Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

The intention of this section is to give you a the knowledge of Binary Options and Double Knockout Options that will enable you understand what they are and how they are used.

Your goals by the end of this section are to be able to:

Setting you up to acheive the goals of this section is our goal. Having some knowledge of knockout options and reverse knockout options, if you are not yet familiar with them, would help you achieve the section goals.

In this section we deepen our look at barrier options by looking at binary options and double knockout options. Both of these products are primarily used in trading strategies. Binary options have also been embedded into strategies such that they are sold to fund the purchase of other options. Binary options can also be known as digital options. Double knockout options are also sometimes called double knock out options or double knock-out options.

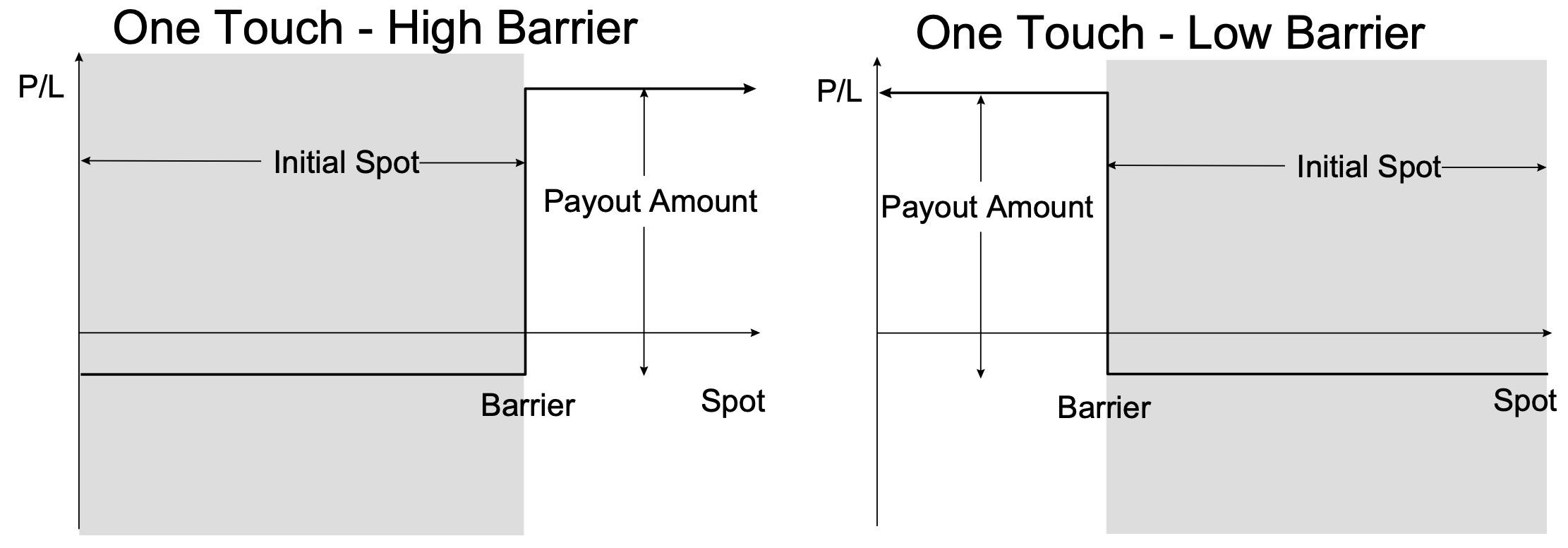

Binary options differ from other options in that they have a fixed payout depending on whether one or more barriers are either triggerd or not triggered. In this guide we will look very briefly at the two most common forms of binary option, the single barrier one touch and the double barrier double no touch.

The one touch comes from the family of barrier products known as digitals. One touches can be incorporated into structures or traded in their own right. Barrier option market makers also trade one touches in the interbank market to adjust the risk profile of portfolios.

A one touch differs from other barrier options in that it does not give the buyer the right to buy or sell a currency at a particular rate. A one touch has a fixed payout amount in a pre-specified currency that is conditional on a pre-specified rate trading in the market during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the one touch. The buyer of a one touch receives the payout amount at expiration if the barrier is triggered. One touch options can also be known as one-touch options.

The price of a one touch option is expresssed as a percentage of the payout amount. For example, a one touch option might cost 10% of the payout amount, providing the buyer with 10x leverage. The price of the one touch option is dependent on:

The simplese use case for a one touch option is to express a directional view. Market professionals sometimes trade a one touch option to obtain leveraged exposure to the market trading in a particular direction or to specific levels. Technical analysis can play a significant role in determining where the market is expected to trade in a particular time frame. One touch options can be used to express a technical analysis view by setting the barrier price at key technical levels.

Another use case of the one touch is to sell the one touch to fund the purchase of other options. One popular strategy is the past was to fund the purchase of a standard European option by selling three or more one touch options such that the initial price of the strategy is zero.

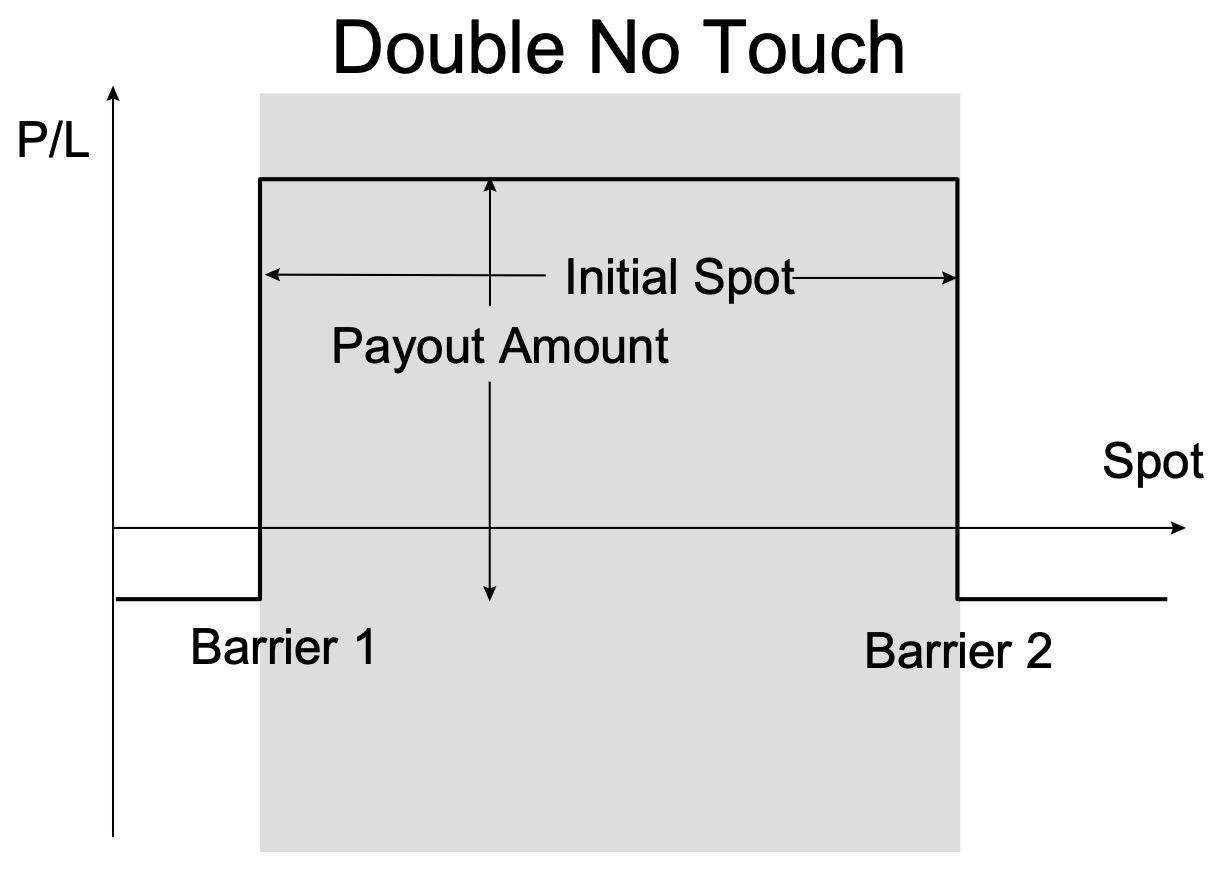

The double no touch, also known as a range binary, first came to prominence in 1994, after a previously volatile USD vs Europe market started to range trade for a few months. For the first time it became possible to take a short volatility position with a well-defined worst case downside.

The buyer of a Double No Touch pays an initial premium for the right to receive a fixed payout amount at expiration if neither of two levels are touched prior to expiration. The barriers are set such that spot is between the two barriers. If spot trades at or beyond either of the barriers the option terminates. The price of a double no touch is quoted as a percentage of the final payout amount.

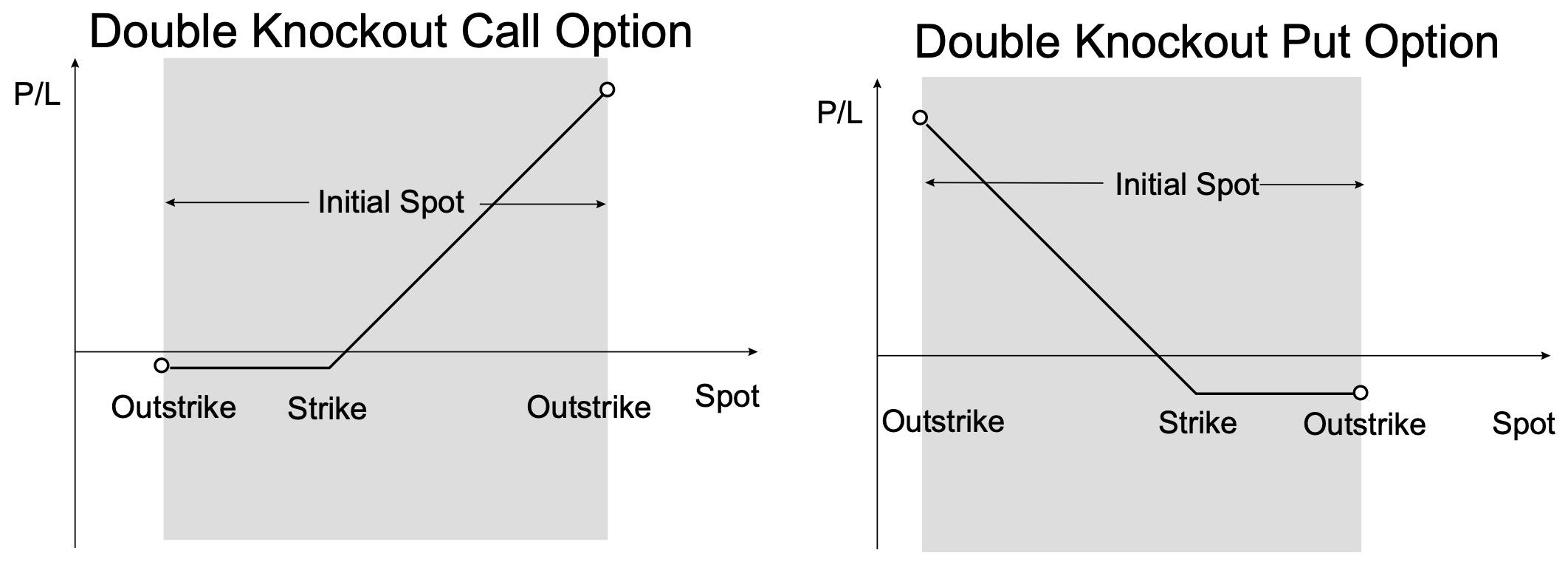

Double knockouts were first used in 1994, and were a natural extension of the growth in the use of reverse knockouts.

The double knockout option differs from a standard option by the additional feature of two outstrike prices. If spot trades at or beyond either outstrike price during global trading hours from the time at which a trade is executed, until the expiration time on the expiration date of the option, then the option terminates. If the outstrikes are never triggered then the pay-off from the double knockout option at expiration is identical to that of the equivalent standard European option.

The outstrikes of a double knockout option are set such that one is above spot and the other is below the initial spot price.

The cost of a double knockout option is less than the cost of the equivalent standard option, and less, the equivalent knockout and reverse knockout options.

The price of the double knockout option is dependent on:

Congratulations on making it to the end of this section. Both Binary Options and Double Knockout Options represent relatively complex financial products and having a solid foundation in them sets you on the path to a much deeper understanding of the FX options market.

You have earned yourself the choice of taking on the challenge of getting to the next level up or sitting back and enjoying the moment of your new achievement:

To better understand binary options and double knockout options it is helpful to have a good grounding in reverse knockout options, reverse knockin options, knockout options and knockout option risk management considerations.