Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

I build businesses, both as independent startups and as new initiatives within large global companies. This series of posts is based on an FX Options training course that I delivered whilst contributing to building FX businesses at a number of investment banks. If you are looking to build a business and require leadership then please contact me via the About section of this website.

In this section we take a practical look at how a salesperson working at an investment bank might go about executing an fx options trade on behalf of a client. To get the most from this section you should first have covered the relevant previous sections and in particular options valuation, option risk characteristics, gamma and the the deep dives volatility and more on volatility.

Each salesperson working on an investment bank FX sales desk is responsible for ensuring that trades are dealt on the correct price, properly delta hedged and that the option and delta hedge are booked with their options desk. The following gives a guide to the process a salesperson goes through when dealing an option with a client...

When a request for an options price is received salespeople should:

1 - Open FENICS.

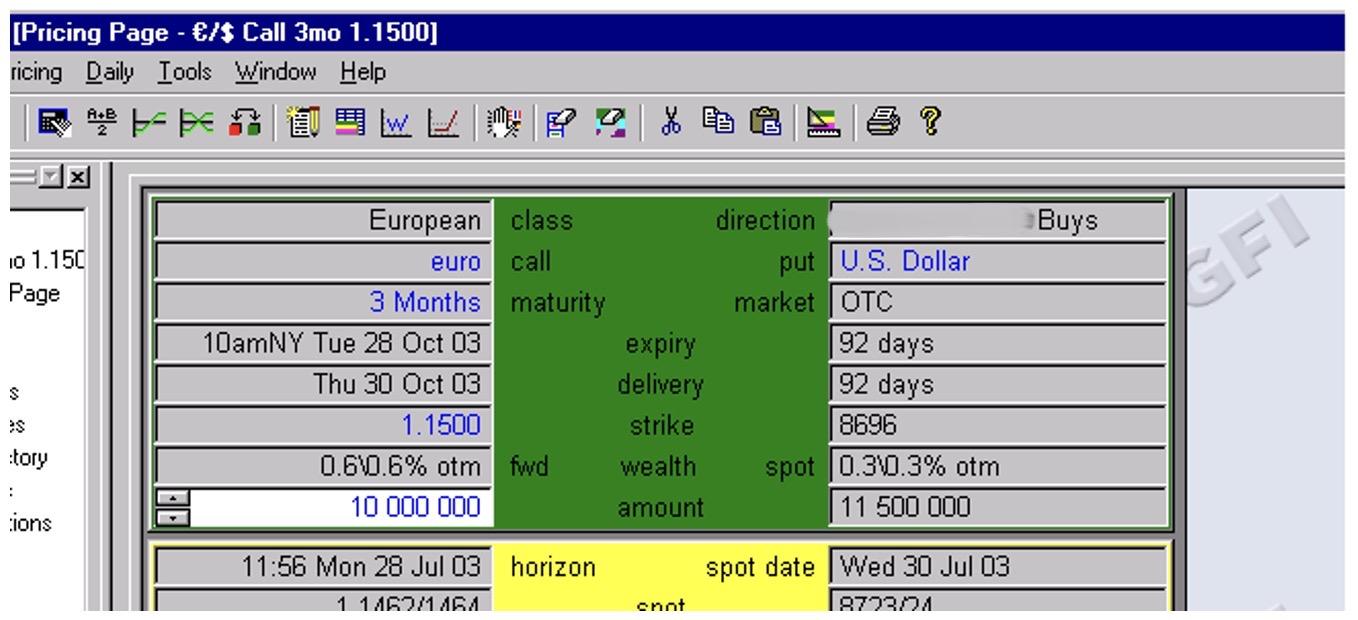

2 - Enter the details of the options contract into the upper section of the pricing tool.

The contract terms are entered in the green block of FENICS. Remember to check that:

3 - The cursor should then take you to the markets section of the pricing tool.

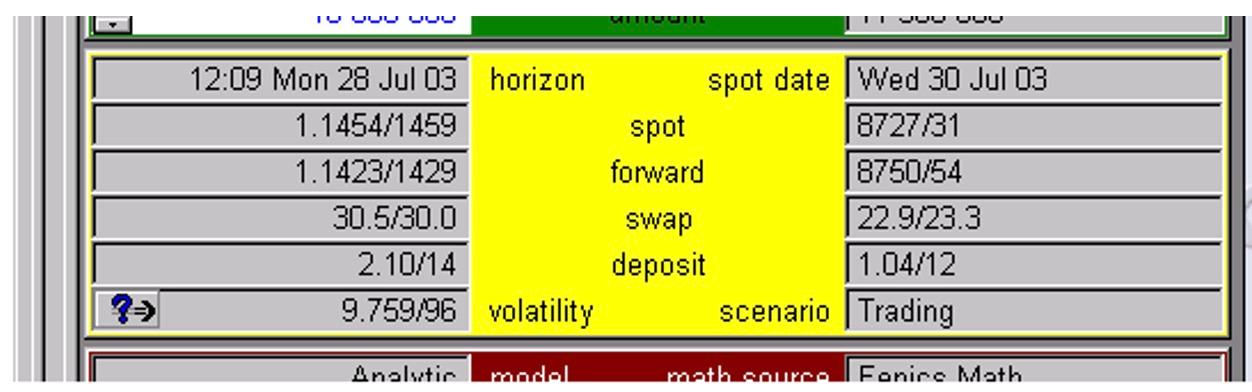

4 - FENICS has a live price feed. Check that the rate displayed in FENICS is where you expect it to be. If not, type in a spot price, this should be close to current market. At this stage the spot needs to be accurate enough to obtain an accurate delta for the option.

5 - FENICS also feeds live swap points. For broken dates these fed rates are interpolated. Check that the forward points look correct. If quoting a broken date be particularly careful that the interpolated rates are correct. If not, ask the forward desk for forward points. You should get a two-way forward price on which you can trade if necessary. The options desk may require you to hedge the option forward so it is important that the forward markets are tradable prices. The date to ask the forward points to is given in the delivery field of the pricing tool.

You should be especially careful when:

The options desk is more likely to require you to hedge the forward delta rather than just the spot delta in these circumstances.

If in doubt ask the options trader.

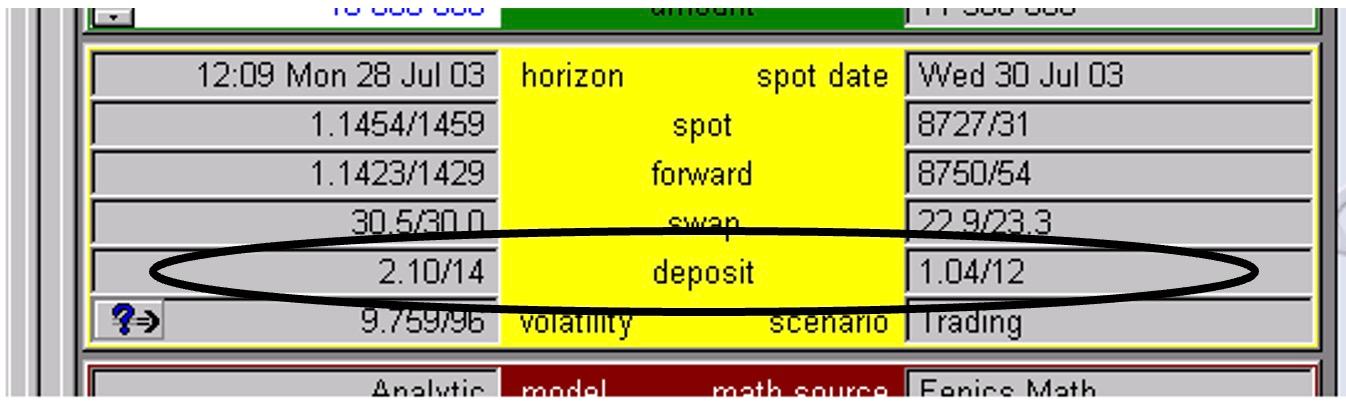

6 - The two deposit rates should now be checked to the screen to make sure they are reasonably accurate. One of them should be changed if necessary. The rate that is changed should correspond to the currency in which we will be receiving or paying premium.

Checking both deposit rates is especially important if you have entered the forward points manually. Since one of the deposit rates would be derived from the forward points that you have input if you have made and error it will show up in the derived rate. If an error has been made in the forward point input the derived deposit rate will either be too high or too low. For example, this would help you identify an error if the forward points have been entered in with the wrong sign.

7 - FENICS is likely to have a live feed of volatilities that is input by the trading desk. The tool will automatically interpolate the traders’ volatility inputs to derive the correct volatility for a specific delta. This interpolation is likely a proprietary bank calculation that has been integrated into FENICS. You are able to trade directly from the price generated by the fed rates for options up to the limit that the trading desk is happy to deal to in face amount and At-The-Money-Forward (“ATMF”) to 10 delta’s. For anything greater than the traders limit in face amount, or any options with a delta less than 10 you should request a volatility from the options trader.

8 - Ask the options trader for the volatility. The options trader will need to know:

Eg. “In EUR / USD I need a two way vol for a 3 month 44 delta EUR call / USD put on 50 USD”

9 - Type the volatility the options trader gives you into the tool, and check that this does not significantly change the delta of the option. If the delta has changed more than say, 5 delta, obtain a new quote from the options trader.

10 - Ensure that FENICS is set to show the price in the form the client has asked to see it.

11 - Before giving the price to the client, read back to the client what you have typed into FENICS to ensure that what you are quoting is what the client is asking for. For example:

“XYZ Bank sells a European standard option, expiry 28 Oct 2003, euro Call / U.S. Dollar Put, strike 1.1500 and a face amount of EUR 10,000,000. The price is 1.83% offered on a spot reference of 1.1495”.

12 - If the client wants a live price then ask the spot trader for a live price in the amount of the delta hedge, type the spot price into FENICS, calculate (hit F1), and quote the client. If the spot trader changes the spot price then tell the client that the price has changed, and re-price the option on the new spot price.

13 - If the client deals on a live price then you must immediately delta hedge the option at the spot price you obtained from the spot trader.

14 - Inform the options desk of the trade, and the details of the delta hedge.

In the next section we start our introduction to non-vanilla FX options by looking barrier options, starting with the knockout option.