Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

The intention of this section is to give you the knowledge of Reverse Knockin Options that will enable you understand what they are and how they are used.

Your goals by the end of this section are to be able to:

Setting you up to acheive the goals of this section is our goal. Having some knowledge of knockout options and reverse knockout options, if you are not yet familiar with them, would help you achieve the section goals.

The reverse knockin option is widely used in both hedging and trading strategies. The reverse knockin is often sold to fund the purchase of another option, as an alternative to selling a standard European option. The same product is known under a number of different names including reverse knock in and reverse knock-in.

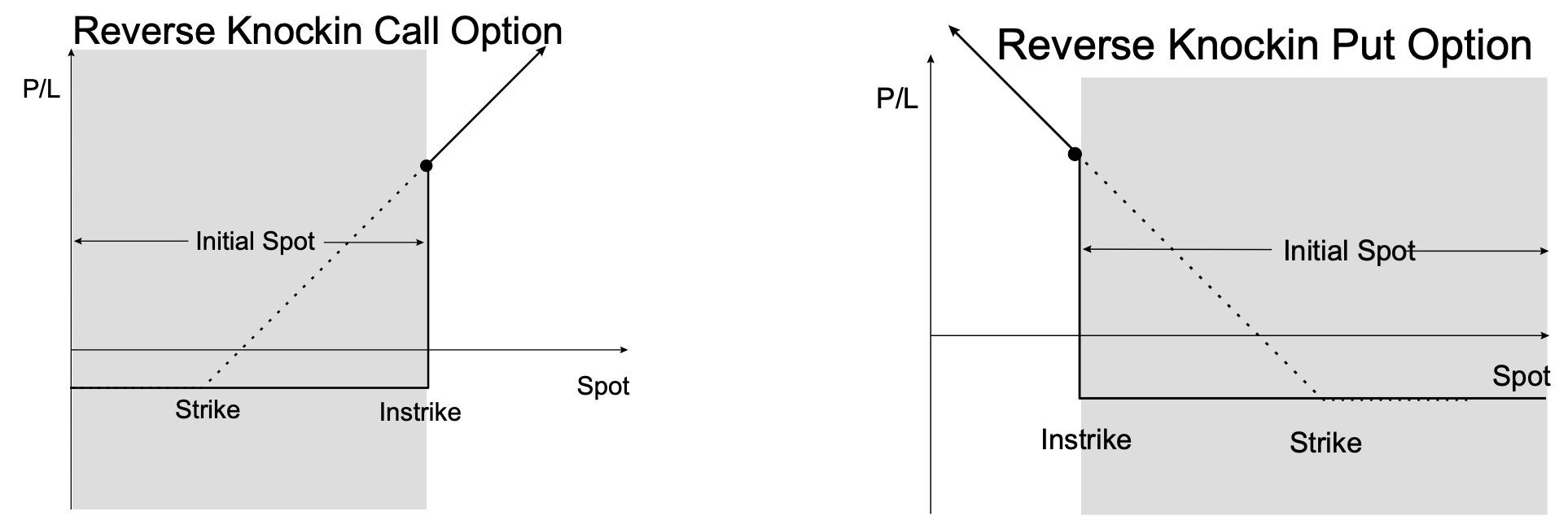

The reverse knockin option differs from a standard European option by the additional feature of an instrike price. The reverse knockin option only comes into existence if spot trades at or beyond the instrike price during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the option. If the instrike is never triggered then the reverse knockin option expires worthless at expiration.

Once the instrike has been triggered the reverse knockin option trades identically to the equivalent standard European option and has the same payout profile at expiration.

The cost of a reverse knockin option is less than the cost of the equivalent standard option.

The instrike of a reverse knockin option differs from that of a knockin option in its location relative to spot and the strike of the option. The instrike of a reverse knockin option is such that the option knocks in as the option is gaining in value.

Structurers often use the reverse knockin option as an alternative to a short European standard option.

The reverse knockin option trades at a price that is close to the price of the equivalent European standard option, if the combination of strike and instrike are chosen appropriately. Given that the obligations of the seller of the reverse knockin are only an issue if the option is knocked in it adds an extra degree of comfort to short sellers. For example, a common hedging strategy is the trigger forward, where the hedger buys a European standard option call (put), and sells a reverse knockin option put (call) with the same strike price. The combination of options can be chosen to result in no net premium.

As for hedging strategies the reverse knockin is best used when sold to fund the purchase of another option. One example of this is where the trader buys a reverse knockout call (put) and funds the purchase by selling a reverse knockin put (call).

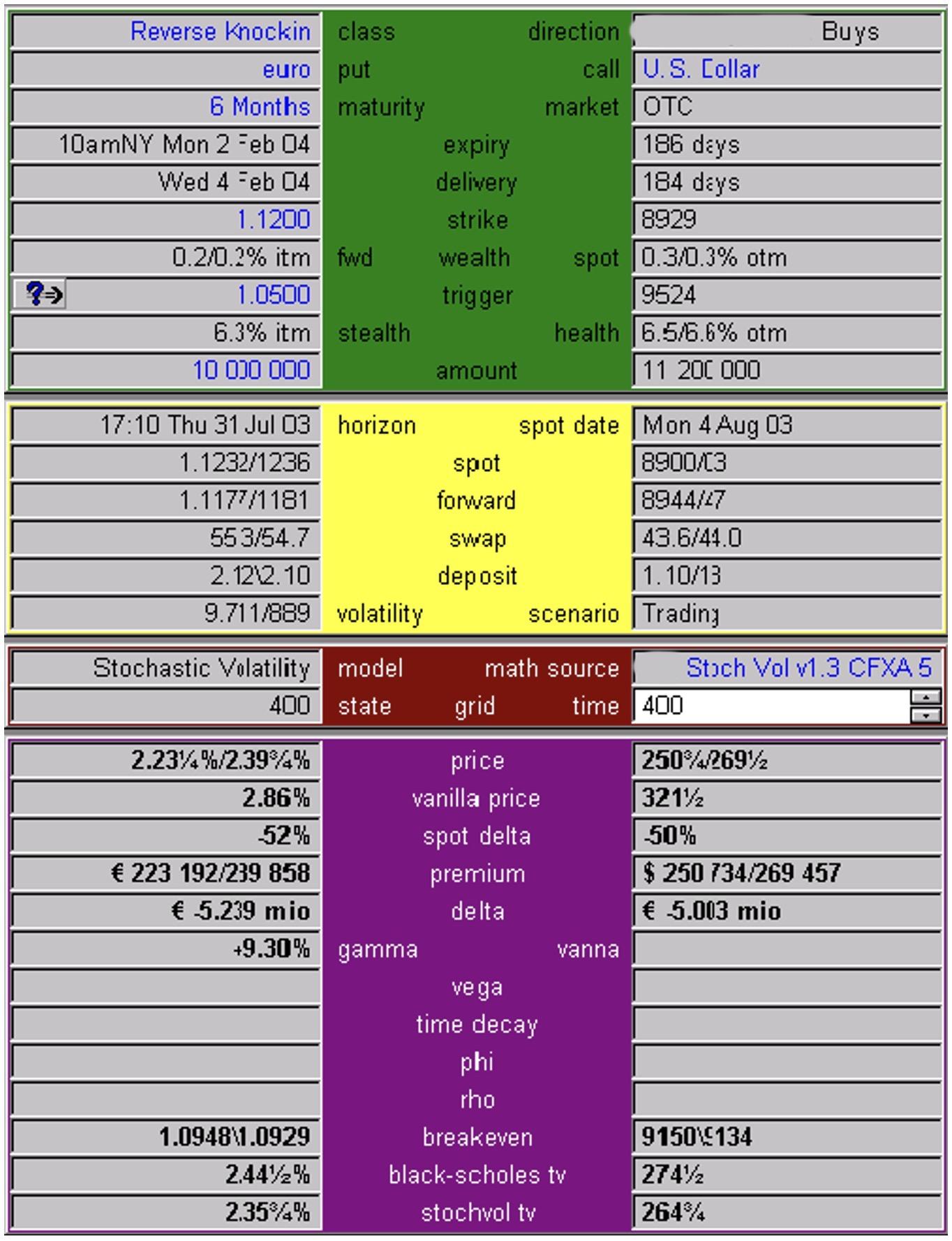

Maturity: 6 month Call/Put: EUR put / USD call Strike: 1.1200 USD per 1 EUR Outstrike 1.0500 USD per 1 EUR

Spot: 1.1232/35 USD per 1 EUR Swap: -0.00553/547 USD per 1 EUR ATM Volatility: 9.70/9.90

Price: 2.235% / 2.395% of EUR face

Equivalent standard European option: 2.82% / 2.88% of EUR face.

If spot does not trade at or below 1.0500 USD per 1 EUR prior to the expiration time on the expiration date, then the option is never activated and expires worthless. If spot trades at or below 1.0500 prior to the expiration time on the expiration date, then if spot finishes below 1.1200 at expiration the buyer of the option will sell EUR at 1.1200.

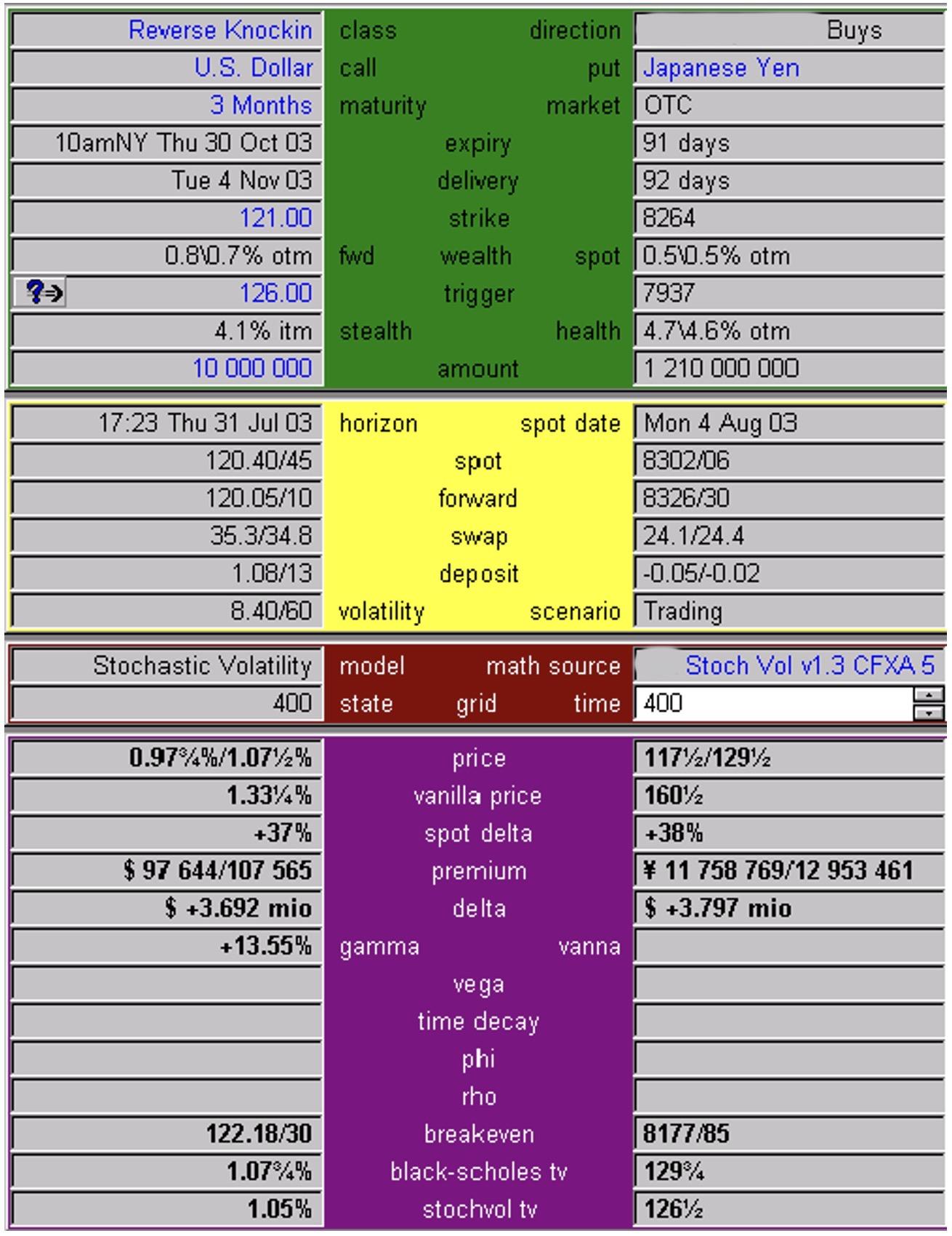

Maturity: 3 month Call/Put: USD call / JPY put Strike: 121.00 JPY per 1 USD Outstrike 126.00 JPY per 1 USD

Spot: 120.40/45 JPY per 1 USD Swap: -0.353/-0.348 JPY per 1 USD ATM Volatility: 8.40/8.60

Price: 0.975% / 1.075% of USD face

Equivalent standard European option: 1.305/1.35% of USD face.

If spot does not trade at or beyond 126.00 JPY per 1 USD prior to the expiration time on the expiration date, then the option is never activated and expires worthless. If spot trades at or below 126.00 prior to the expiration time on the expiration date, then if spot finishes above 121.00 at expiration the buyer of the option will buy USD at 121.00.

Congratulations on making it to the end of this section. Reverse Knockin Options represent relatively complex financial products and having a solid foundation in them sets you on the path to a much deeper understanding of the FX options market.

You have earned yourself the choice of taking on the challenge of getting to the next level up or sitting back and enjoying the moment of your new achievement:

To better understand reverse knockin options it is helpful to have a good grounding in reverse knockout options, knockout options, knockout option pricing examples and knockout option risk management considerations