Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

In the first part of this series I started to describe the background to FX4Cash, Deutsche Bank's international payments business, and the circumstances in which I came to lead the business. I covered how we prevented the business from being closed down and the first step we took on the path to success in the second part. In the third part I detailed the problems with the way in which FX4Cash was being distributed and the changes we implemented to unlock its potential. In the fourth part, I first described how the FX4Cash team was reorganised and given new roles and responsibilities. I then covered the transformation of the product management function and how and why the operations team were empowered to be leadership peers in the new structure.

In this section I will detail the problems that FX4Cash solved for corporate customers.

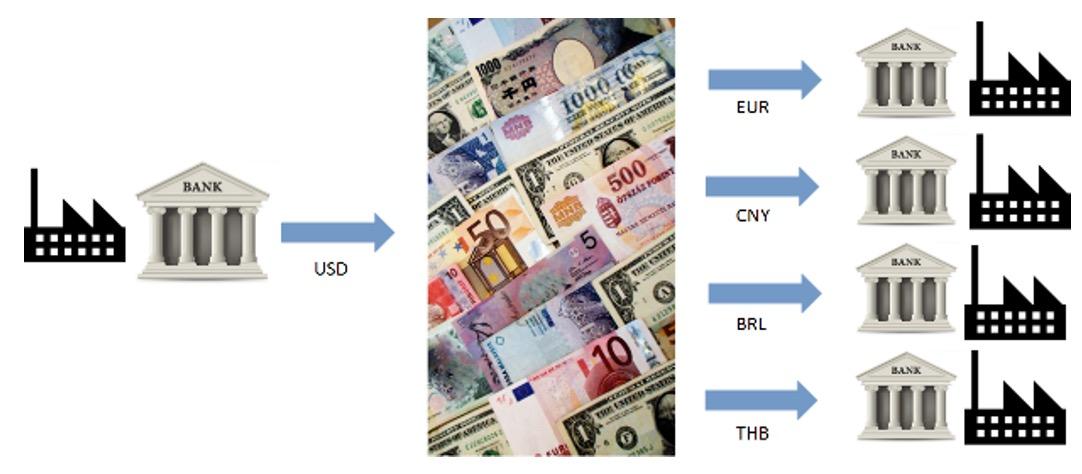

To understand the problems that FX4Cash solved for corporate customers it is first necessary to describe how the customers made cross-border payments prior to FX4Cash. The global payment solutions that existed prior to FX4Cash consisted of two options:

Prior to FX4Cash, most companies employed a hybrid global payments strategy that used both of the two options listed above.

For currencies in which multiple payments were required on a regular basis, companies would open an account in that currency with one of their cash management banks. This account would be funded by performing foreign exchange transactions when required to convert the companies functional currency into the payment account currency. Whilst this method works, it has a number of very significant drawbacks. Large multinational corporations often have highly complex supply chains and the number of currencies in which they need to make payments is large. Opening accounts in all these currencies is expensive and difficult to manage. Keeping track of all the accounts a large company holds is non-trivial. Maintaining security and debit authority for large numbers of accounts is time consuming and creates risk of fraud. Performing AML and KYC updates that cash management banks have a regulatory responsibility to conduct periodically is burdensome. Ensuring that each account is sufficiently funded prior to payment runs in those currencies creates a liquidity management challenge.

A key problem with this approach resulted from the way in which cash management banks provided some of the foreign currency accounts. In many cases the cash management bank did not have its own branch or other legal presence in the country in which the account was held. The account was provided by a third party bank as part of the cash management banks NOSTRO network. This resulted in payments requiring a number of hops through the various parties in the payment chain. It also required unnecessarily complex payment instructions. For these reasons, payments made from such accounts were prone to processing failures. When payments fail it can be both an expensive and time intensive process to remediate the failed payment.

Another challenge of holding a large number of accounts in different currencies is the effect on the profit and loss accounts when quarterly earnings are released. Holding cash in a large number of currencies requires those currencies to be translated back into accounting currency terms at the end of each accounting period. The volatility of currencies creates gains and losses in currency accounts that directly impact the profit and loss account at quarter end.

The biggest problem with making payments from a large number of currency accounts is the need to make a payment run for each of these accounts. This entails setting up each payment file from the company's ERP system and producing one file per account per payment run. Then for each payment run the treasury or accounts payable team would need to go through the security process for the relevant account for each payment run.

Therefore, maintaining large numbers of currency accounts and making payments from them has a number of critical challenges that create significant friction in the global payment process.

For currencies that payments are made infrequently it is not worth opening an account with a cash management bank. Instead, a payment will be made in functional currency and the receiving bank will perform a foreign exchange conversion to convert the functional currency amount into an amount of payment currency. There are many problems with this approach. The first problem is determining the amount of functional currency to send to the receiving bank. As foreign exchange rate fluctuate it often results in the receiving bank having a shortfall in payment currency. This results in an operational procedure to request the shortfall to be made up by a second payment of functional currency from the payer. This is usually a multi-day operational exchange involing the two banks in the payment chain. This operational procedure is costly in both time and money for both parties. Another critical problem with this process is the lack of control over the exchange rate used by the receiving bank which may charge excessive fees for the foreign exchange conversion.

Another significant problem with paying with functional currency was the need to make the payment two days prior to the payment date to allow for the two day settlement period for most foreign exchange transactions. This created an additional cost due to the loss of interest on the funds held in the functional currency account.

FX4Cash enabled a corporate customer to make payments in 130 currencies from a single payment file and by only making a single debit from the customer's functional currency account. FX4Cash eliminated almost all the friction from the legacy methods of making international payments.

FX4Cash enabled corporate customers to rationalise international currency accounts, eliminating the costs of those accounts and perhaps more importantly eliminating all the time intensive tasks associated with maintaining those accounts. Reducing the number of accounts help also minimised the risk of fraud or unauthorised use of those accounts.

As FX4Cash only required a single payment file, ERP systems were not required to produce multiple payment files. Making all payments from a single payment run eliminated the need to go through a security procedure for each currency as this burden was reduced to a single security procedure.

FX4Cash provided a hugely simplified solution to the challenge of making large volumes of payments in a broad array of currencies. Compared to legacy offerings FX4Cash was faster, cheaper and less time consuming. Customers were able to achieve vastly higher rates of straight-through-processing from the fully systematic payment processing that FX4Cash provided.

Customers also benefited from improved liquidity management by only being required to maintain sufficient funds in a single account to facilitate payments.

The vast majority of payments made by corporations using FX4Cash were made the same day or the next day. Only emerging market currency payments had a two day processing time. The payments that were made same day usually were processed end-to-end in a matter of minutes subject to successful compliance checks.

The ability to make same day versus next day payments was largely a function of the time zone that the payments were issued in. A customer issuing G10 currency payments from Asia would typically be able to make all payments same day. A customer based in the European time zone would be able to make all payments destined for that time zone and the Americas for G10 currencies same day. Payments to Asia, meanwhile, would be made on a next day basis as the payment systems in Asia would already have closed by the time the payment instructions were issued by the company. Payments issued by customers based in one of the US time zones would typically make most payments to Europe and Asia on a next day basis. For this reason, it was not uncommon for payment processing from US customers to be based on the West Coast of the US so that payments could be issued at the start of a new day in Asia.

FX4Cash enabled corporate customers to take control of the foreign exchange rates that cross-border payments required. There were a number of rate options available to customers that were designed to meet the requirements of the different types mandates under which the corporate treasury functions of the customers operated.

For example, some customers were mandated to use the same foreign exchange rate on all payments made in a particular currency on a given day. For those customers FX4Cash provided a daily rate that was tailored to the time zone in which the customer was based.

Other customers were mandated to use a rate that could be demonstrated to be within some tolerance of the publicly available rate at the time the payment was issued. These customers were typically required by the board to provide auditable transaction cost analyses periodically to demonstrate compliance with their mandate. FX4Cash provided real-time reporting to customers so that they had visibility of the rate used on each payment.

The foreign exchange rates applied to payments are a function of the size of the payment. The foreign exchange market does not deal in amounts less than one million of base currency where the base currency is typically US dollars or euros. Since the average size of payments through banks is of the order of $50,000 bank trading desks have to accumulate payments over time before they can trade the resulting position in the inter-bank market. To account for the risk associated with sub-market amounts the spread applied to the foreign exchange transactions to facilitate payments increases as the payment size decreases.

In order to provide clients with the best possible rates, FX4Cash provided a feature to customers such that they could elect to aggregate all payments in a particular currency in a payment file so that the best possible rate could be applied based on the gross aggregated amount of all the payments in that currency. This enabled the customer to benefit from much tighter spreads on the foreign exchange rates.

Customers with large volumes of payments could even negotiate custom pricing to be used in FX4Cash. The ability to offer the customers making very large volumes of payments their own tailored pricing agreements was highly valued by those clients.

FX4Cash was successful because it enabled corporate customers to eliminate the friction they had encountered in making international payments. FX4Cash provided corporations with a one-stop-shop for international payments that was simpler, better, faster and cheaper than the alternatives.