Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

I build businesses, both as independent startups and as new initiatives within large global companies. This series of posts is based on an FX Options training course that I delivered whilst contributing to building FX businesses at a number of investment banks. If you are looking to build a business and require leadership then please contact me via the About section of this website.

In this section we continue our look at barrier options by looking at some knockout option pricing examples. To get the most from this section you should first have covered the first section on knockout options.

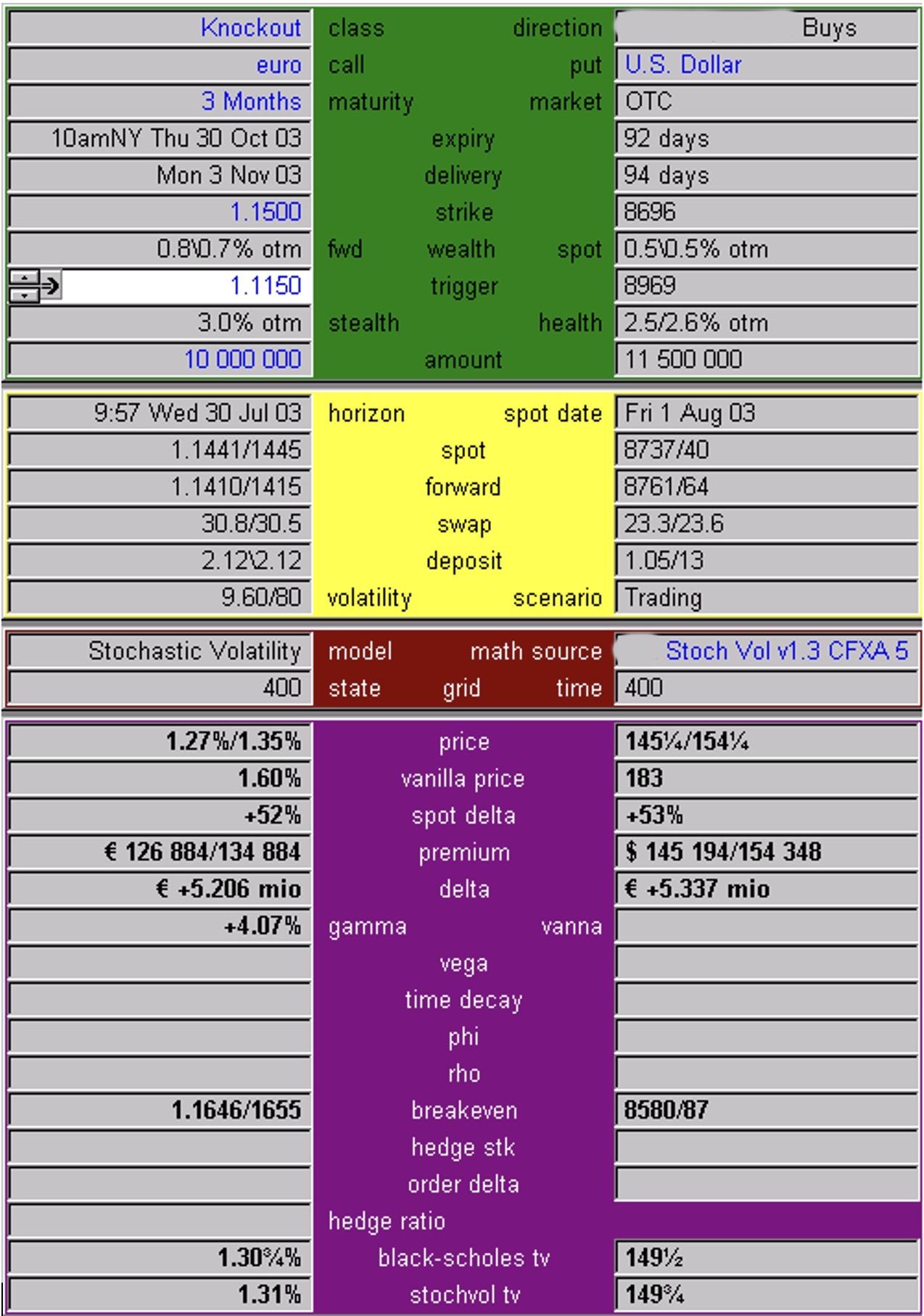

Maturity: 3 month Call/Put: EUR call / USD put Strike: 1.1500 Outstrike 1.1150

Spot: 1.1441/45 USD per 1 EUR Swap: -0.00308/305 USD per 1 EUR ATM Volatility: 9.60/9.80

Price: 1.27% / 1.35% of EUR face

Equivalent standard European option: 1.56% / 1.62% of EUR face.

If spot trades at or below 1.1150 USD per 1 EUR prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or below 1.1150 prior to the expiration time on the expiration date the buyer of the option will buy EUR at 1.1500 if spot is at or above that level at expiration.

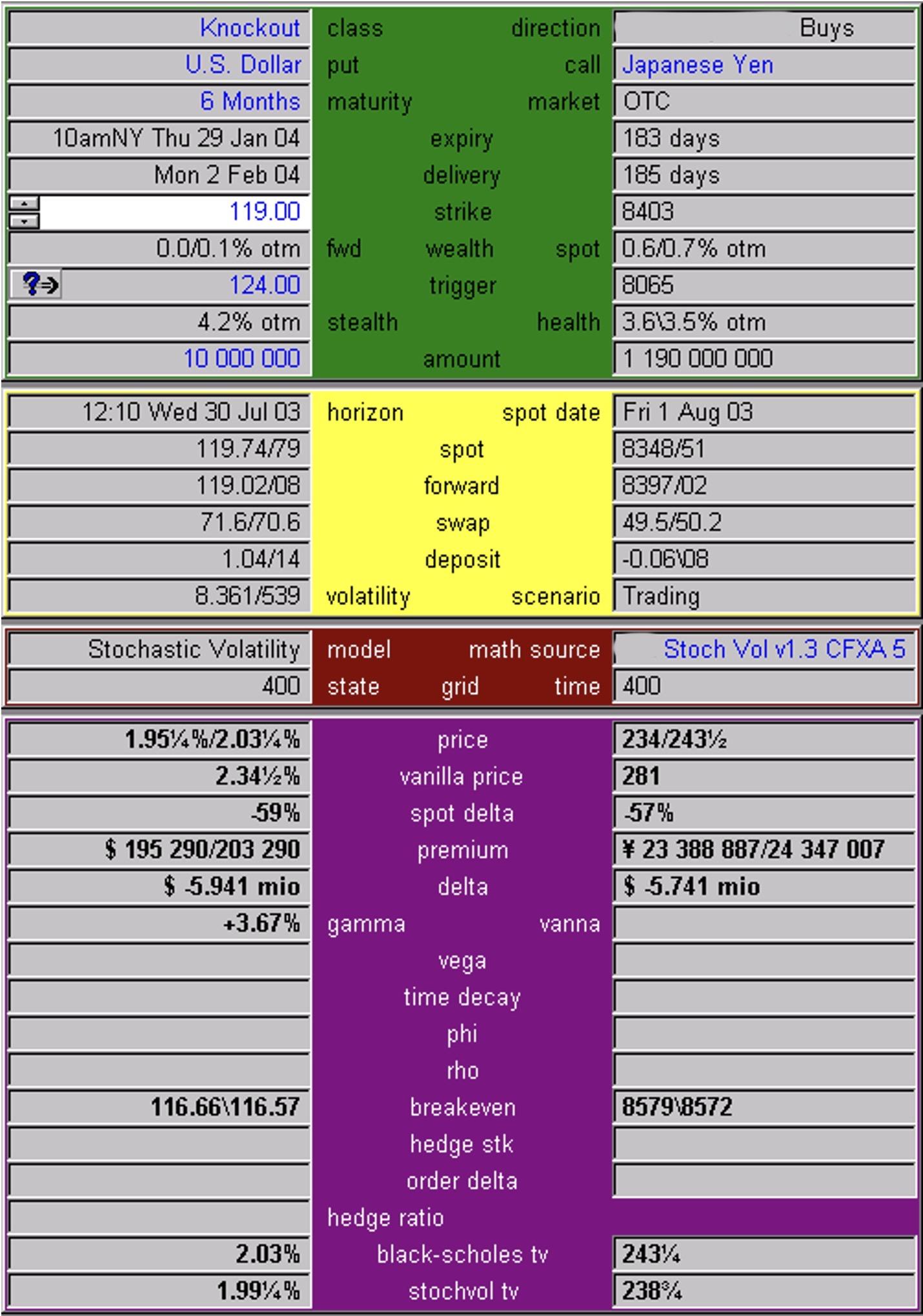

Maturity: 6 month Call/Put: USD put / JPY call Strike: 119.00 JPY per 1 USD Outstrike 124.00 JPY per 1 USD

Spot: 119.73/78 JPY per 1 USD Swap: -71.6/-70.6 JPY per 1 USD ATM Volatility: 8.35/8.55

Price: 1.955% / 2.035% of USD face

Equivalent standard European option: 2.31/2.385% of USD face.

If spot trades at or above 124 JPY per 1 USD prior to the expiration time on the expiration date, then the option terminates. If spot does not trade at or above 124 prior to the expiration time on the expiration date, then the buyer of the option will sell USD at 119 if spot is at or below that level at expiration.

Large barrier delta - slippage risk If the face amount of the option is large for that particular currency pair, and/or the barrier delta is large, then special consideration should be given to the potential for slippage risk if the knockout option is being sold. The barrier delta is the delta hedge amount for the option when spot is about to trigger the outstrike. The size of the barrier delta is significant because when the outstrike is triggered a spot order must be executed to close out the delta hedge associated with the knockout option, as once the outstrike is triggered the knockout ceases to exist and no longer requires the delta hedge. If the order at the outstrike is greater than can reasonably be executed at the outstrike level by a spot trader in typical market conditions then losses may be incurred when the order is filled. These potential losses have to be accounted for in the pricing of the knockout option. The best way to account for potential slippage losses is to price the knockout with an adjusted outstrike, where for the purposes of the initial pricing the barrier is moved to the level where the spot order at the barrier might reasonably be filled. This has the effect of making the knockout option more expensive. The amount by which it is more expensive is the amount by which potential future losses due to slippage in filling the order at the outstrike are compensated upfront. Slippage risk is greatest in those currencies that are least liquid. When taking into account at what level a spot loss order at the outstrike price may get filled, consideration should be given to the fact that the order could get filled in time zones where liquidity in the currency pair may reduced.

Outstrikes placed at round number levels When pricing a knockout option some consideration should be given to the level at which the outstrike is placed. If the outstrike is placed at a round number level, or a big figure level then it may increase the likelihood of being knocked out. The market has become accustomed to barrier levels that are at such levels and can target the orders associated with the barriers. As these levels can be congested by orders it can increase the risk of slippage (see above). Clients should be advised not to have outstrikes at round number levels.

Boundary conditions

Probability of triggering the outstrike The value of a knockout option is dependent on the probability of the outstrike being triggered. The probability of hitting the barrier should be checked by pricing up a One Touch digital with the same barrier level. If the probability is less than 10% or greater that 90% then special care should be taken in checking the boundary conditions described in 3 above.

Parity at the barrier If the knockout option is a parityout, i.e. if it has intrinsic value when the outstrike is triggered then the price should reflect the additional risk at the barrier. In particular the width of the bid ask price should be consistent in currency terms with the width of an equivalent One Touch digital with a coincident barrier. It should also be checked that the amount of parity is within any limits that are set for such discontinuous risk, allowing for the fact that there may be trades with similar risk in any existing portfolio of barrier options. This risk is similar to that of a reverse knockout option that we will see in a later section.

Trading bands Special care should be taken for currency pairs that are not freely floating. In particular, outstrike price levels should be avoided if they are outside any trading bands. Since levels outside the trading band are unlikely to be traded, the option no longer has the characteristics of a knockout option and should not trade at a discount to the equivalent European standard option.

Term structure Knockout options are sensitive to the term structure of interest rates and volatility. If the term structure of interest rates and / or volatility are steep, then an appropriate term structure model should be used to capture these effects.

In the next section we continue our introduction to barrier options by looking at knockout option risk management considerations.