenues to shareholders risks declining.

The importance of building truly diversified sources of revenue that have low correlation to volatility levels has never been more urgent.

The opportunity exists to leverage technology to build substantial revenues from non-traditional sources by solving problems from clients' high friction operational processes.

The underlying transactions generally originate from clients such as Hedge Funds and Real Money Funds who do not trade FX as an asset class and for whom the need to transact FX comes from periodic, downstream operational processes. Typically, these processes are administered by team members whose job functions have no core need for FX execution expertise. The need to execute FX is often a necessary but burdensome.

Providing an automated solution that both determines the transaction reqiurement, provides execution and meets all the trade booking and reporting requirements is highly appreciated by clients. Time savings and risk reduction are often highly valued.

The benefits of such technology solutions are genuinely shared between the FX business and the client. The transaction flow opportunity is not volatility dependent, is repetative and comes from high friction operational processes that are ill suited for execution via multi-bank platforms. This mutual benefit is generally manifest in higher margins for the FX provider.

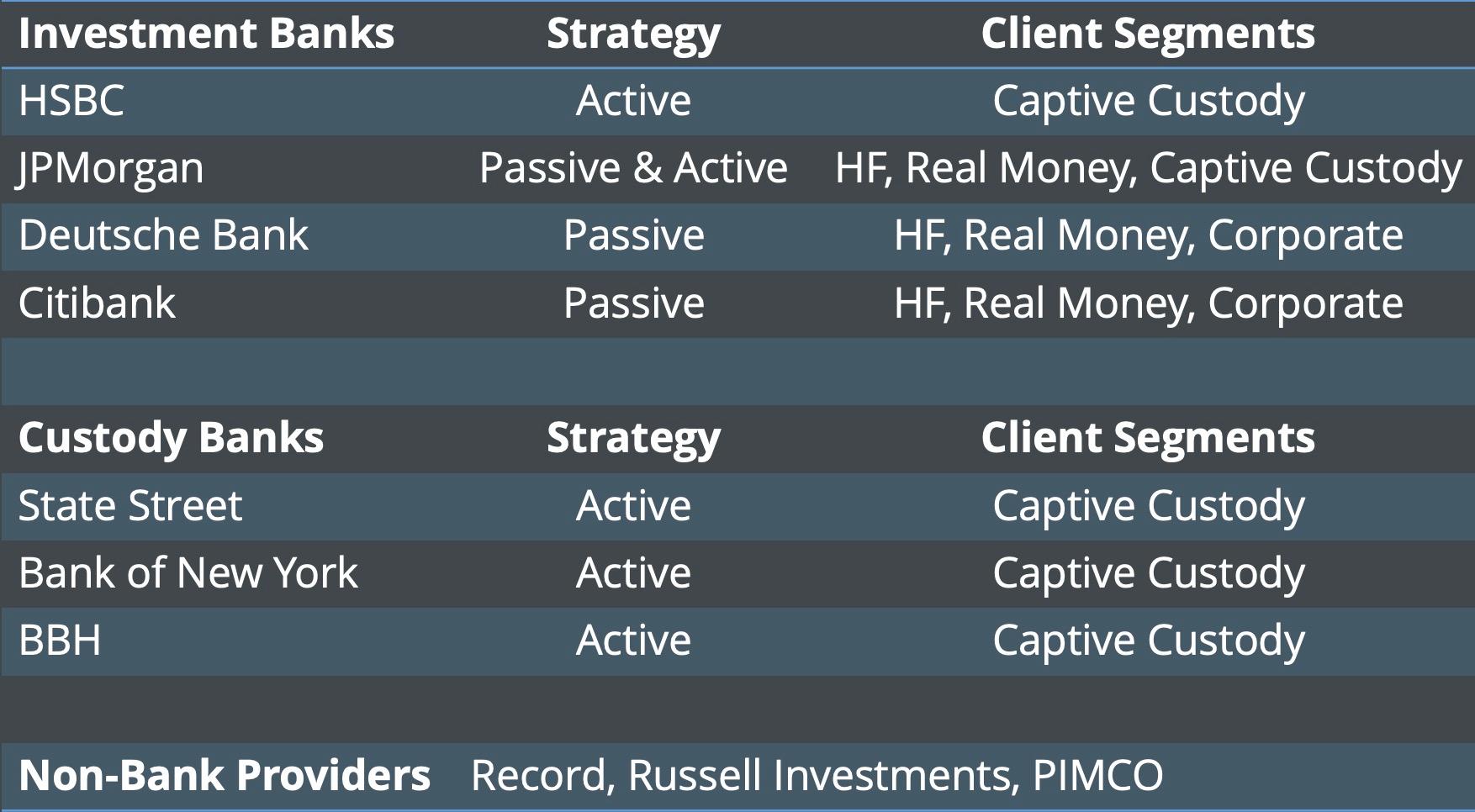

The leadership teams of FX Businesses lack the deep technology expertise and experience to effectively manage businesses where technology now represents the greatest differentiating factor. There a number of banks with meaningful Overlay-like businesses, however, the technology in all cases is too rigid to meet the challenge of clients with diverse, operationally driven needs. Poor execution of copy-cat Overlay type offerings at the leading FX businesses has resulted in technology that is ill suited to fulfill the true scale of the opportunity. Whilst these offerings support the headcount of small teams from their modest revenues, none have reached anywhere near the true scale of the opportunity. Furthermore, client needs remain unmet.

The offferings continue to be subscale from the failure to properly establish the internal joint ventures required to partner the relevant distributions teams external to the FX business unit with the products and solutions the FX business provides.

The customers with greatest needs are often clients of the investment bank but not clients of the FX business. Opportunities exist across many client segments including Hedge Funds, Real Money and Corporates. The greatest opportunities often originate from ideosyncratic, operationally driven FX conversions in Hedge Funds and Real Money clients that do not trade FX as an asset class and for whom FX transactions are necessary but burdensome.

Silod sales credit based distribution incentivisation policies often act as a barrier to the internal cooperation required to cross market FX solutions to clients. Without the appropriate alignement of incentives to properly reward each business unit, including actual revenue transfers and not just sales credits, the opportunity cannot be fully realised.

This requires a number of formal joint ventures to be established that provide for the appropriate measurement, incentivisation and fiscal transfers to properly reward each of the partners. Appropriate ongoing governance is required to ensure the partnership is being optimised.

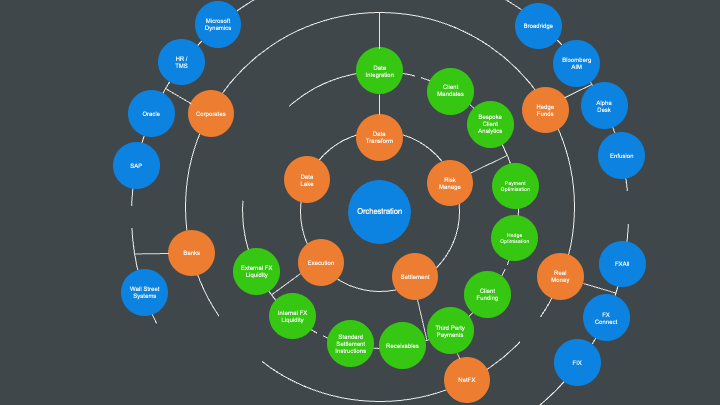

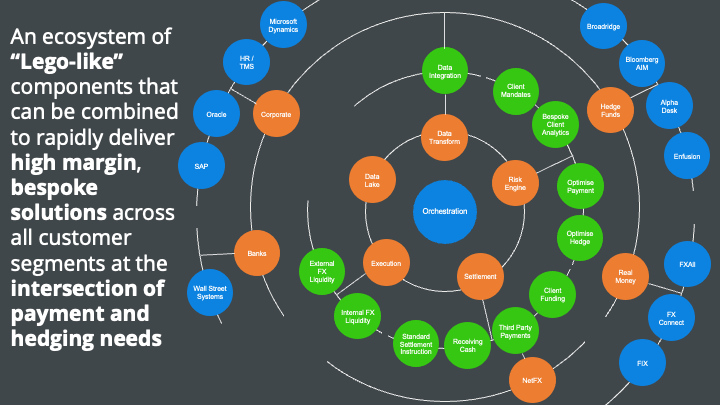

The technologies required to fully realise the opportunity need a central orchestration capability that enables bespoke client workflow solutions to be assembled from the relevant combination of component technologies. The orchestration layer also provides the client specific logic required to fit the clients business requirements. The ultimate objective is create fully automated workflows that require minimal human intervention once set up.

The graphic below describes the technology ecosystem in which the solution operates:

The worlds leading investment banks' FX businesses have failed to realise their best revenue opportunity. The challenge arises from both thought leading technology requirements and organisational incentives alignment. Few FX businesses have the necessary experience and skills to meet these challenges, leaving a significant opportunity unrealised.

However, for those businesses with a need to increase revenues and to diversify those revenues away from a dependence on FX market volatility the opportunity remains significant. The solution is to augment the leadership team with the appropriate skills and experience.

If you are looking to build a business in this space and require leadership then please contact me via the About section of this website.