Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

The intention of this section is to give you a the knowledge of Reverse Knockout Options that will enable you understand what they are, how they are used and what needs to be considered from a risk perspective.

Your goals by the end of this section are to be able to:

Setting you up to acheive the goals of this section is our goal. Having some knowledge of knockout options, if you are not yet familiar with them, would help you achieve the section goals.

Reverse knockout options are a type of fx option and are one of the most widely used barrier options. Although they were introduced to the market much later than knockout options, their use became far more widespread far more quickly. Reverse knockouts are most often used to express a directional view. The reverse knockout option can also be referred to as the reverse knock out option, reverse knock out or reverse knock-out option. Don't be confused by this terminology, they all refer to the same product.

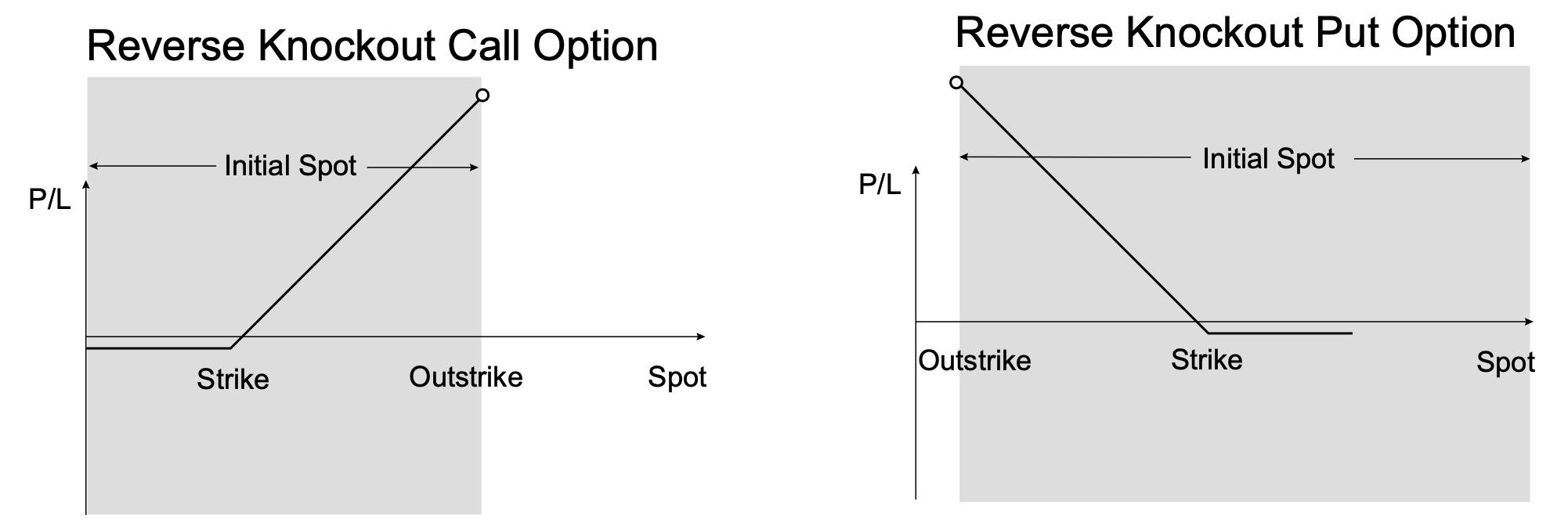

The reverse knockout option differs from a standard fx option by the additional feature of an outstrike price. If spot trades at or beyond the outstrike price during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the option, then the option terminates. If the outstrike is never triggered then the pay-off from the reverse knockout option at expiration is identical to that of the equivalent standard European option. The profit from a reverse knockout option is limited to the intrinsic value between the strike price and the outstrike price.

The cost of a reverse knockout option is usually substantially less than the cost of the equivalent standard European option.

The outstrike of a reverse knockout option differs from that of a knockout option in its location relative to spot and the strike of the option. The outstrike of a reverse knockout option is chosen such that the option knocks out as the option is gaining in intrinsic value. That is, the outstrike is triggered and the reverse knockout is terminated as spot is moving in the direction In-The-Money with respect to the strike price.

One of the key reasons why the reverse knockout option is typically substantially cheaper than the equivalent standard European option is that it's maximum payoff is limited to the intrinsic value between the strike price and the outstrike price, whereas, the standard European option has unlimited upside potential.

The maximum payoff is calculated as follows:

The reverse knockout option is a highly popular derivative trading strategy. It offers significant leverage. Given the location of the barrier the reverse knockout option is not suitable as a hedging product.

The reverse knockout option is ideally suited to expressing directional views, and is not suitable as a hedging instrument. European standard options offer the holder unlimited upside. However, even in long trending markets, the spot market does not move in a sudden straight line. The reverse knockout is therefore ideal for expressing a limited directional view within a specific time period. The great advantage of a reverse knockout is that it typically trades at a fraction of the cost of the equivalent European standard fx option.

Hints for structurers:

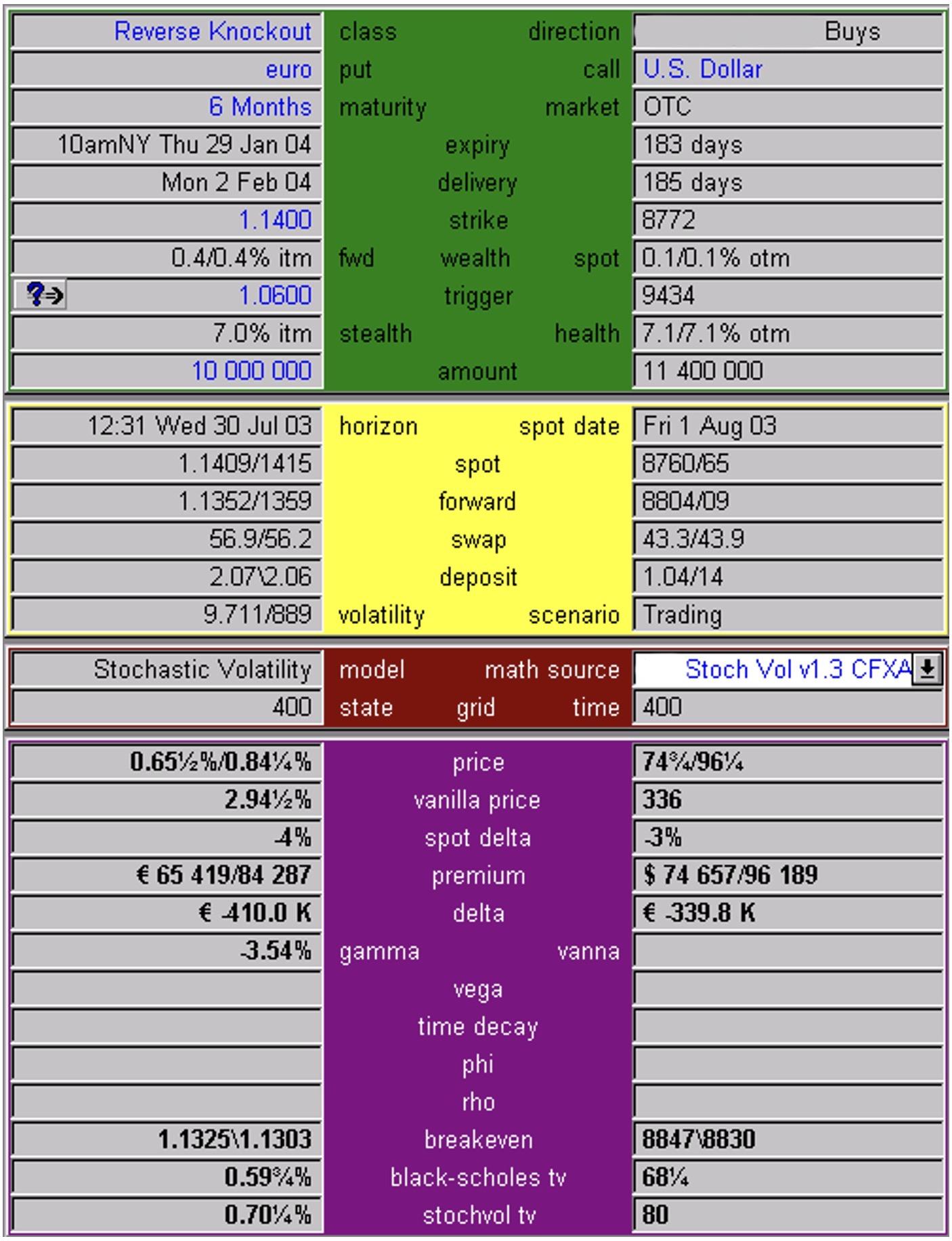

Maturity: 6 month Call/Put: EUR put / USD call Strike: 1.1400 Outstrike 1.0600

Spot: 1.1409/15 Swap: -0.00569/562 USD per 1 EUR ATM Volatility: 9.70/9.90

Price: 0.655% / 0.845% of EUR face

Equivalent standard European option: 2.915% / 2.985% of EUR face.

If spot trades at or below 1.0600 prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or below 1.0600 prior to the expiration time on the expiration date, then the buyer of the option will sell EUR at 1.1400 if spot is at or below that level at expiration.

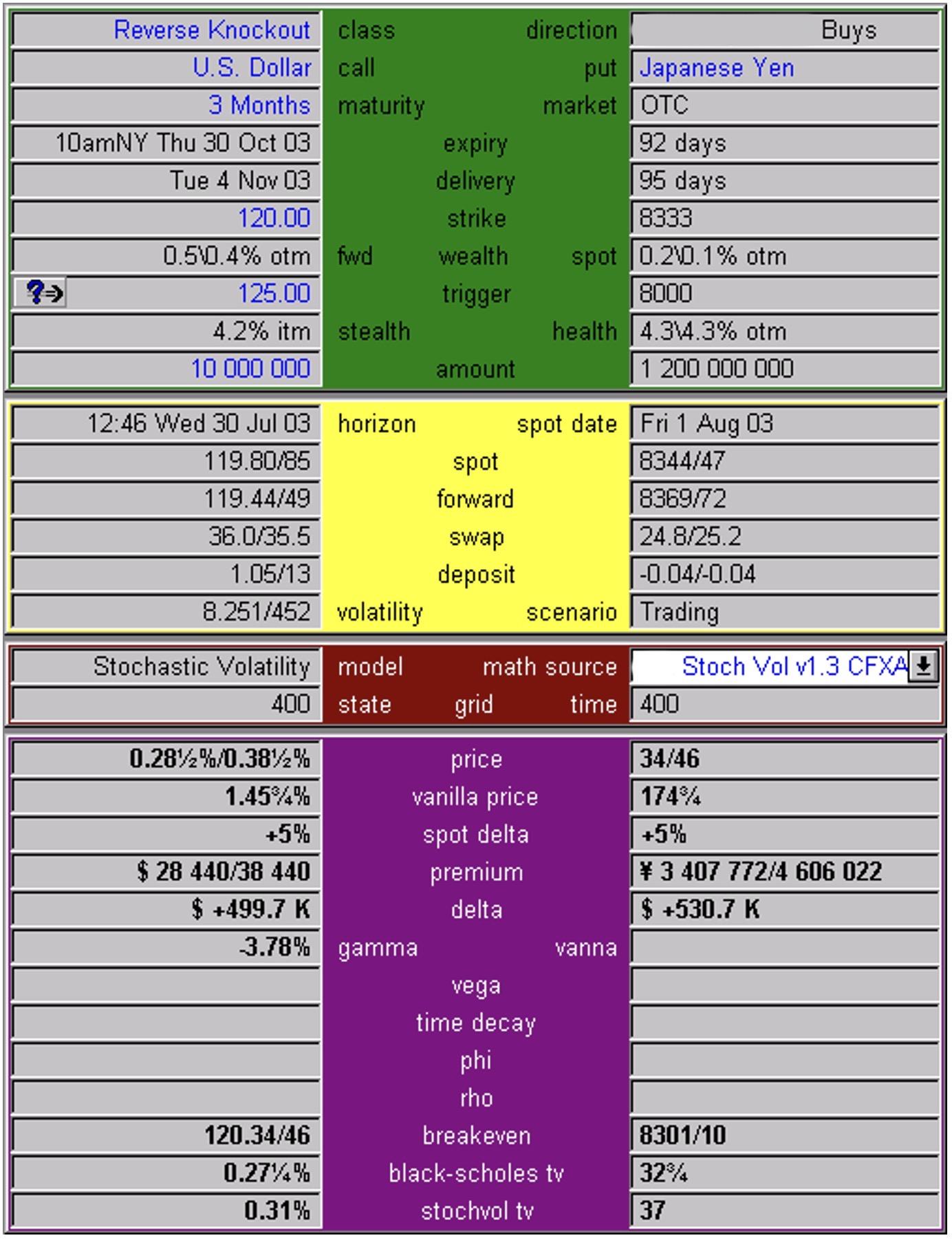

Maturity: 3 month Call/Put: USD call / JPY put Strike: 120.00 Outstrike 125.00

Spot: 119.80/85 Swap: -0.360/-0.355 JPY per 1 USD ATM Volatility: 8.25/8.45

Price: 0.285% / 0.385% of USD face

Equivalent standard European option: 1.415/1.485% of USD face.

If spot trades at or above 125 prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or above 125 prior to the expiration time on the expiration date, then the buyer of the option will buy USD at 120 if spot is at or above that level at expiration.

An important consideration in managing a portfolio of reverse knockout options is the efficient management of spot orders at the barrier. It is essential that reports are generated on a daily basis that recalculate the order required to de-hedge the option at the barrier so that the orders with the spot desk can be updated. It is also important to generate a report that indicates which spot orders are most likely to be executed and in the short term. It should be remembered that to estimate which orders on most likely to be triggered, the distance between current spot and the barrier must be measured in standard deviation terms, not simply in percentage terms. In other words, the relative volatility of the currency pair must be taken into account.

Another consideration of spot orders associated with the outstrike of a reverse knockout option is whether the client requires immediate notification of a barrier event. If the client requires 24-hour notification of a barrier event, then the client’s contact details should be included to with the order with instructions to call the client.

When you are short a reverse knockout you are short dVega/dVol, and dVega/dSpot. This means that for a short reverse knockout position, which would be long vega, you would have the following risk:

dVega/dVol – As volatilities increase you would derive into a shorter vega position, and need to buy vol at a high level. As volatilities decreased you would derive into a longer vega position, and need to sell volatility at a low level. Therefore as vols moved you would lose money rehedging your vega position. A short dVega/dVol position is the volatility equivalent of a short gamma position.

dVega/dSpot – As spot moves either towards the barrier, or out of the money, then the long vega position starts to reduce. Therefore, effectively the position gets short vega in a moving market, when vols should move higher, and stays long vega in a stable market where vols should move lower.

Congratulations on making it to the end of this section. Reverse Knockout Options represent relatively complex financial products and having a solid foundation in them sets you on the path to a much deeper understanding of the FX options market.

You have earned yourself the choice of taking on the challenge of getting to the next level up or sitting back and enjoying the moment of your new achievement:

To better understand reverse knockout options it is helpful to have a good grounding in knockout options, the pricing of knockout options and knockout option risk management considerations.