Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

I build businesses, both as independent startups and as new initiatives within large global companies. This series of posts is based on an FX Options training course that I delivered whilst contributing to building FX businesses at a number of investment banks. If you are looking to build a business and require leadership then please contact me via the About section of this website.

In this section we continue our look at barrier options by looking at knockin options. To get the most from this section you should first have covered the sections on knockout options, the knockout option pricing examples and the knockout option risk management considerations.

The knockin option trades less frequently than the knockout option, but has specific uses for both hedgers and traders.

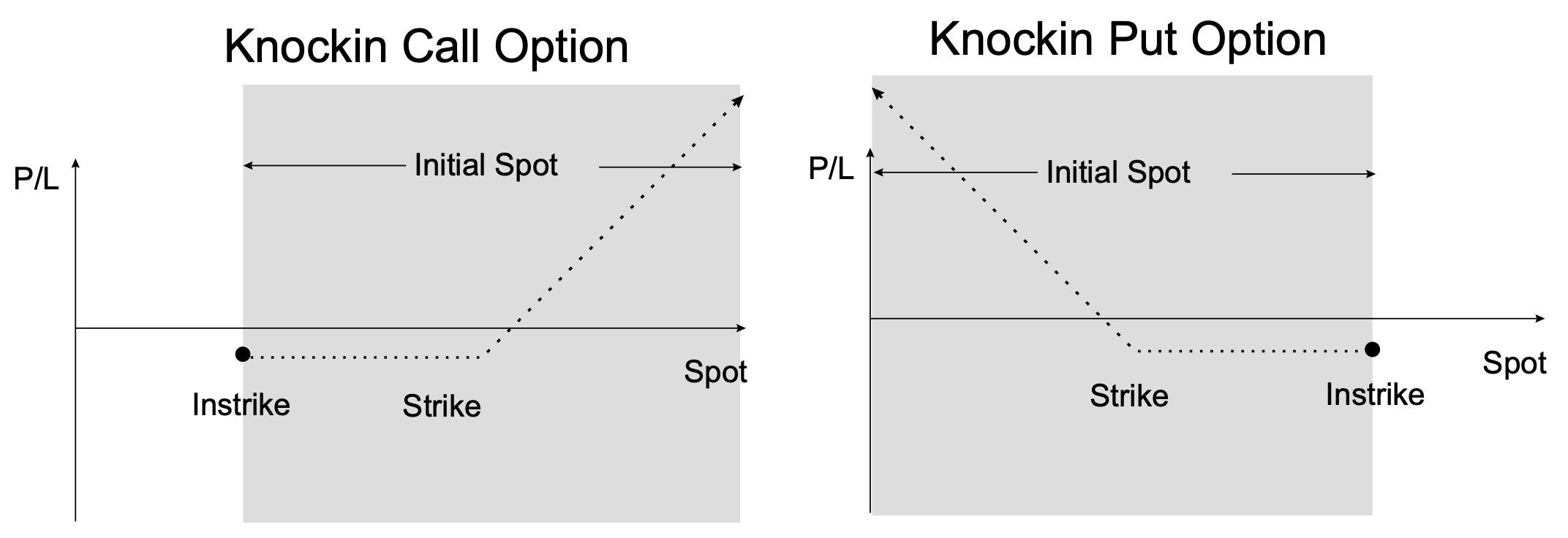

The knockin option differs from a standard option by the additional feature of an instrike price. The knockin option only comes into existence if spot trades at or beyond the instrike price, during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the option. Once the knockin option has been triggered, and comes into existence, then it has an identical payoff at expiration to the equivalent European standard option. If the instrike is never triggered the option expires worthless at expiration.

The instrike price of a knockin option is set relative to spot and strike such that the option comes into existence as the underlying option is moving of Out-Of-The-Money.

The knockin option is most often used in trading strategies, in particular to express a specific technical analysis view.

In order for a knockin option to become live, spot must first to travel in direction of out of the money with respect expect to the option. Therefore, for the knockin option to be a valuable trading tool it must be used in circumstance where spot is expected to go in one direction and then reverse direction strongly.

An example of this would be a situation where spot is expected to bounce from a significant support level and then quickly move away from support. In this example the instrike would be set such that it is just before the technical support level. The option gets knocked in as spot trades and bounces from support and then quickly moves through strike of a now live option.

The advantage of using a knockin option in these circumstances is that it trades at a substantial discount to the equivalent European standard option.

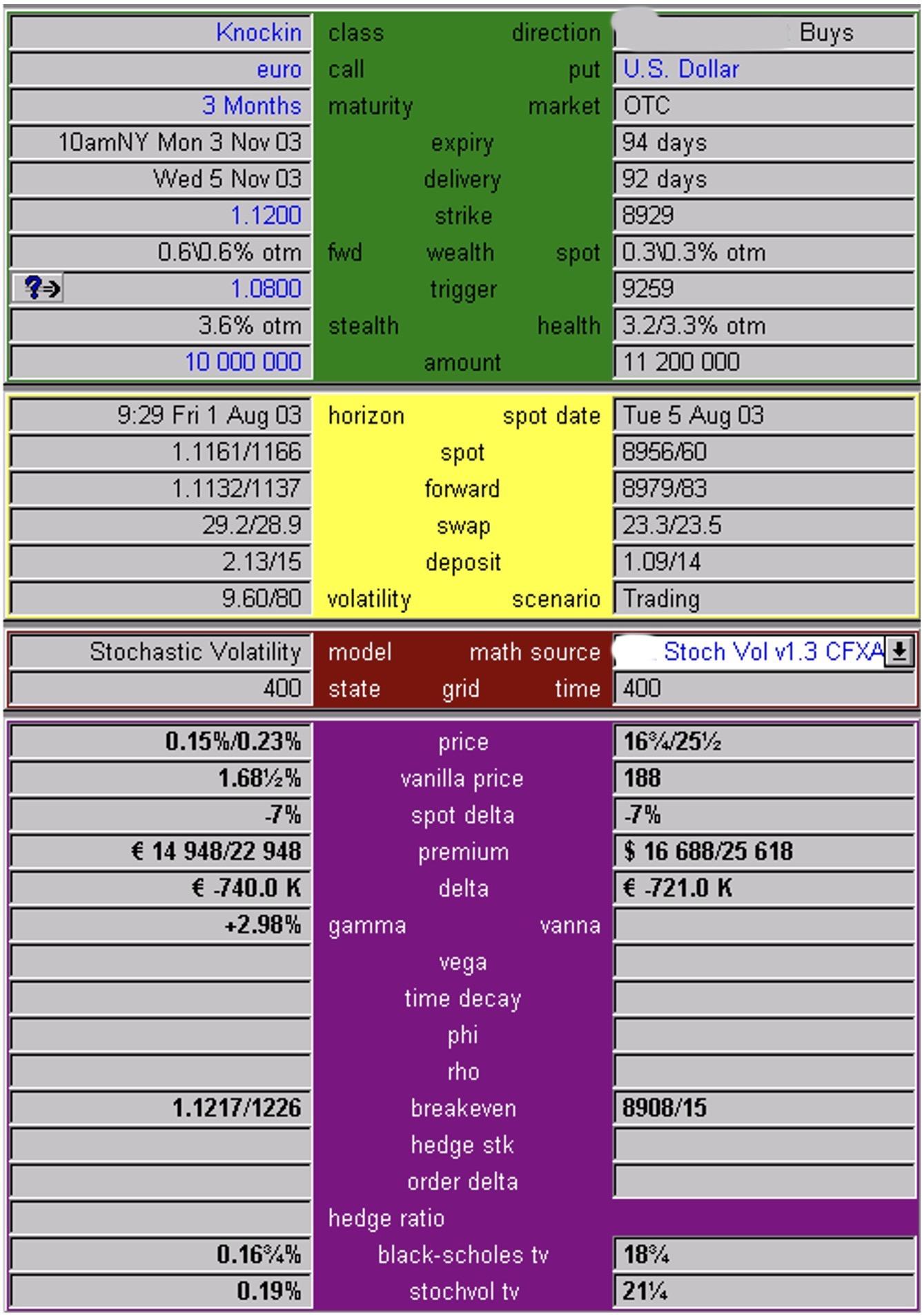

Maturity: 3 month Call/Put: EUR call / USD put Strike: 1.1200 USD per 1 EUR Instrike 1.0800 USD per 1 EUR

Spot: 1.1161/63 USD per 1 EUR Swap: -0.00292/288 USD per 1 EUR ATM Volatility: 9.60/9.80

Price: 0.15% / 0.23% of EUR face

Equivalent standard European option: 1.66% / 1.715% of EUR face.

If spot does not trade at or below 1.0800 USD per 1 EUR prior to the expiration time on the expiration date, then the option never exists and expires worthless. If spot does trade at or below 1.0800 prior to the expiration time on the expiration date, then the option is knocked in and if spot finishes above 1.1200 the buyer of the option will buy EUR at 1.1200.

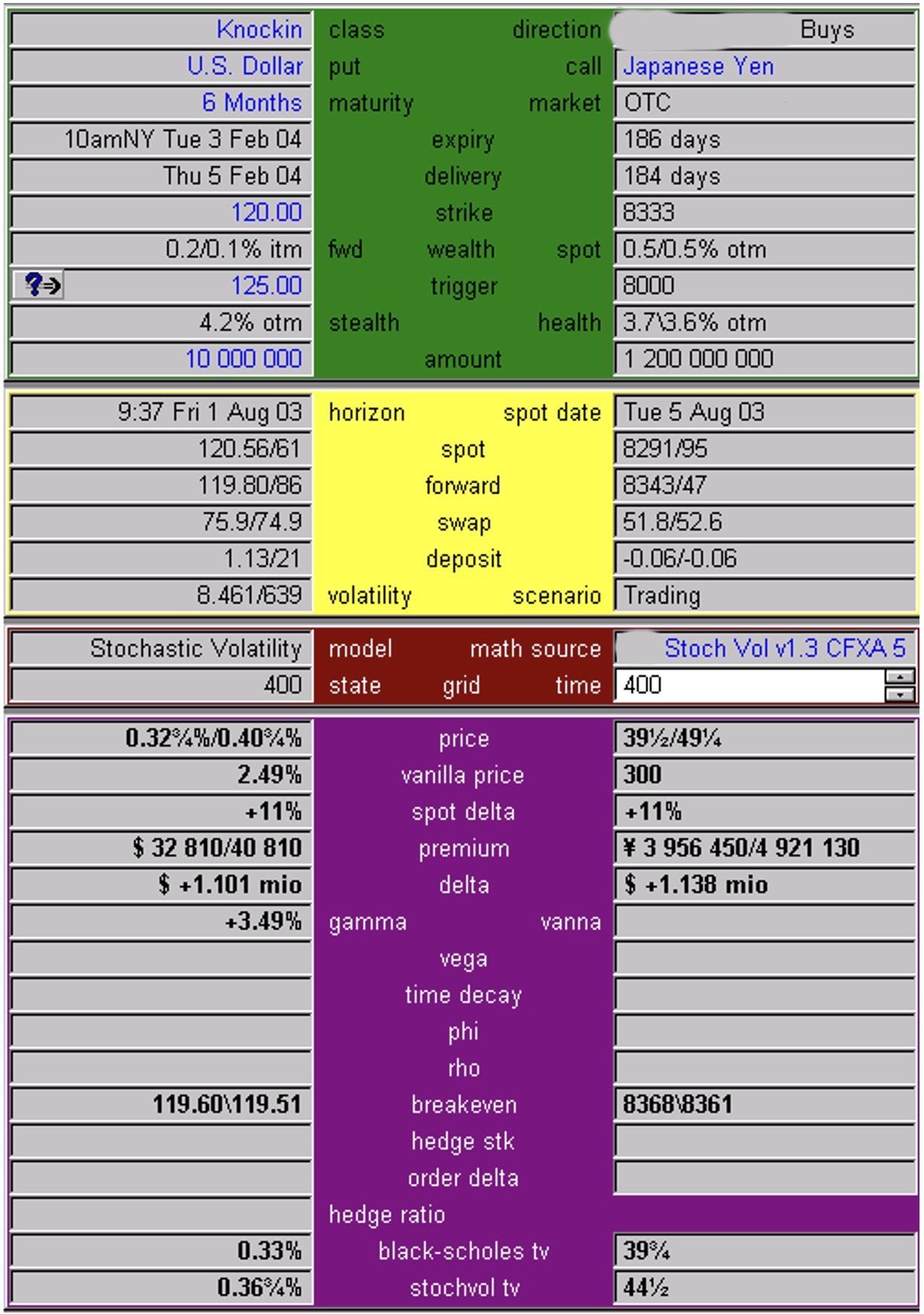

Maturity: 6 month Call/Put: USD put / JPY call Strike: 120.00 JPY per 1 USD Instrike 125.00 JPY per 1 USD

Spot: 120.56/61 JPY per 1 USD Swap: -0.759/-0.749 JPY per 1 USD ATM Volatility: 8.45/8.65

Price: 0.325% / 0.405% of USD face

Equivalent standard European option: 2.44/2.52% of USD face.

If spot does not trade at or above 125.00 JPY per 1 USD prior to the expiration time on the expiration date, then the option never exists and expires worthless. If spot does trade at or above 125.00 prior to the expiration time on the expiration date, then the option is knocked in and if spot finishes below 120.00 the buyer of the option will sell USD at 120.00.

In the next section we continue our introduction to barrier options by looking at the reverse knockout option.