Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

I build businesses, both as independent startups and as new initiatives within large global companies. This series of posts is based on an FX Options training course that I delivered whilst contributing to building FX businesses at a number of investment banks. If you are looking to build a business and require leadership then please contact me via the About section of this website.

In the previous sections we have covered the terminology of FX options, looked at the various types of options and looked at some common option strategies. Now we will take a look at how options can be funded and the combinations of options that use these funding options.

Options Can Be Paid For In Three Different Ways:

When you buy an option you pay a premium at the inception of the option. This is the simplest way of “paying” for an option.

Options can be partially paid for by giving up some of the protection. For example by buying an OTM option instead of an ATM option.

Another way to pay for an option is to give up some of the potential gains in the underlying position.

Buying an option provides a STOP-LOSS. Selling an option creates a STOP-PROFIT and reduces the cost of the STOP-LOSS OPTION. The great flexibility of options lies in the ability to structure a position buying and selling at various strike prices in various amounts.

The Forward Rate Bracket is one of the most commonly trades strategies. It has many attractive features for a risk manager. Firstly, it requires no premium to be paid. Also, it provides a degree of protection as well as a degree of opportunity.

To understand the Forward Rate Bracket we need to look first at short option positions that generate premium.

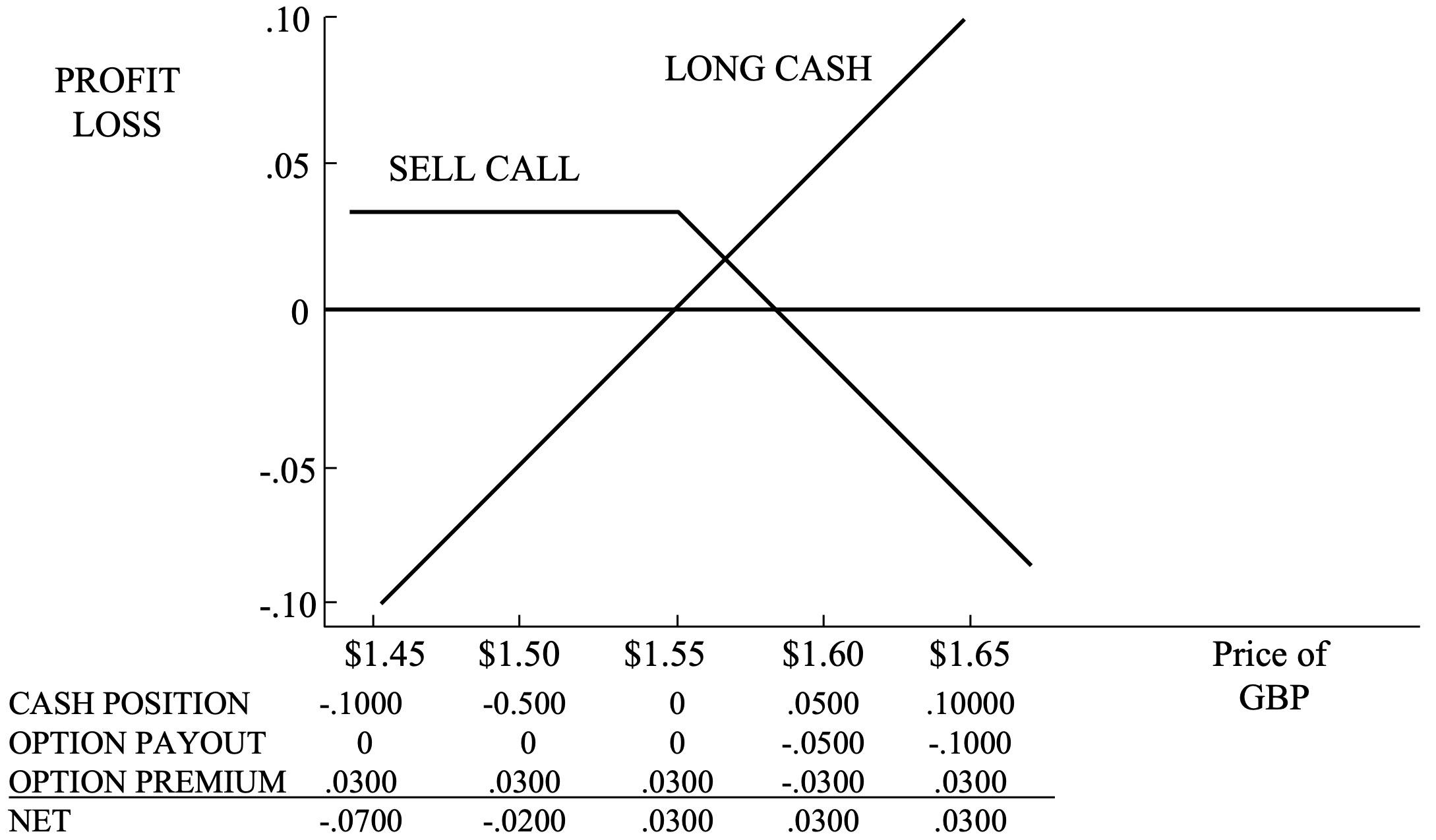

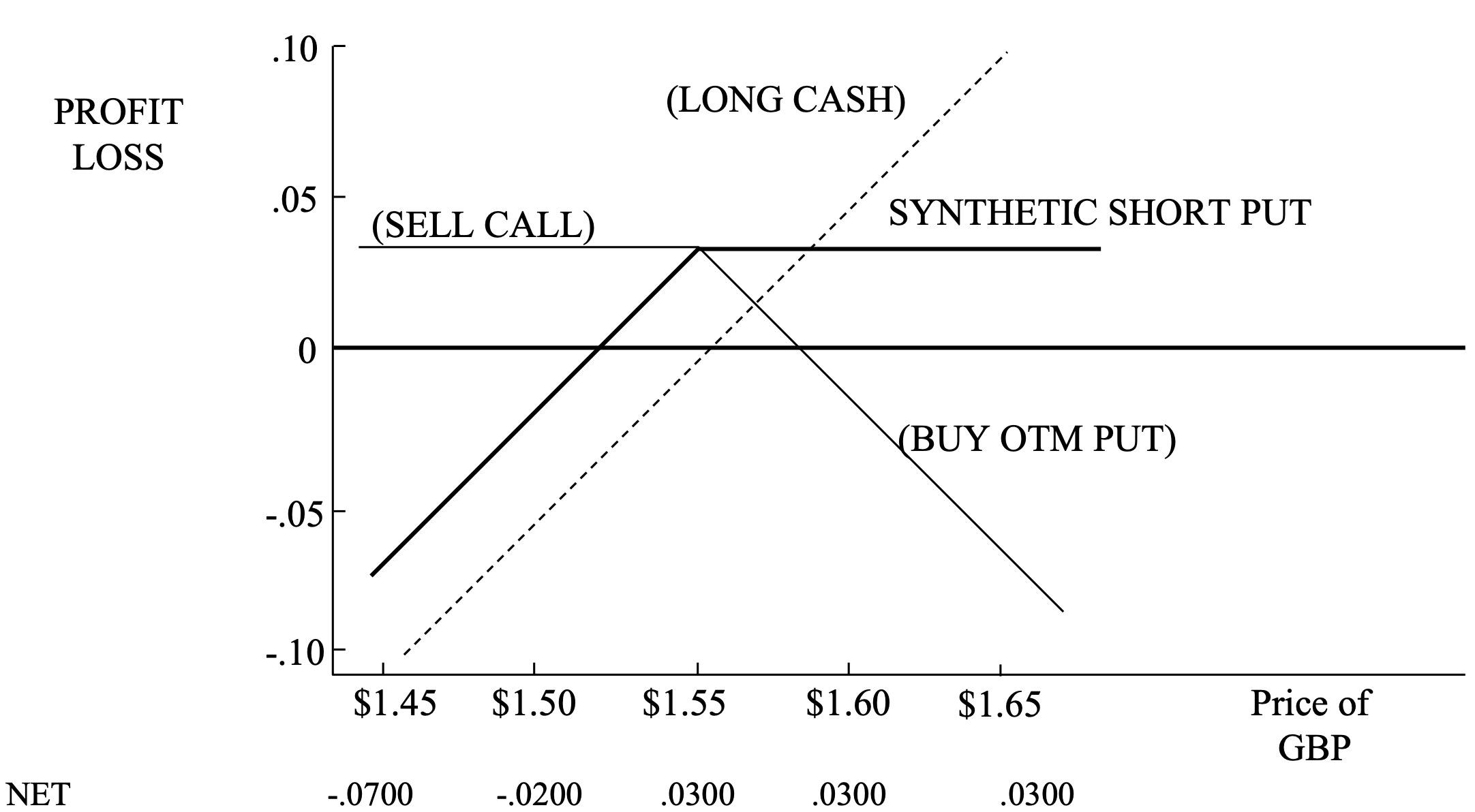

As previously, we start with the ATM case. The ATM option has a strike price equal to the forward therefore the diagram for the option kinks at the same point as the forward crosses the x-axis. The horizontal line in the options diagram is 0.0300 USD per 1 GBP above the x-axis, representing the premium received for selling the option. The maximum profit on the strategy is the 0.0300 USD per 1 GBP premium received. The strategy loses money at the point where the long forward position starts to lose money. All the gains on the long forward position are offset by the losses on the short call position.

The long forward combined with the short call position leaves us synthetically short a put option.

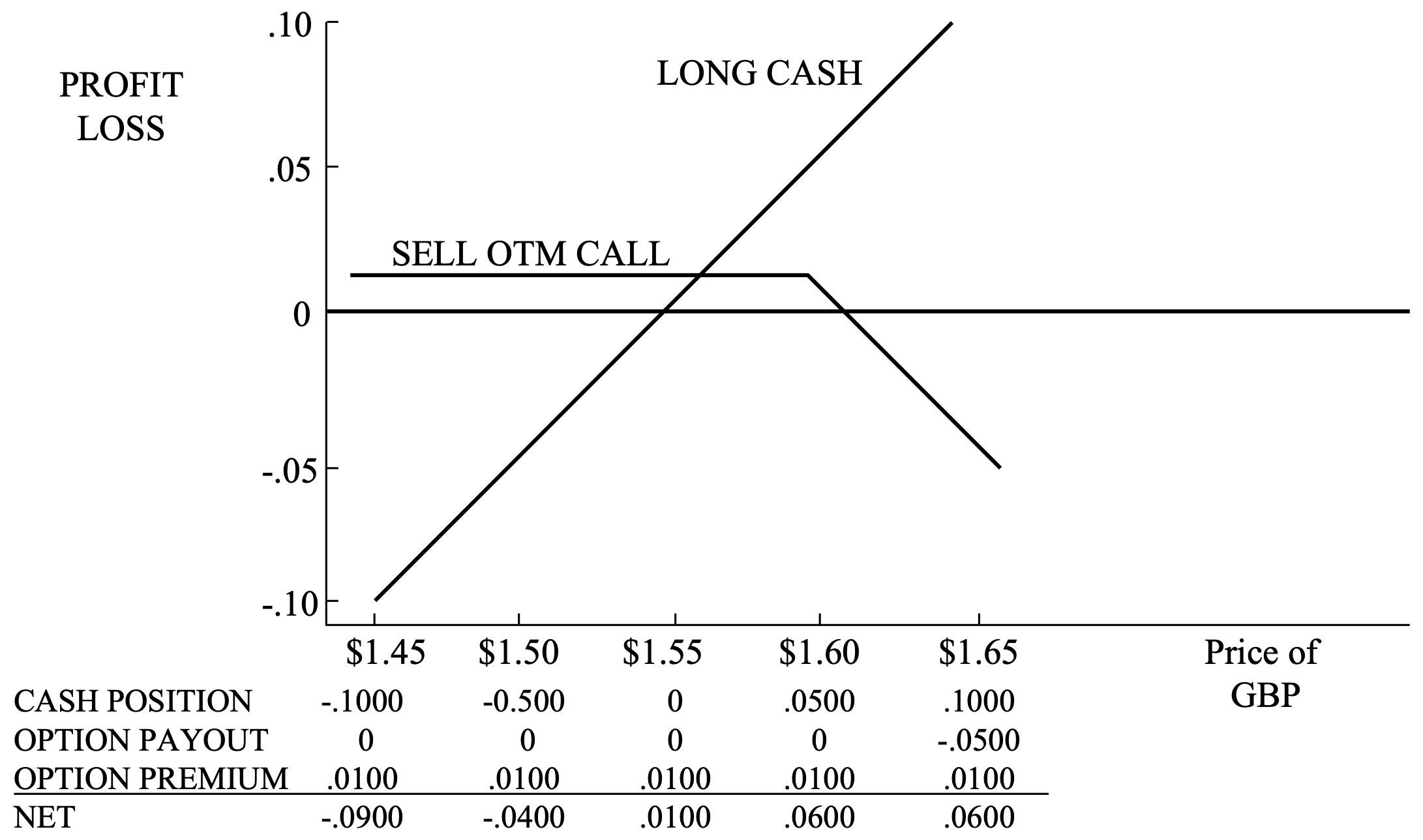

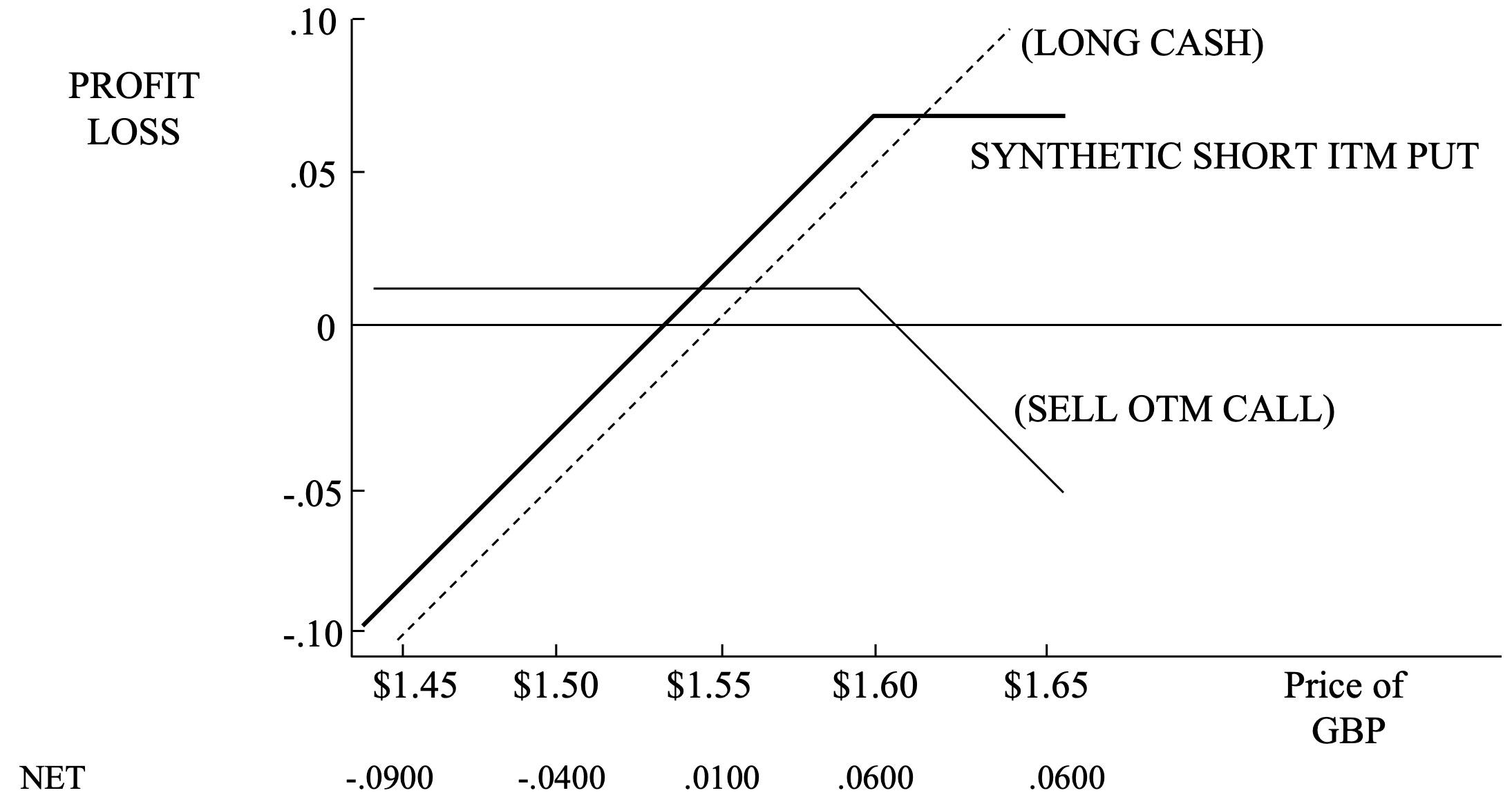

Selling an OTM is similar in impact to the case where we looked at buying options previously.

Note again, that for the OTM option the horizontal part of the option diagram is close to the x-axis, representing the limited premium that was received for the OTM option relative to the ATM option. In this case the amount of premium received for selling the OTM 1.5000 call option is 0.0100 USD per 1 GBP.

The net position therefore from the long forward combined with the short OTM call option is that of a short ITM synthetic put option.

We now have all the building blocks in place to create the Forward Rate Bracket:

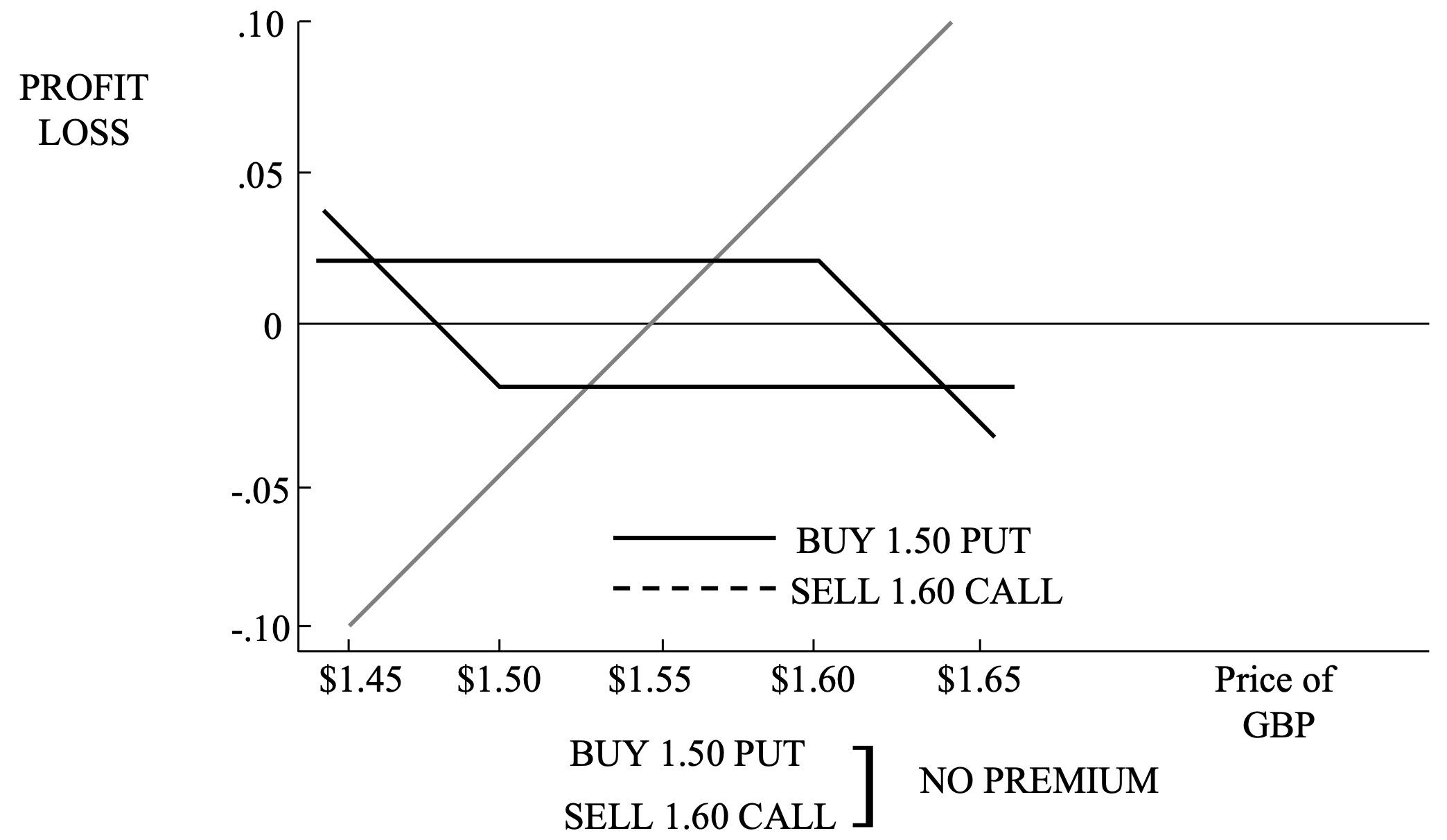

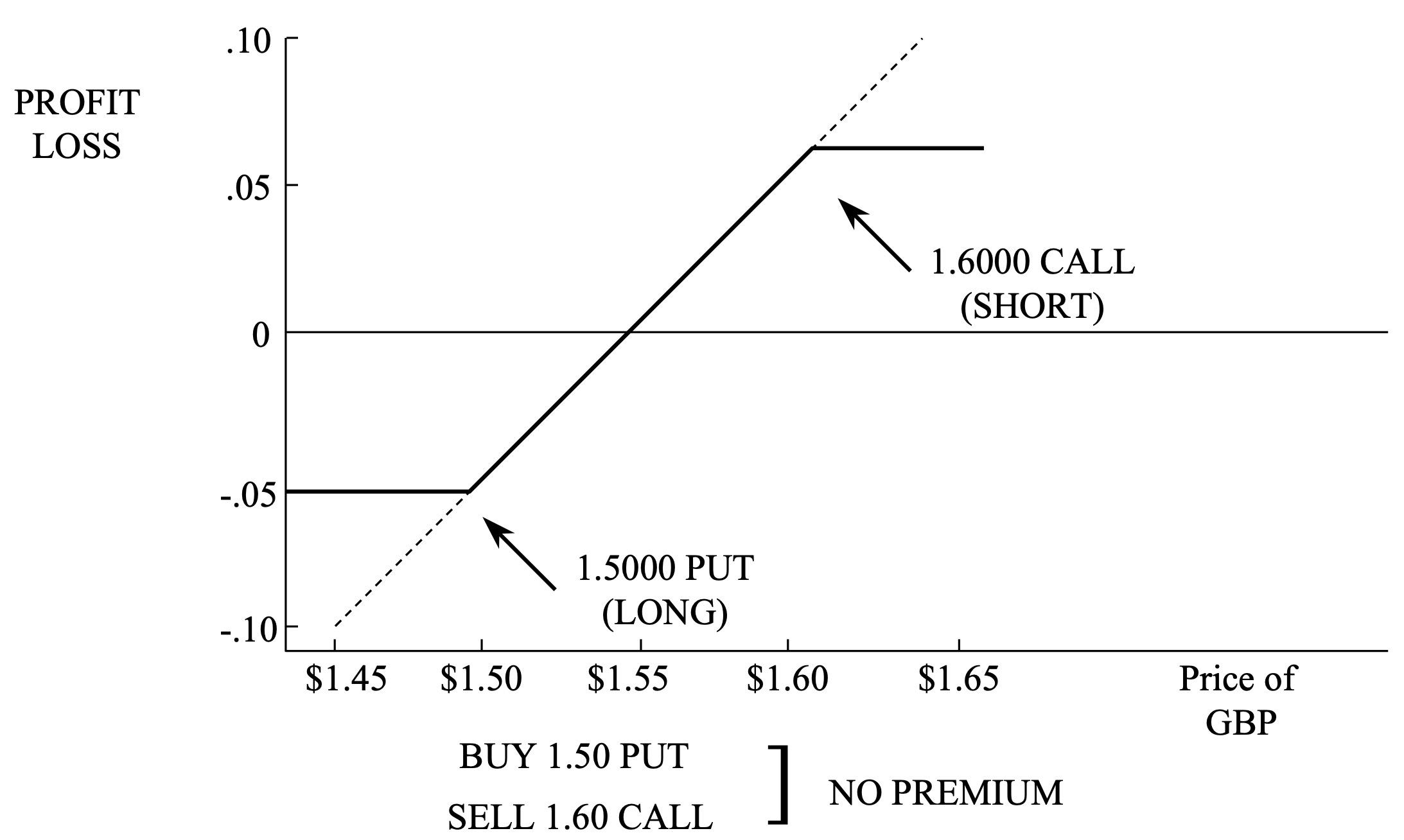

The Forward Rate Bracket is the combination of a long OTM put (call) option and a short OTM call (put) option combined with a long (short) underlying position.

As the diagram of the net position shows, the Forward Rate Bracket has removed the unlimited downside of the long forward position. The combined position also has limited upside potential as the upside has been sold off in order to have the option premium paid for the long put option completely offset by the premium received for the sold call option.

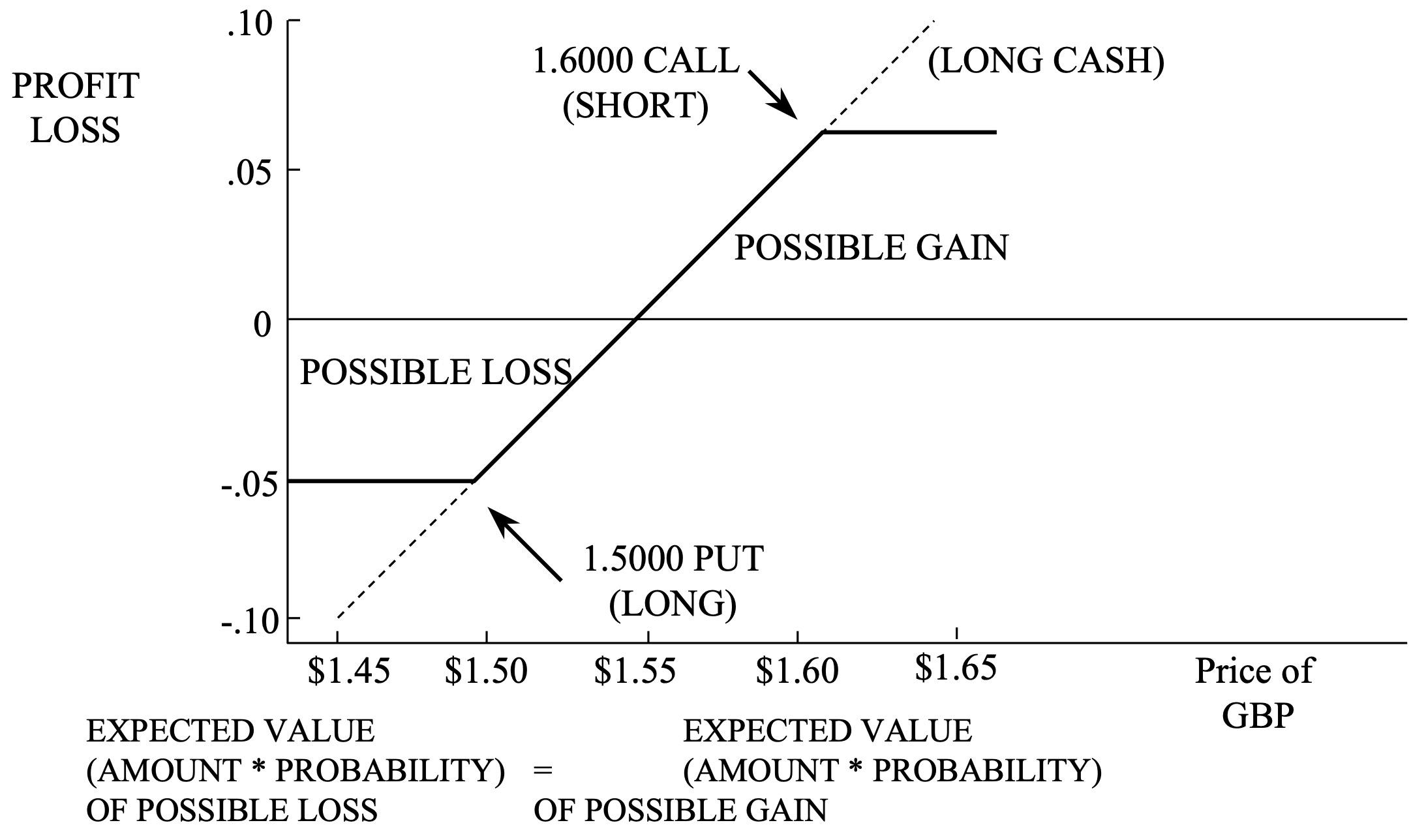

If spot finishes outside the strikes, one or the other option will be exercised. If spot finishes within the strikes, the underlying position is covered at the prevailing spot rate (as if there were no hedge). The expected value of the possible gain is equal to the expected value of the possible loss. The strike prices of the two options in the Forward Rate Bracket are approximately equidistant from the forward outright. Options pricing theory assumes equal chance of trading above or below the forward outright.

The risk manager who chooses to hedge using a Forward Rate Bracket can elect how narrow or wide to set the strike prices.

Wide strike prices mean:

The wider the brackets, the more aggressive the hedge and therefore the more like no hedge at all.

Narrow Strike Prices mean:

The narrower the brackets, the more conservative the hedge, the more like a forward contract:

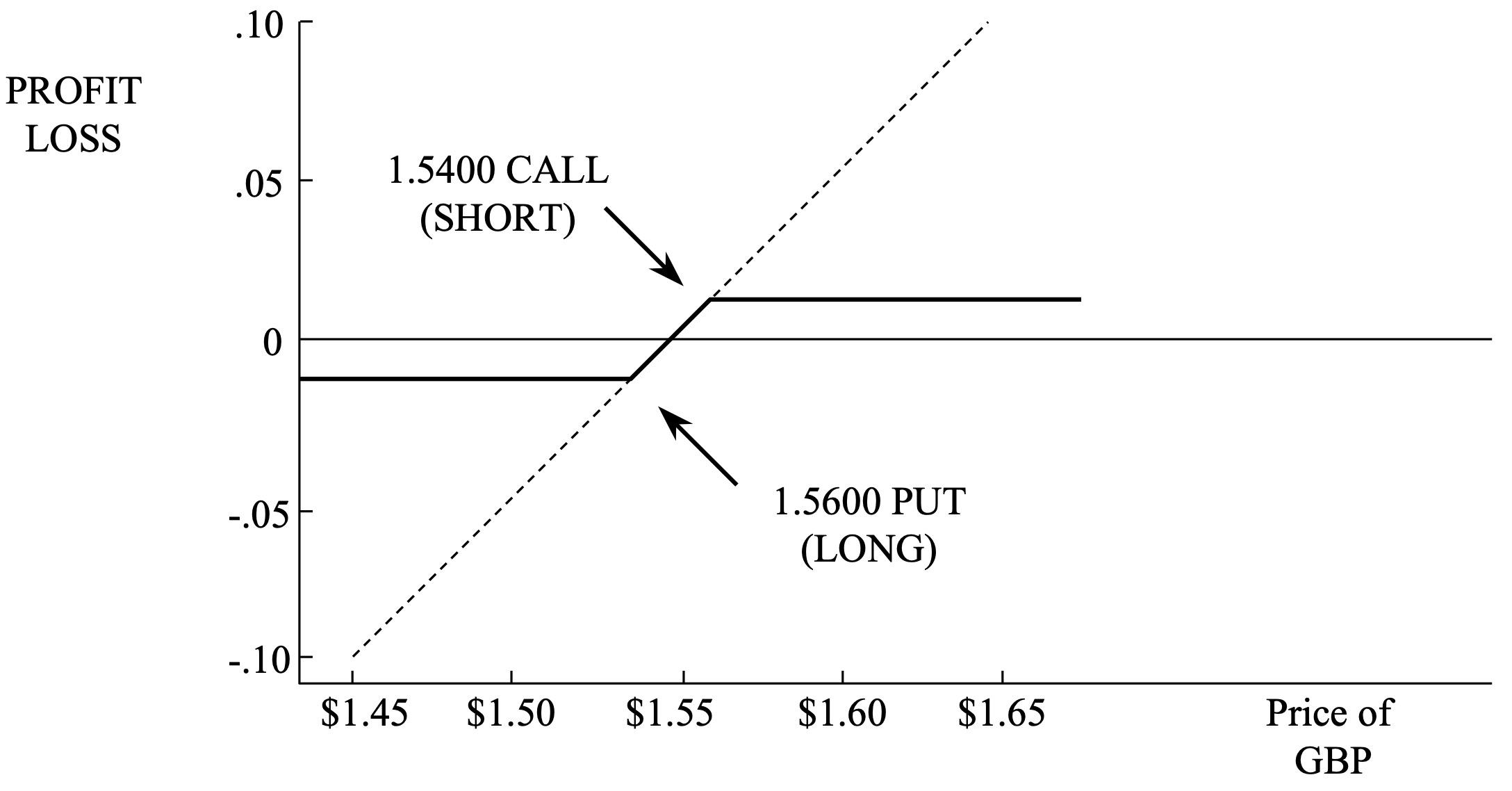

If buying a put and selling a call, each with strike prices equidistant from the forward generates a no-premium option position, then buying a put as above and selling a call with a strike price closer to the forward could result in a positive premium cash flow.

Alternatively, the put could be fully paid for by selling a close-to-the-forward call on a fraction of the exposure.

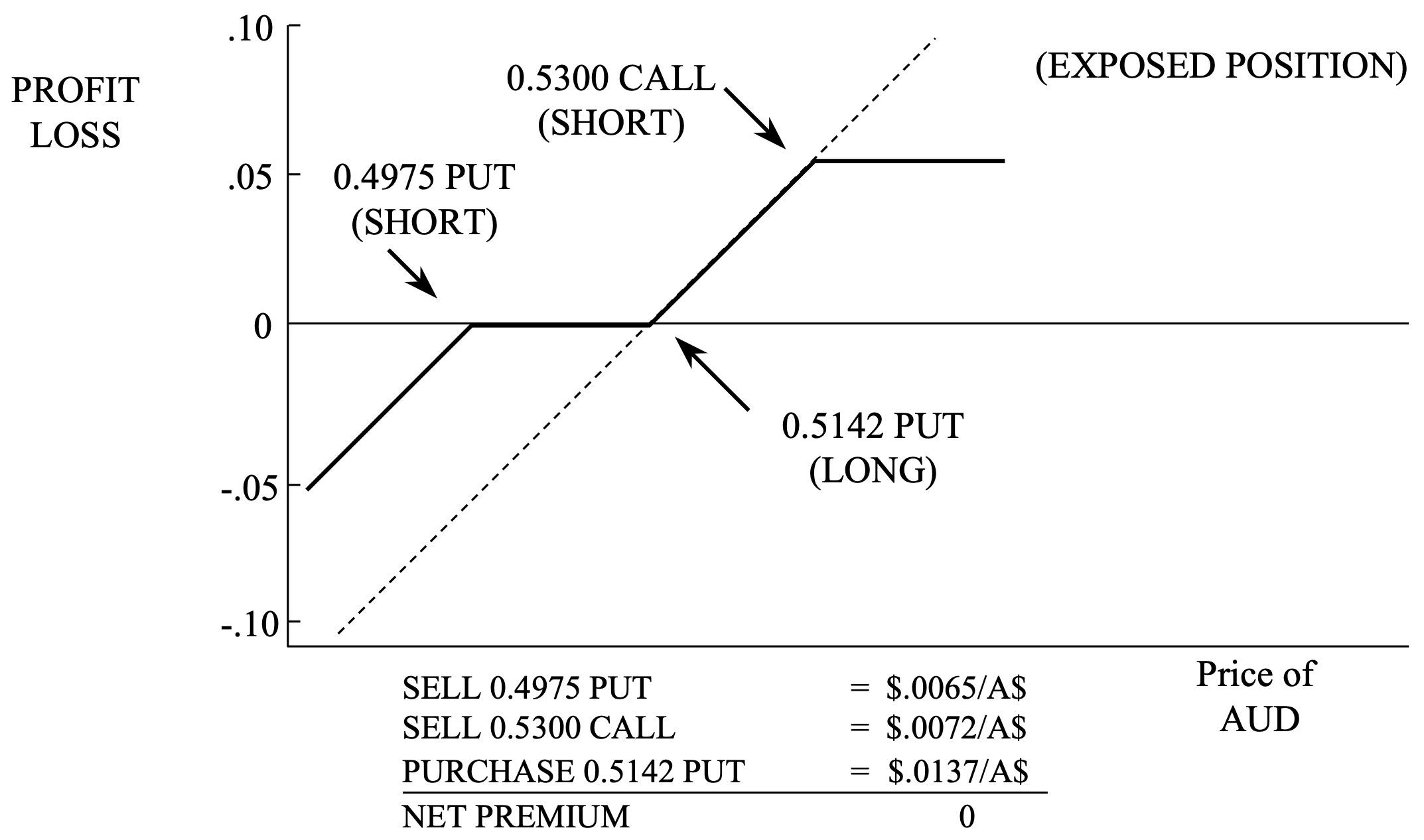

Consider a Second Hedging Problem. A global fixed income manager invests in 3-Month Australian Treasuries, with a coupon of 4.5%.

Market Conditions Spot = 0.5160 3-Month Forward = 0.5142 Market Stable - some (limited) down side risk.

The global fixed income manager aims to insure a currency outcome no worse than the forward. However, the risk manager would also like to leave some limited upside potential from a move higher in AUD.

In the Seagull strategy the client with a long underlying position buys an ATM put option to hedge at the forward rate. The amount of protection is limited by the sale of an OTM put option. The strategy has upside potential up to the strike of a short call option which is sold to make the strategy overall premium neutral.

The Seagull strategy is a powerful hedge in stable market conditions. The strategy effectively shifts the risk outside of trading range. Within the range, the strategy provides the best of both worlds:

The Seagull provides a superior stop-loss performance compared to the exposed position by hedging the exposure between the long ATM put and the short OTM put.

In the next section we continue our introduction to FX options by looking at option valuation.