Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

I build businesses, both as independent startups and as new initiatives within large global companies. This series of posts is based on an FX Options training course that I delivered whilst contributing to building FX businesses at a number of investment banks. If you are looking to build a business and require leadership then please contact me via the About section of this website.

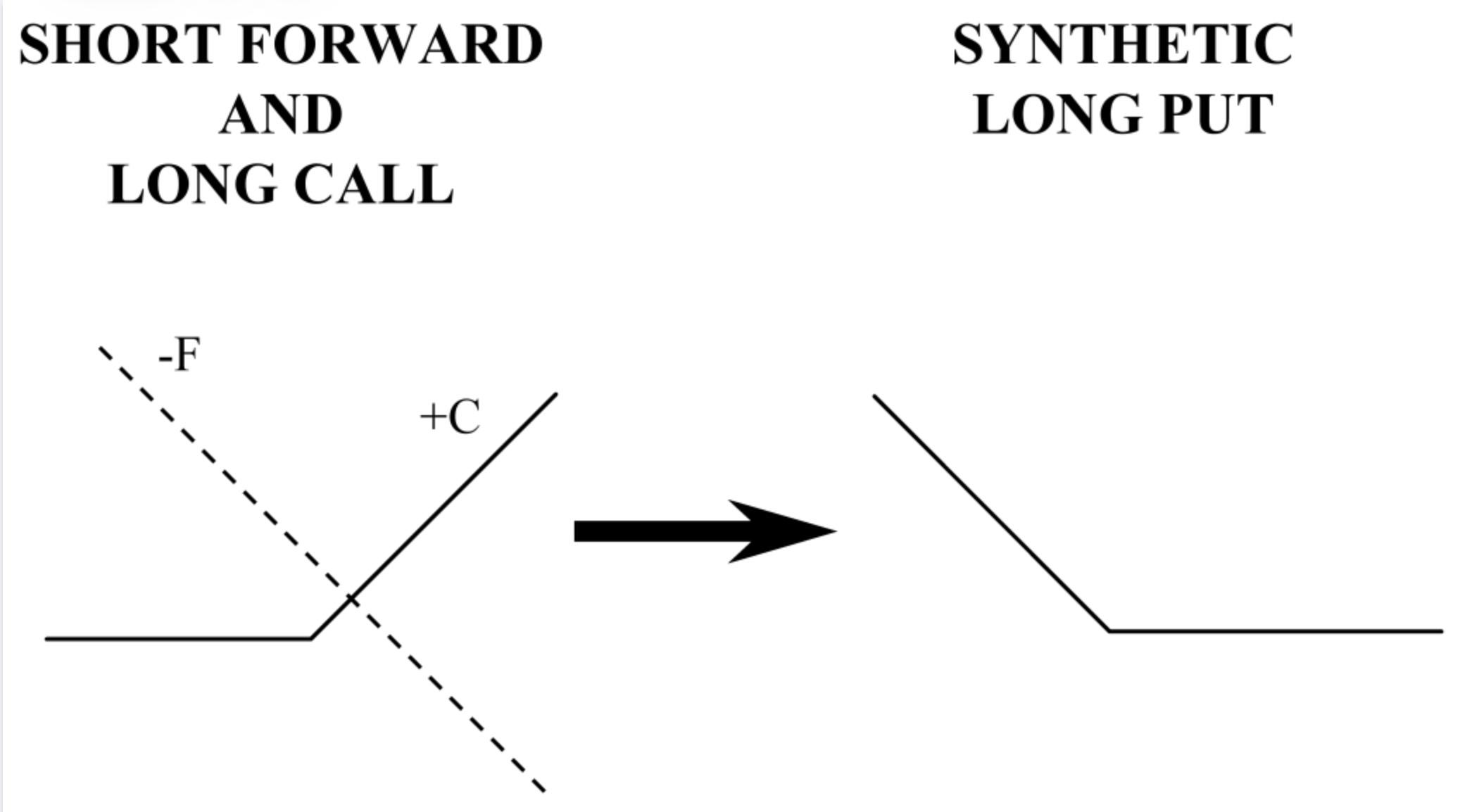

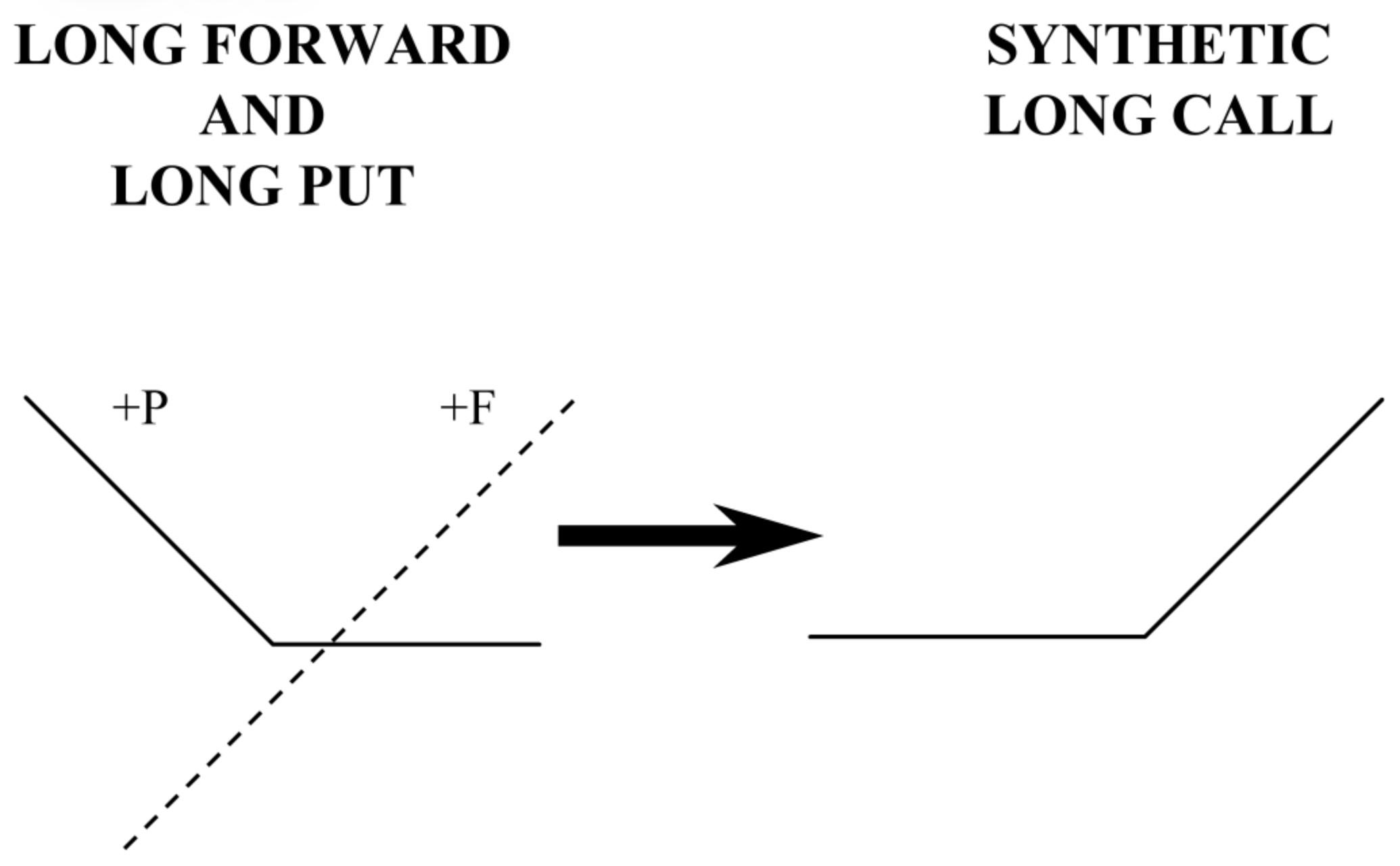

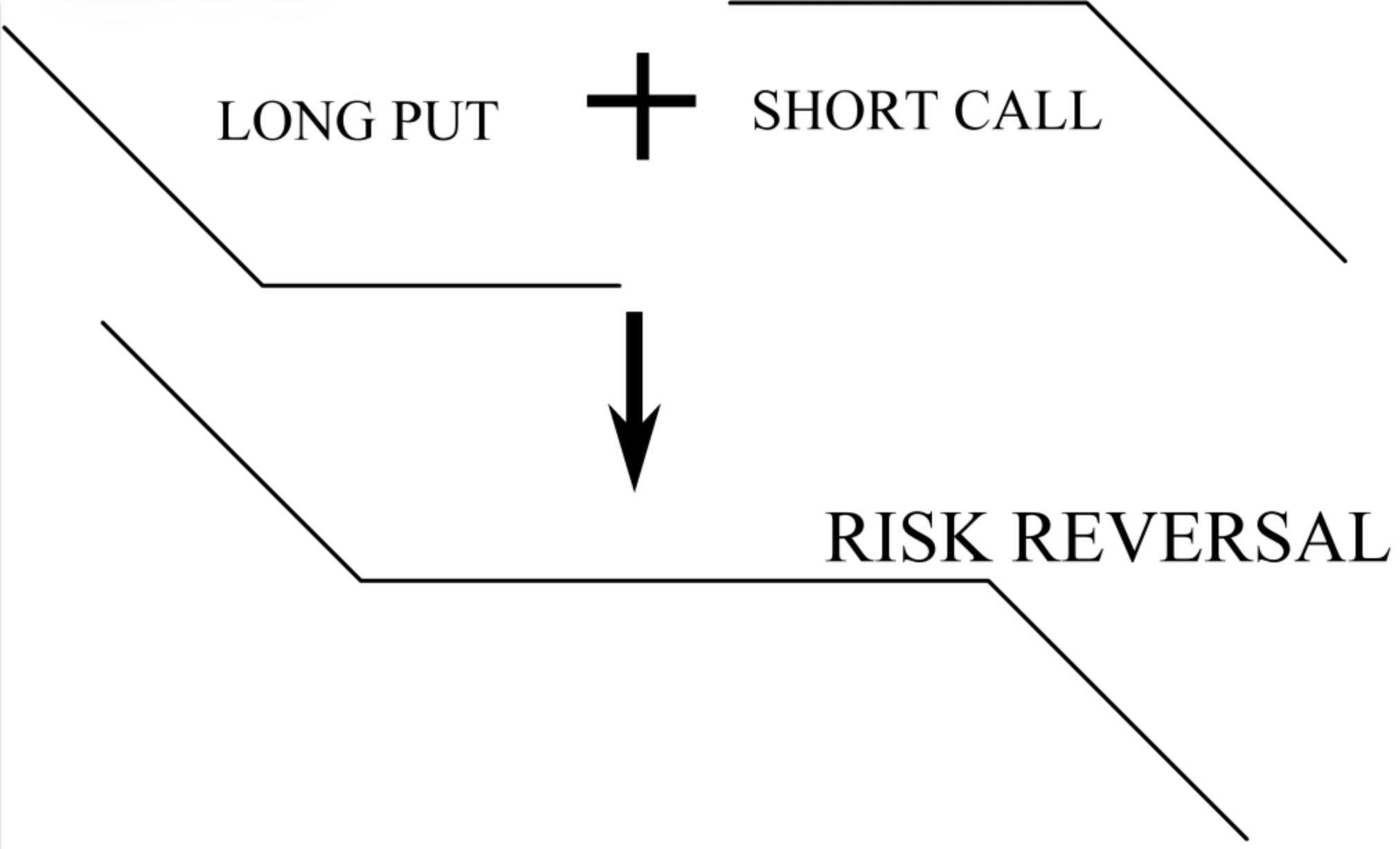

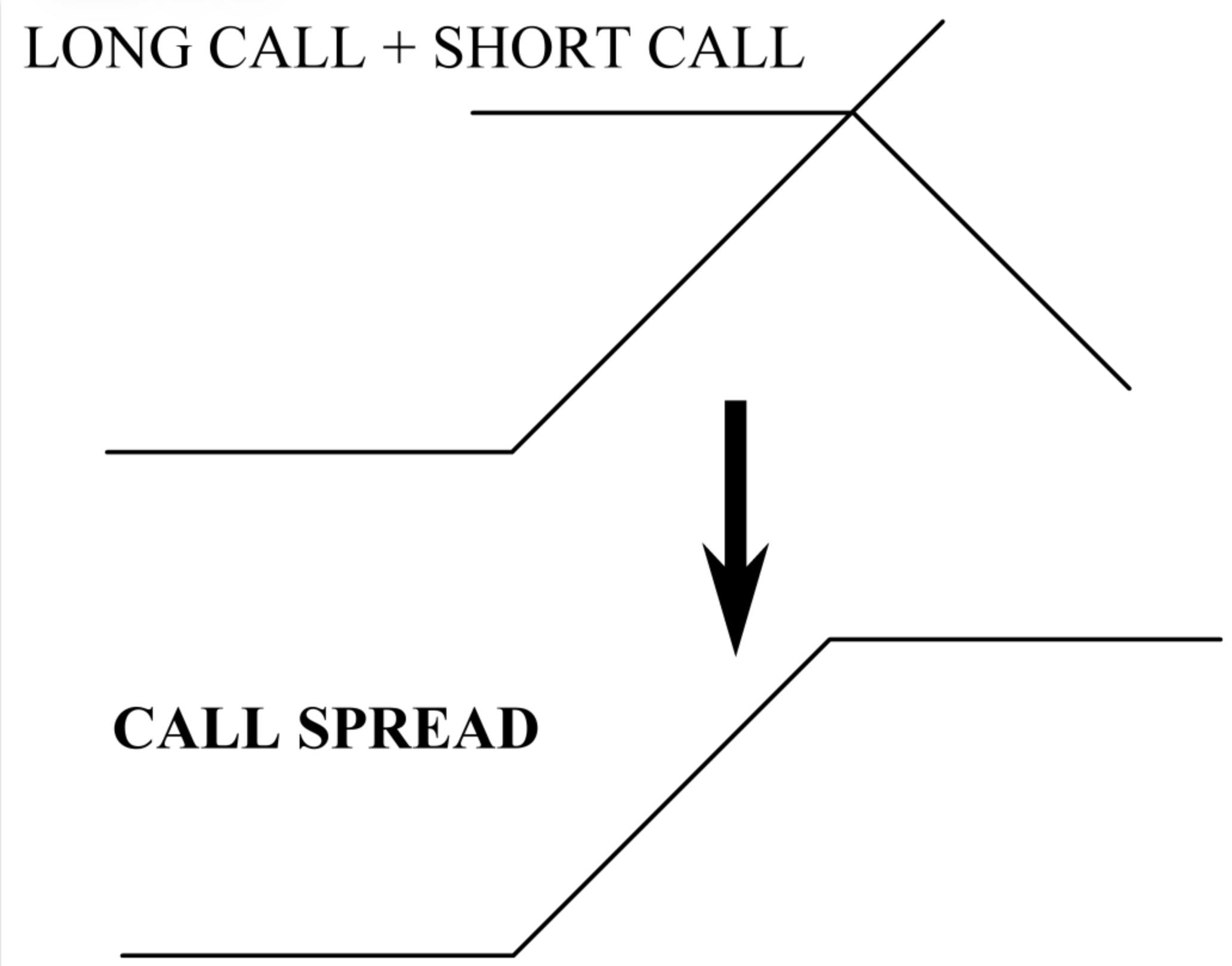

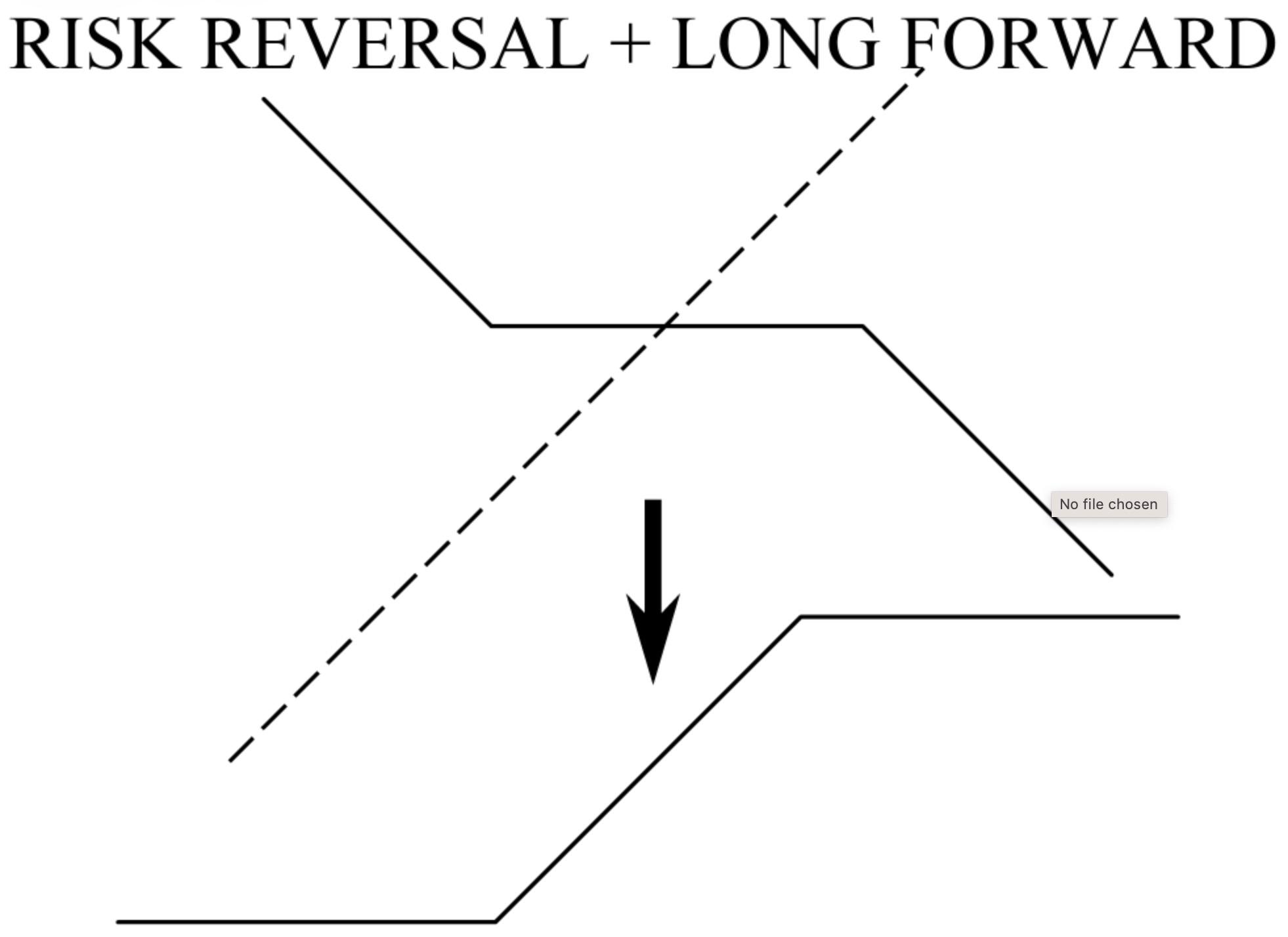

Having reviewed the terminology of FX options in the first section we now turn to the various option and cash position types that help provide us a foundation to build on in later sections. The ability to describe combinations of options and underlying positions in pictures is a powerful tool in gaining options intuition. This chapter introduces the basic building blocks, and some of the ways in which options and underlying positions can be combined to produce alternative profit & loss profiles.

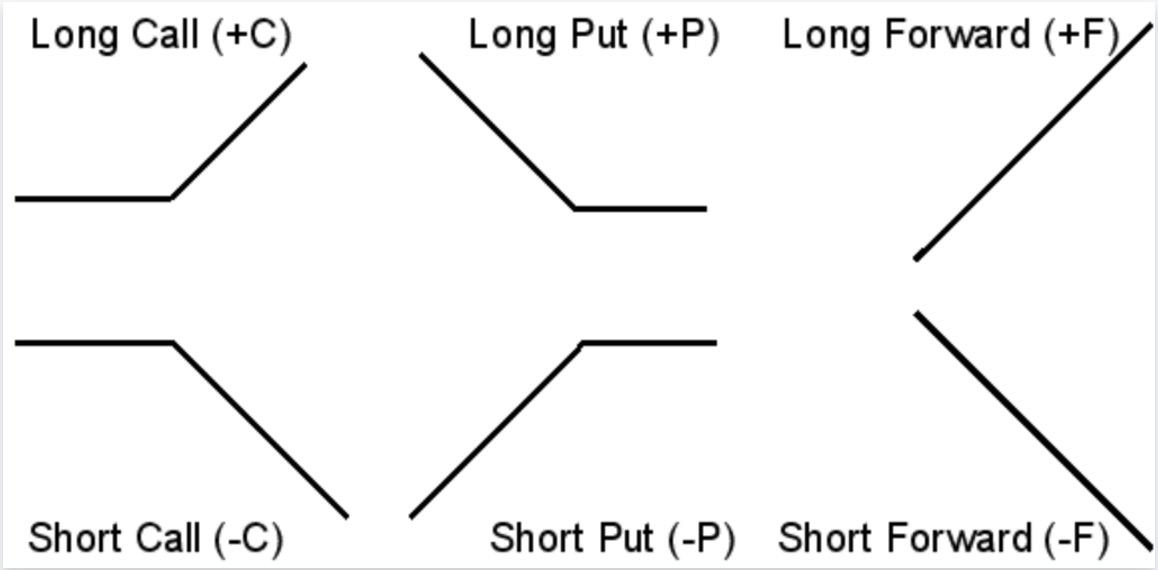

There are six basic building blocks to an options position:

The underlying position, if any:

And long or short options positions:

The six basic building blocks:

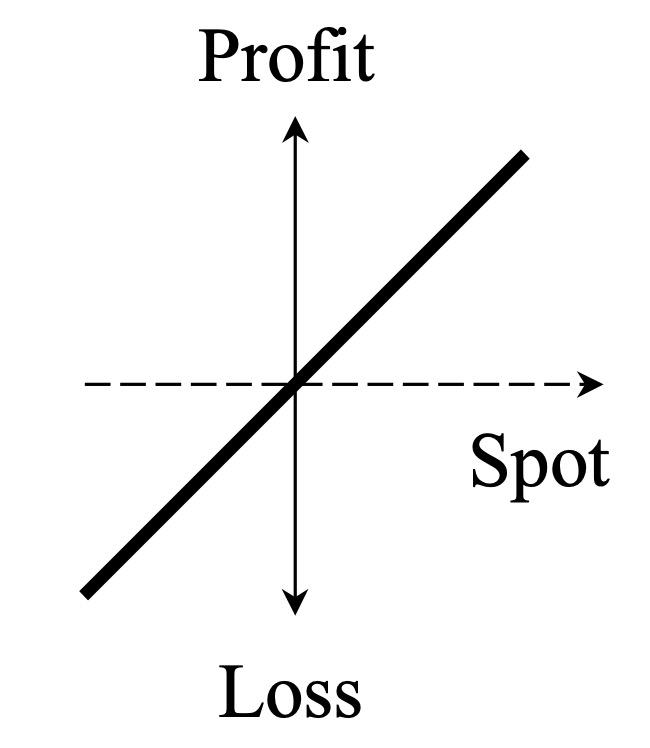

The simplest positions to understand are the underlying long and short cash positions. The long forward often represents an underlying long exposure, i.e. a need to sell the underlying base currency in the future.

The diagram simply shows that for a long position, as spot moves higher the position gains in value, but if spot goes down the position incurs a loss.

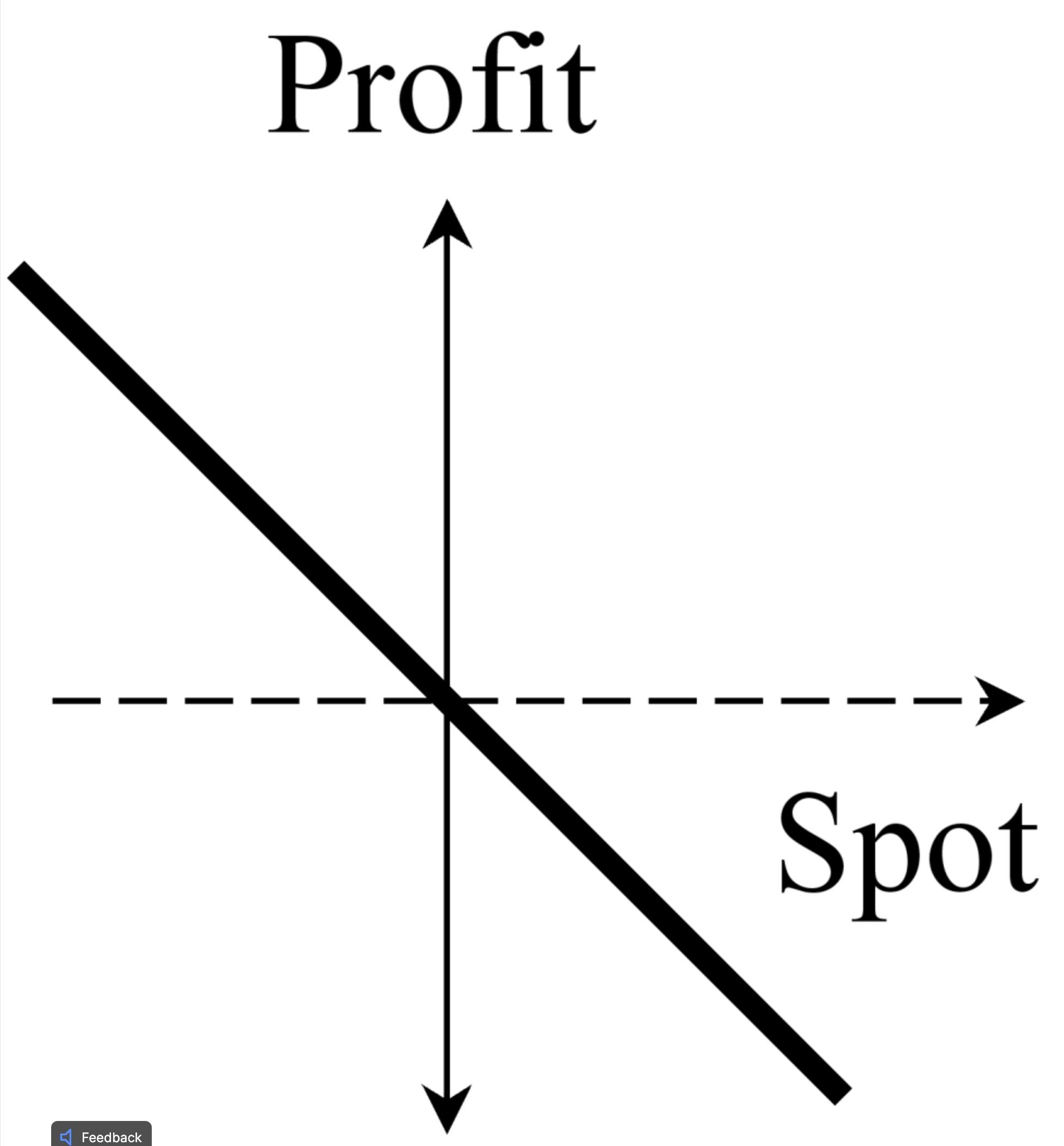

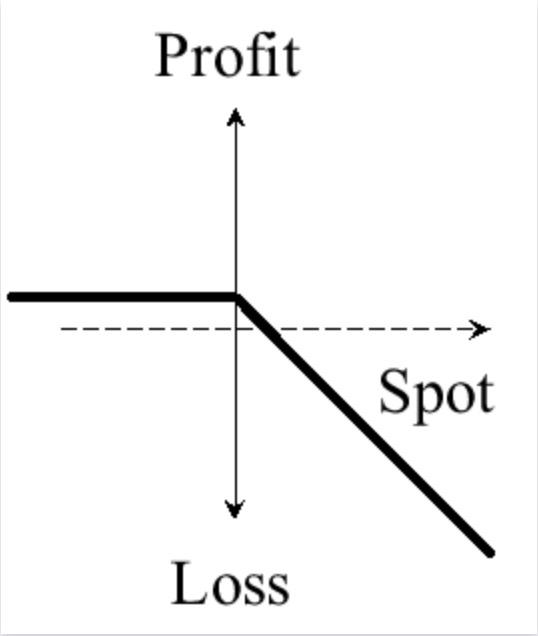

The short forward is often used to represent an underlying short exposure, i.e. a need to buy the underlying base currency in the future.

The diagram simply represents that as spot moves higher the position incurs a loss, but if spot moves lower the position gains in value.

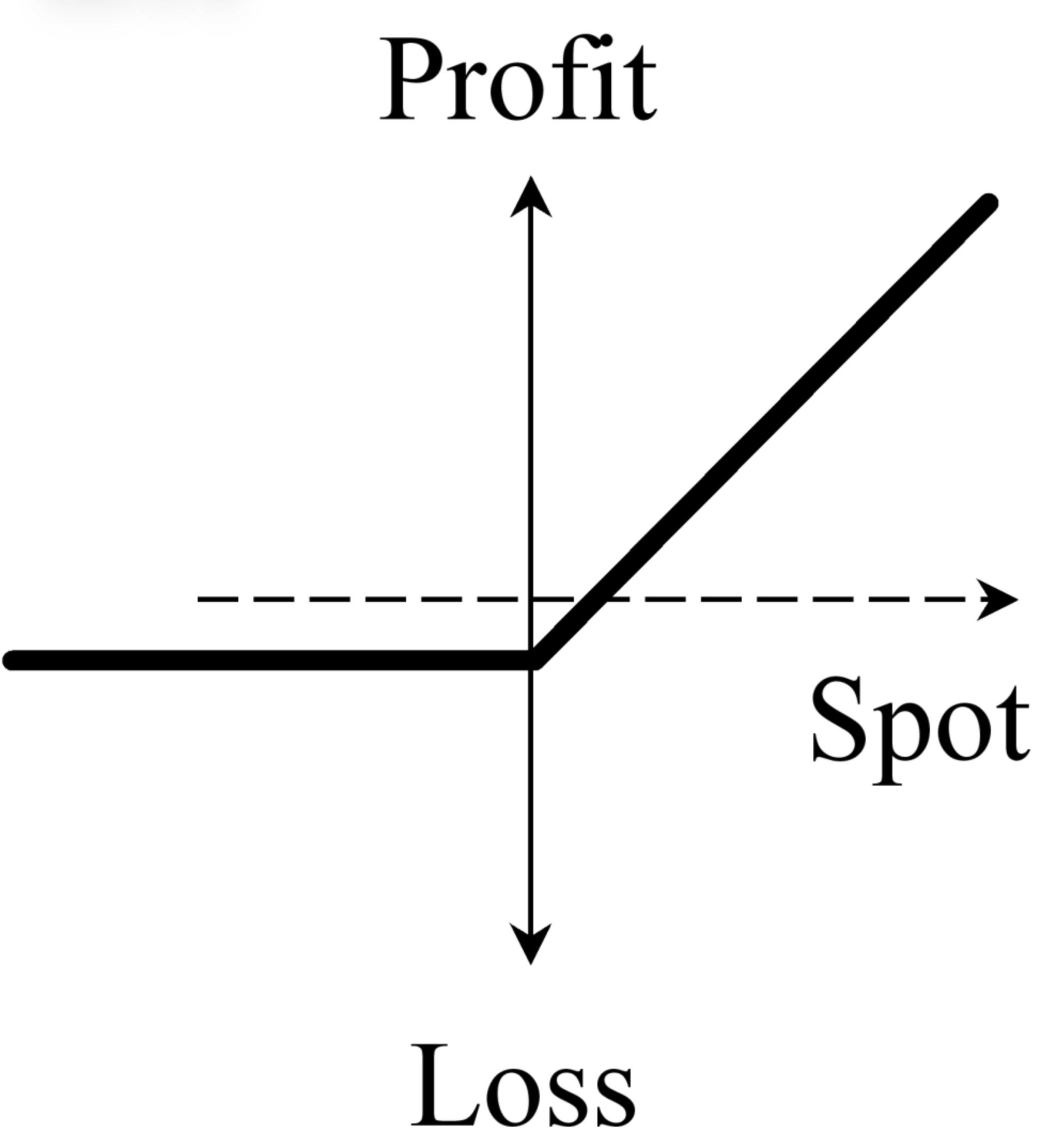

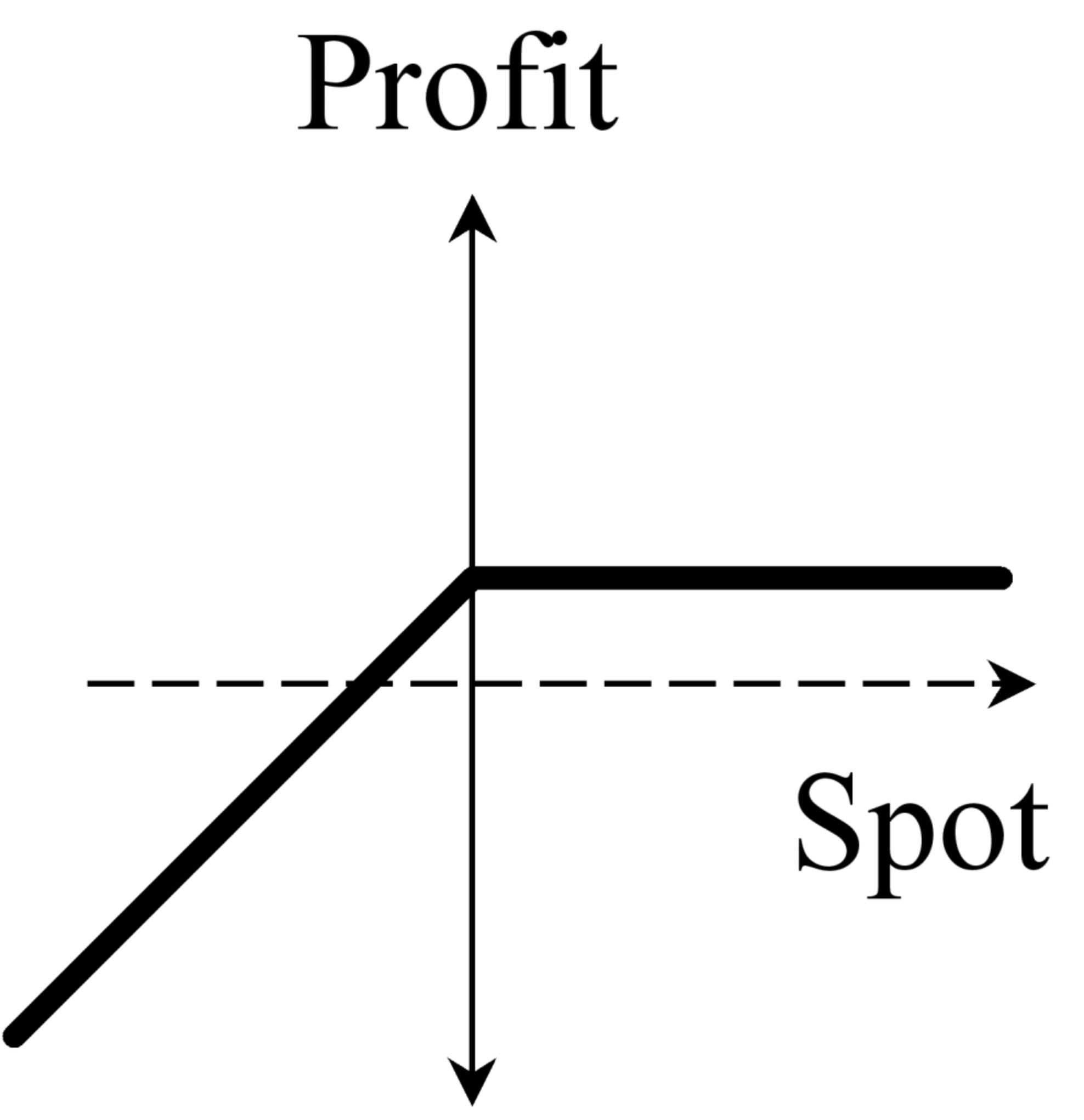

The holder of a call option has the right, but not the obligation, to buy the underlying currency at the strike price. It only makes sense to exercise the option if the strike price is a more favourable rate that can be obtained in the spot market on expiration day. If the market rate is lower than the strike price then the option will be left to expire worthless.

If you own a call option you have the right but not the obligation to buy a currency at some future date.

The right to buy.....

The long call therefore has the upside features of a long forward position.

But not the obligation…

The long call does not have the unlimited loss potential of a long forward.

The seller of a call option is obliged to sell the underlying currency if the holder exercises the option.

The short call therefore has the unlimited loss feature of a short forward position

… however, without the upside potential of the short forward.

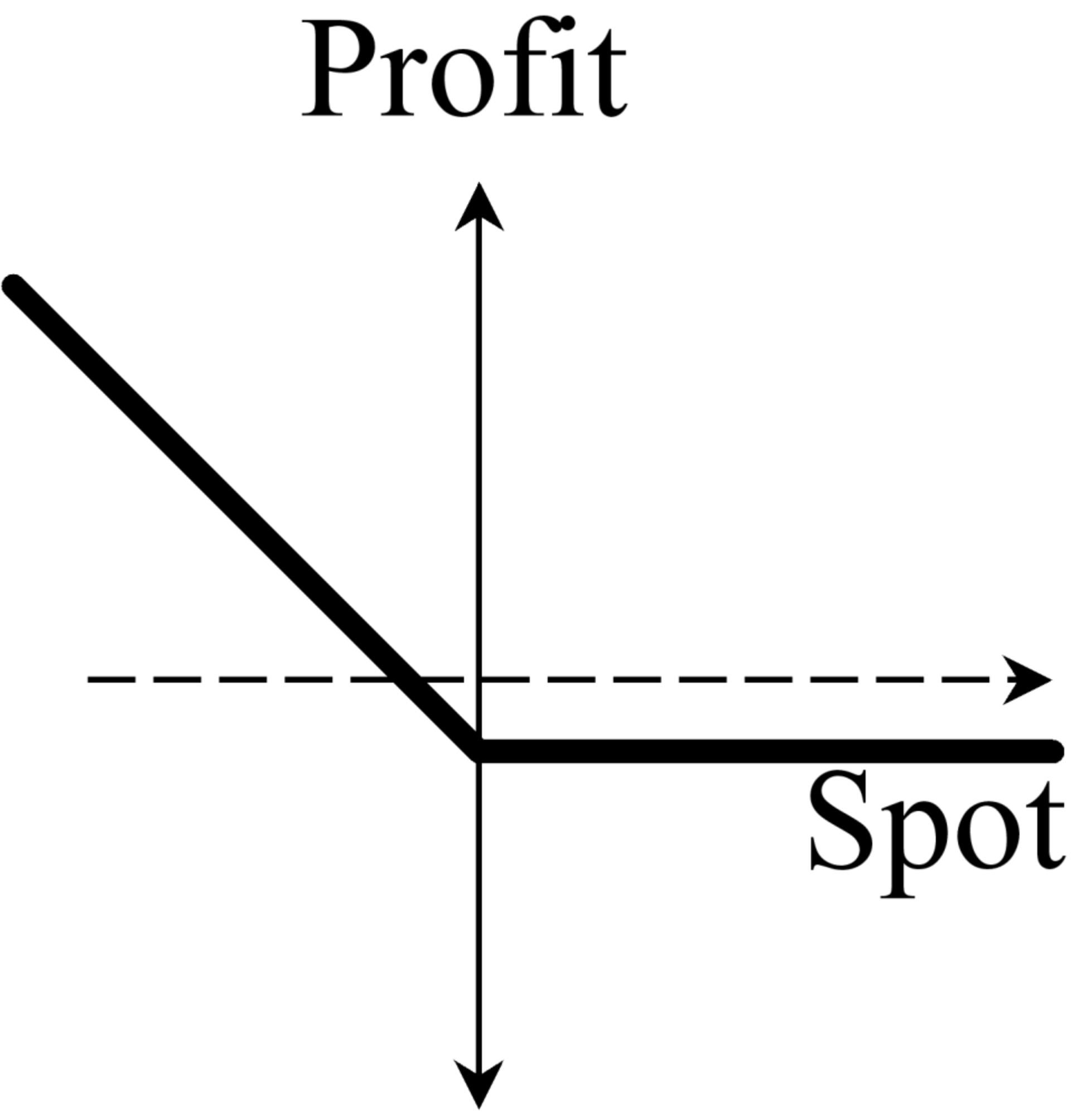

The holder of a put option has the right to sell the underlying currency at the strike price. It only makes sense to exercise the option if the strike price is a more favourable rate that can be obtained in the spot market on expiration day. If the market rate is higher than the strike price then the option will be left to expire worthless.

If you own a put option you have the right but not the obligation to sell a currency at some future date.

The right to sell.....

The long put therefore has the upside features of a short forward position.

But not the obligation…

The long put does not have the unlimited loss potential of a short forward.

The seller of a put option is obliged to buy the underlying currency if the holder exercises the option.

The short put therefore has the unlimited loss feature of a long forward position

… however, without the upside potential of the long forward.

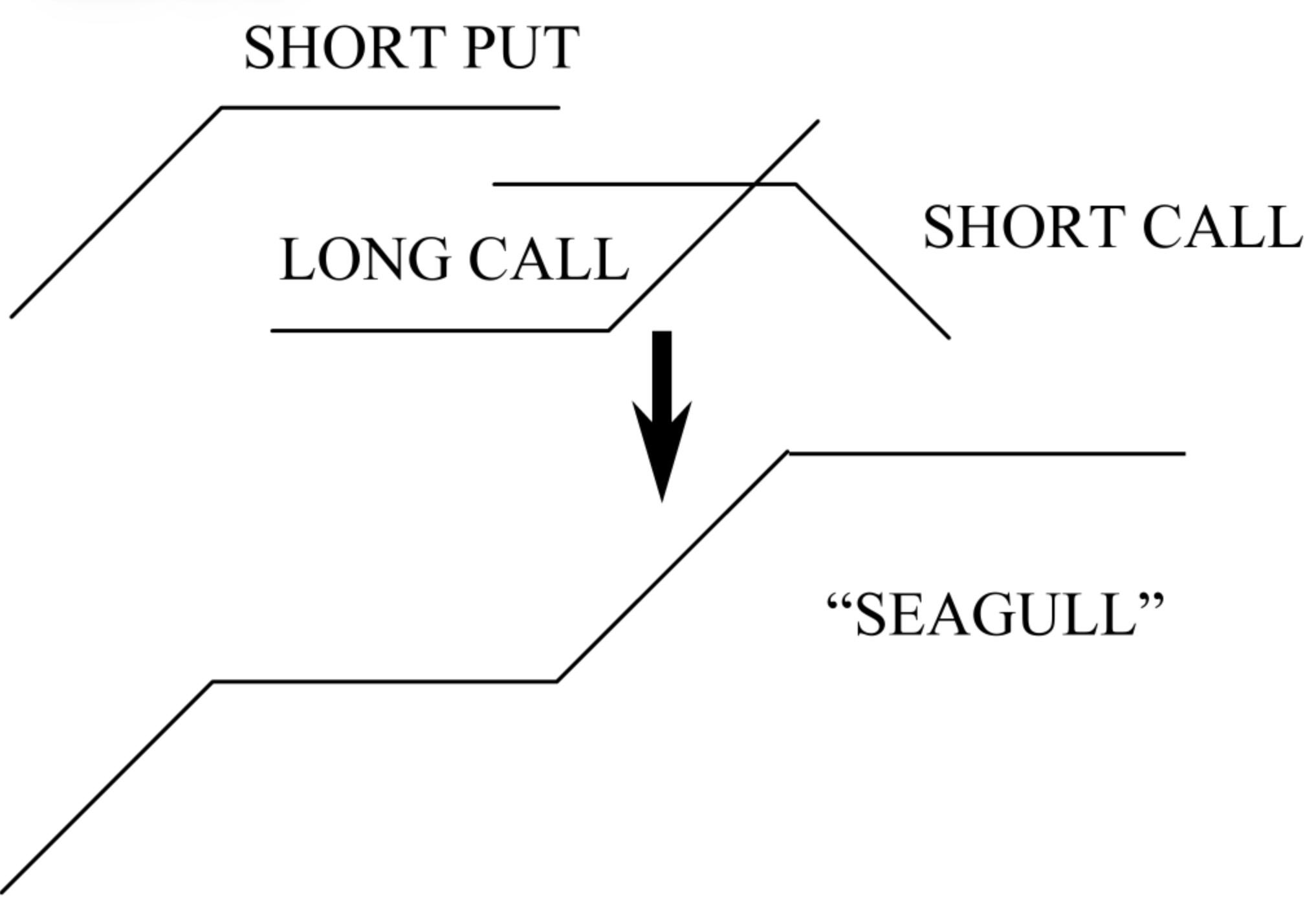

One way to gain a better understanding of the use of options is to use profit and loss profiles. The six building blocks can be combined to pictorially describe the resulting position. This is useful for describing the benefits of a particular combination of the building blocks. It is also useful for highlighting any undesirable risk characteristics.

In the next section we continue our introduction to FX options by looking at common option strategies.