Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

In this section we look some of the risk characteristics of barrier options and also the imact they have on both the FX cash and FX options markets. To get the most from this section you should first have covered the sections on barrier option intuition, reverse knockout options, binary options and double knockout options, knockout options and knockout option risk management considerations.

Exotic options had a considerable impact on both the cash and options markets since 1996. In 1996 the supply of exotics was greater than the underlying options market could cope with. Many providers were unaware of the effective face amounts that they were trading. Hedging scheme errors by many providers compounded the problems. Since then the market has evolved such that the small number of banks with exceptional proprietary models have a significant competitive advantage.

The spot market has an increased focus on barrier option stop loss orders. Many barriers are placed at “round number” levels, i.e. at big figures, etc. As a result of this the spot market now targets such barriers. Price action in the spot market is now often linked to outstrikes being defended and order books are dominated by barrier option related spot orders. This has caused the price action around big figures to change.

The reason why an exotics options trader has an order at the barrier level is a consequence of the trader delta hedging the portfolio. When the transaction is first initiated it is delta hedged and put into the portfolio. The net delta of the portfolio is dynamically delta hedged. A barrier option has an associated delta until either the barrier is triggered or it expires. If a barrier is triggered the delta will change. For a knockout option the option will no longer exist if triggered and therefore the delta goes to zero. For a knockin option the delta will change to that of the European option. Either way a spot trade needs to be executed to rebalance the delta of the portfolio due to the barrier option being triggered. It is this spot transaction that requires the barrier order.

If a market maker sells a knockout option then the barrier order will be a stop loss. If the market maker buys a knockout option the barrier order will be a stop profit.

If a market maker sells a knockin option then the barrier order will be a stop profit. If the market maker buys a knockin option the barrier order will be a stop loss.

In practice most of the orders that the exotic options traders leave with the spot desk are stop loss orders. It is reasonable to ask why are they always stop-losses. In general clients tend to bet that barriers won’t touch - ergo, exotic option market makers profit if spot moves towards the barrier for the first time -- ergo, exotic option market makers’ hedges are always against the direction of the spot move just before the barrier. At the barrier, they must take positions off, going with the spot movement -- hence stop loss orders.

However, they don’t always act like stop losses, as:

Slippage can be incurred on stop loss orders that are placed at the barrier level in order to reverse the options delta hedge. Slippage is typically not incurred on all stop-loss orders, however, on specific trades, where the slippage risk is considered to be significant, additional slippage edge should be charged.

To calculate how much slippage edge should be charged on high slippage risk trades the barrier should be moved to the level where the spot desk might reasonably be expected to fill the stop loss order. This needs to take into account the fact that the order is likely to be good in all time zones and therefore may be executed in poor liquidity conditions.

Market makers can get short large amounts of discontinuous barrier options such as Reverse Knockouts, Double Knockouts and Digitals. Market makers get long vega through these trades and have to sell volatility as a hedge. When barriers are triggered market makers have to buy volatility back. Some barrier options have long maturities and if the size of the exotic option is large compared to the normal levels of liquidity to a particular maturity then it can cause volatilities to those maturities to be more volatile. For example, back-end volatilities can be more volatile if there are large barrier positions.

The Black-Scholes pricing model has proved inadequate for exotic option valuation. Many of the models underlying assumptions have been proved to be false. Different institutions have dealt with the modelling issues in different ways and the differences can sometimes be seen in market prices. There are fewer banks prepared to warehouse significant amounts of exotic option risk. The exotic options broker market has developed to enable market makers to lay risk off to others.

The key the change in the market is the increased impact of higher order volatility derivatives:

These effects are known as “Bad Deriv”. When you are short discontinuous barrier options, as spot and/or volatilities move, you “derive” into a worse position.

dVega/dVol is the change in vega for a 1% change in implied volatility. A trader can have either a long or short dVega/dVol position. E.g. A for butterfly where the trader is short the middle strike and long the wings would give the trader a long dVega/dVol position. For barrier options if the trader is short a range binary he would be short dVega/dVol.

It is instructive to compare dVega/dVol to gamma. dVega/dVol is the risk measure of an options sensitivity to implied volatility that gamma is as a risk measure of an options sensitivity to spot. If a trader is long dVega/dVol then to hedge his vega position as volatility changes he would buy low implied volatility and sell high volatility. Therefore, like hedging a long gamma position as spot moves, the trader profits if implied volatilities change. Conversely, if a trader is short dVega/dVol then to hedge his vega position as volatilities change he would sell low volatility and buy high volatility. So, the trader would lose if volatility itself is volatile and profit if implied volatility remains stable.

There are non-exotic examples. dVega/dVol problems are not new, and are not unique to exotic options. Before the development of the exotics market a major money centre bank suffered losses from a short dVega/dVol position. The head of trading did not believe OTM’s should be bid over the ATM’s, i.e. he believed the market to be wrong by having strangles trade over the ATM’s. So, he structured the books to be long straddles and short strangles, i.e. put on a butterfly position in all books. Initially the bank made money as the volatility market itself was stable. Then the volatility markets started to move and then the head of trading lost money on re-hedging vega position.

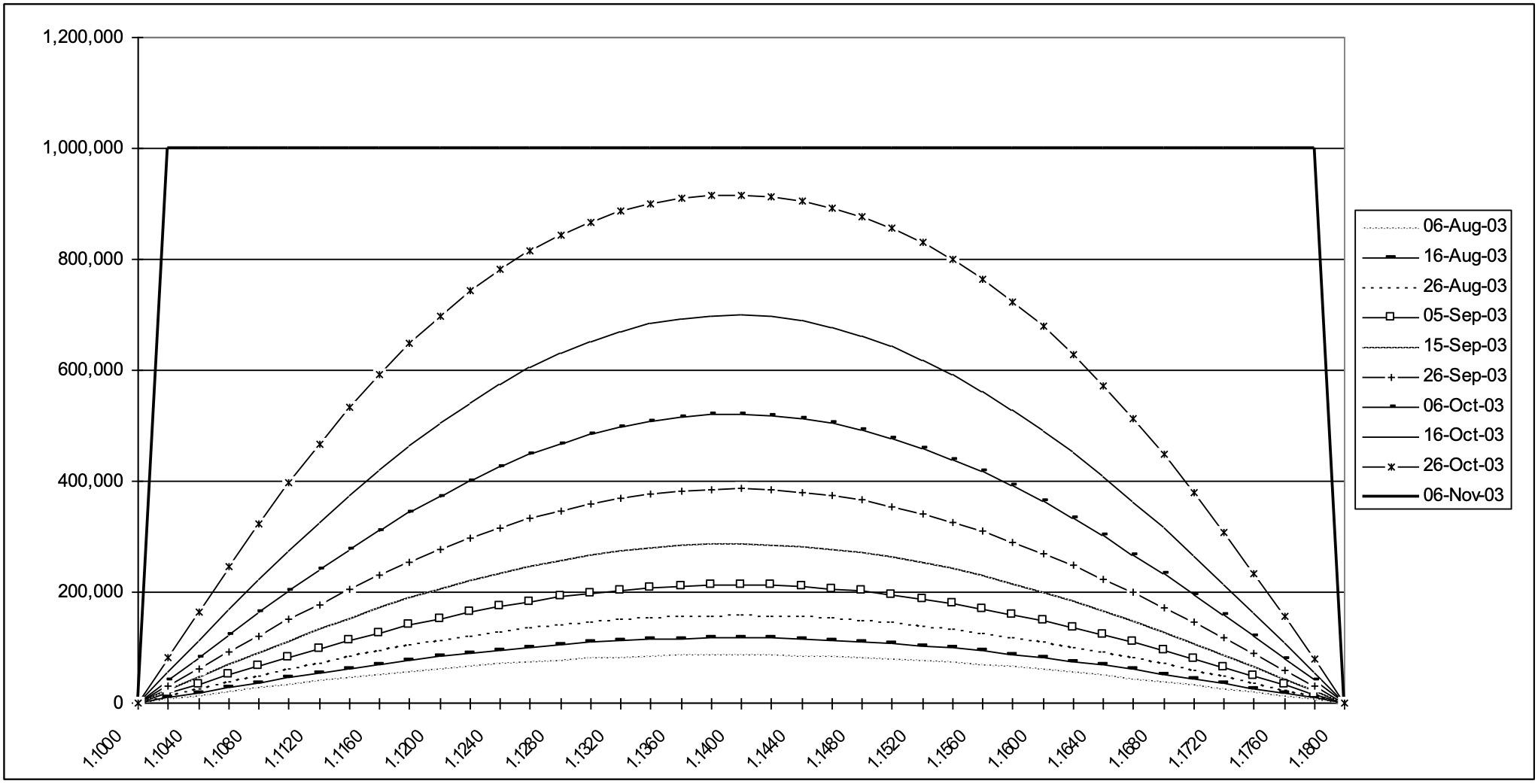

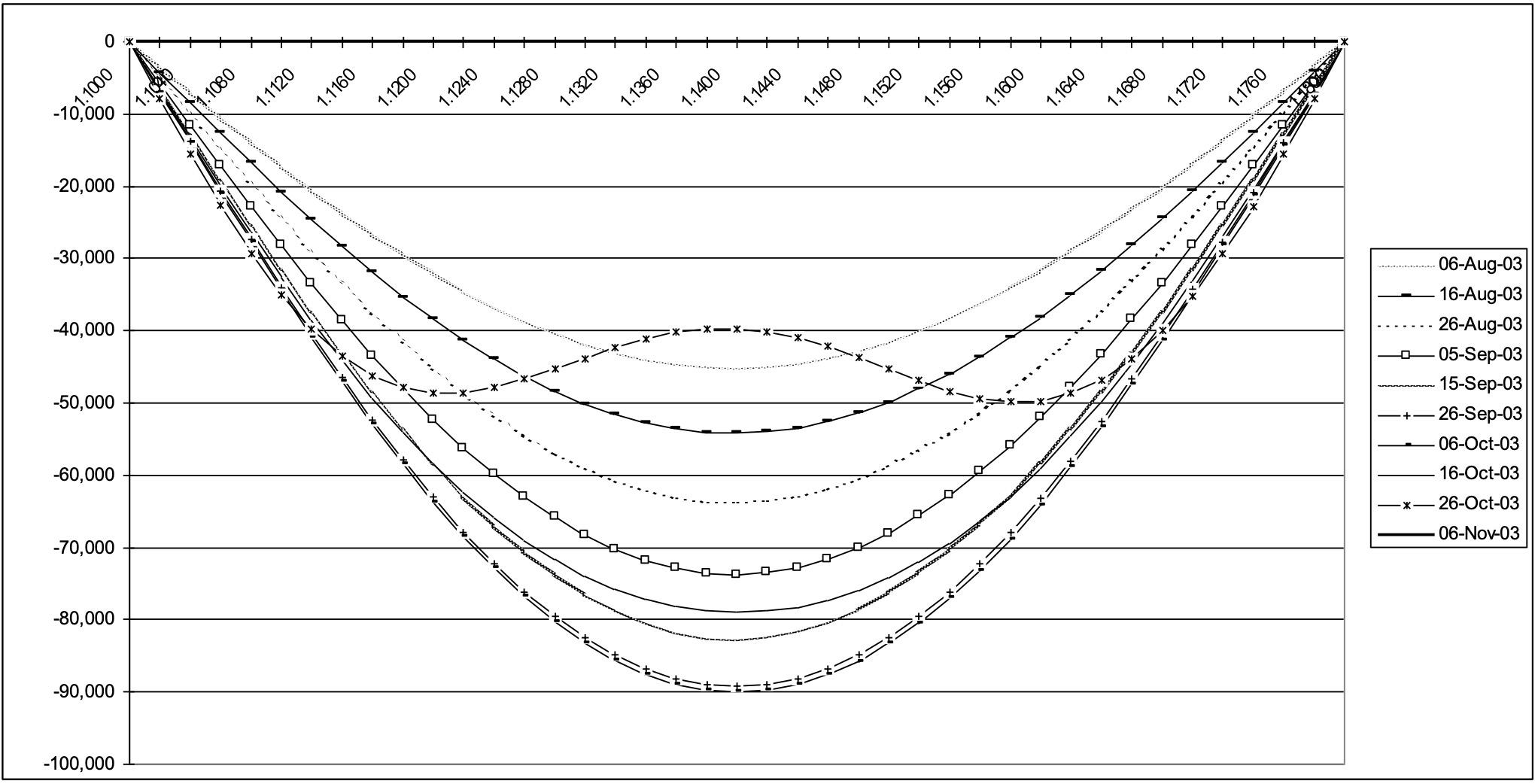

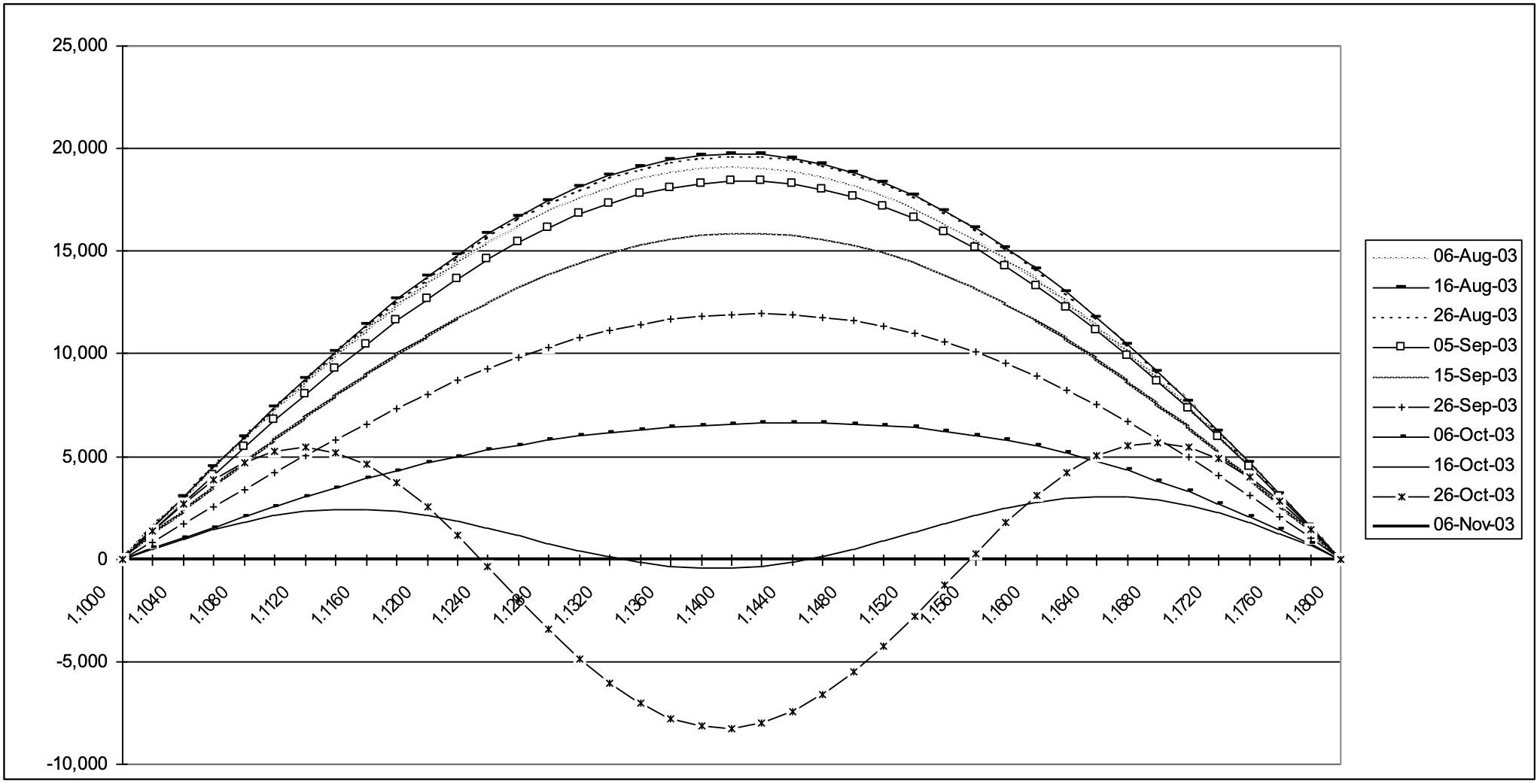

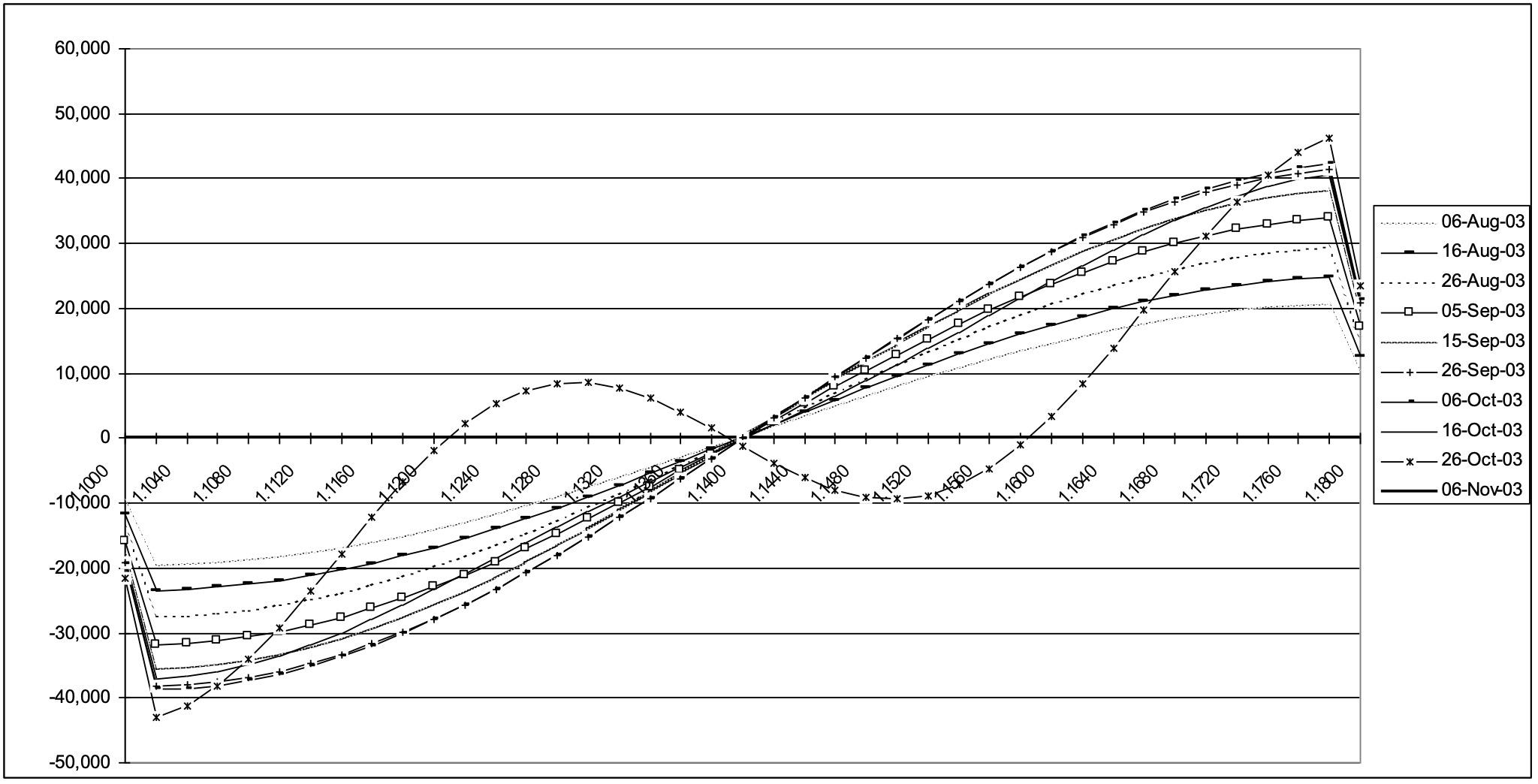

The double no touch is a good example of the importance of higher order derivatives. The following charts show graphically how the value and various volatility related derivatives evolve over time.

Consider the following Double No Touch:

Double No Touch: Value

Double No Touch: Vega

Double No Touch: dVega/dVol

Double No Touch: dVega/dSpot

The reverse knockout is another good example of the importance of higher order derivatives. The following charts show graphically how the value and various volatility related derivatives evolve over time.

Consider the following Reverse Knockout Option:

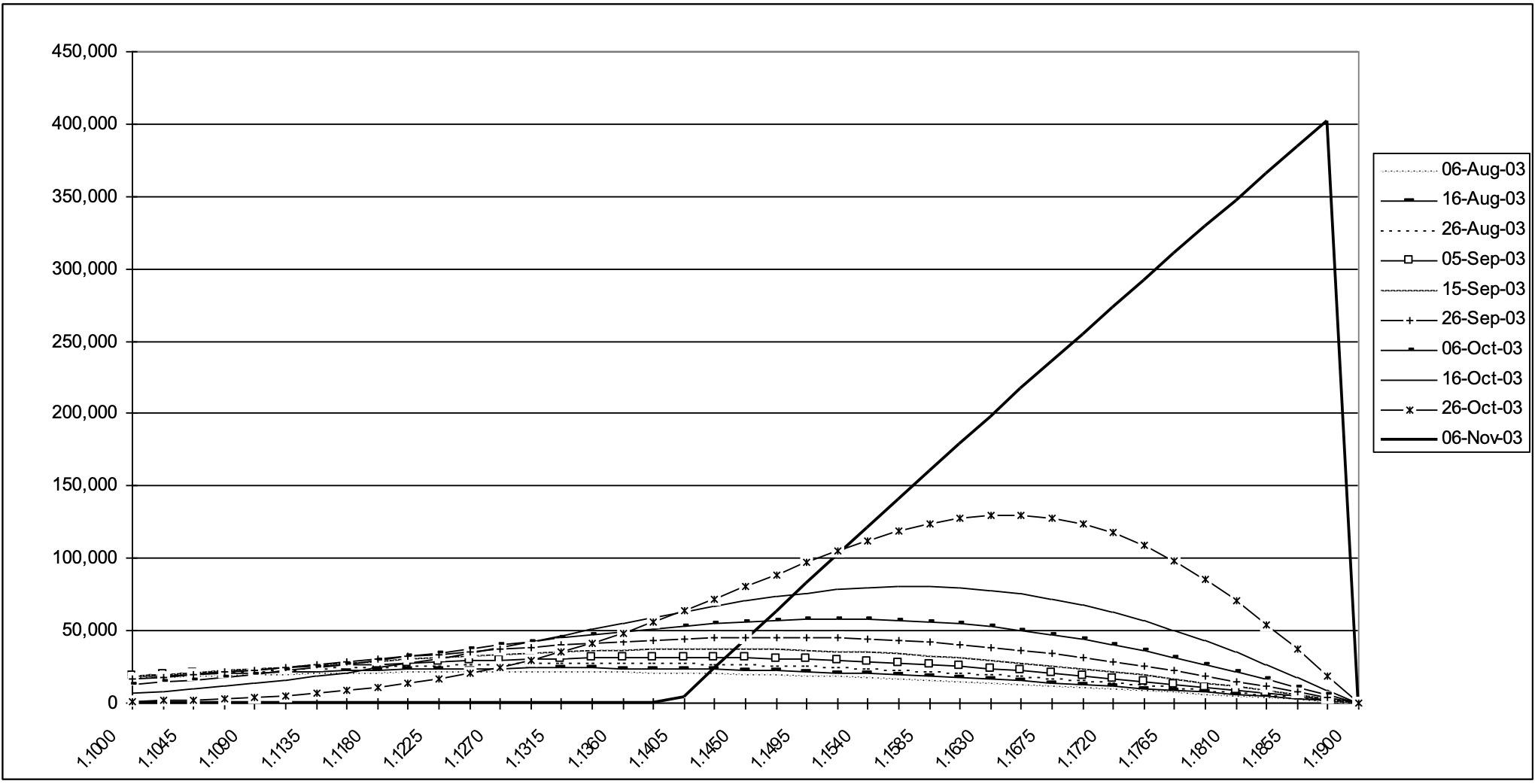

Reverse Knockout Option: Value

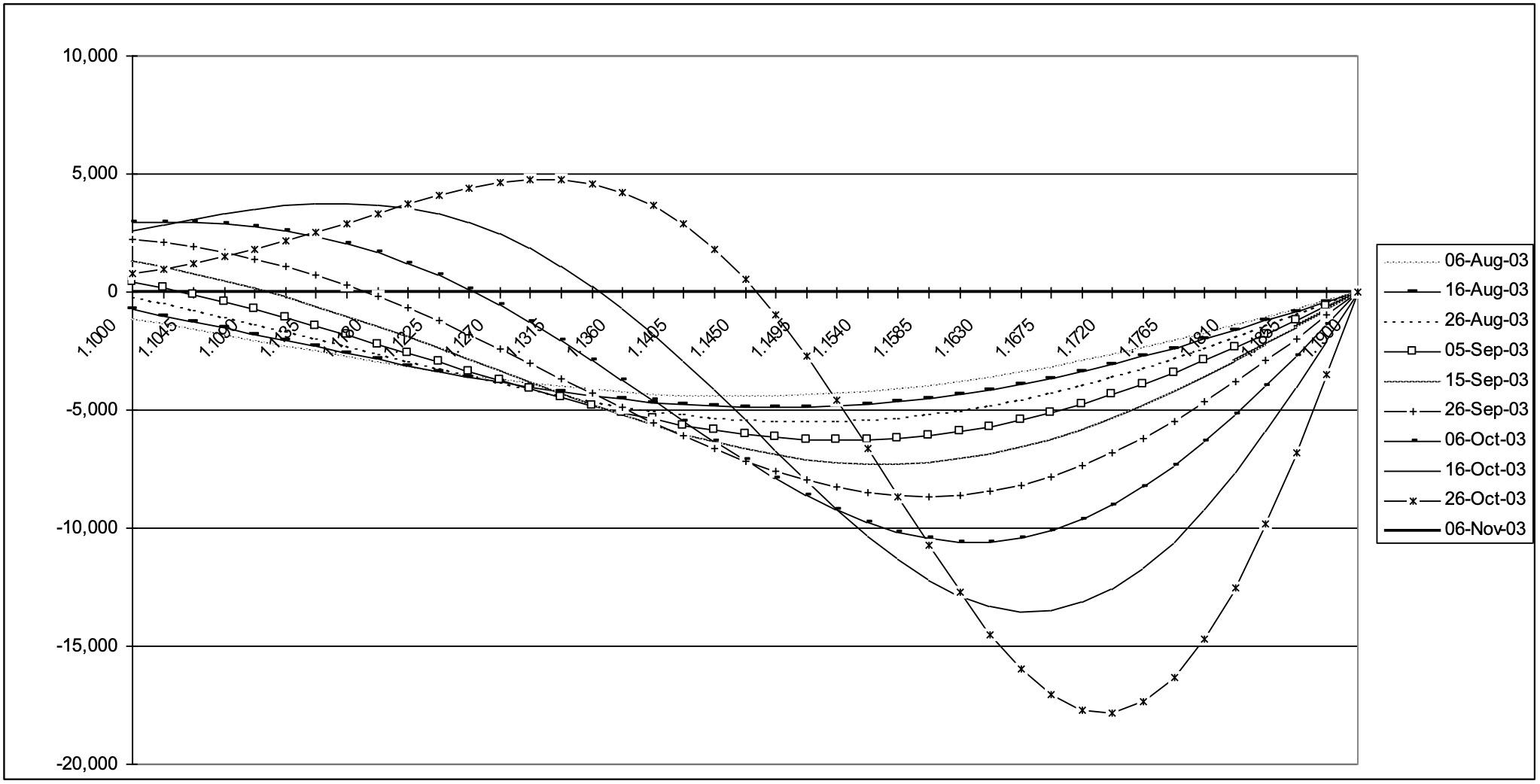

Reverse Knockout Option: Vega

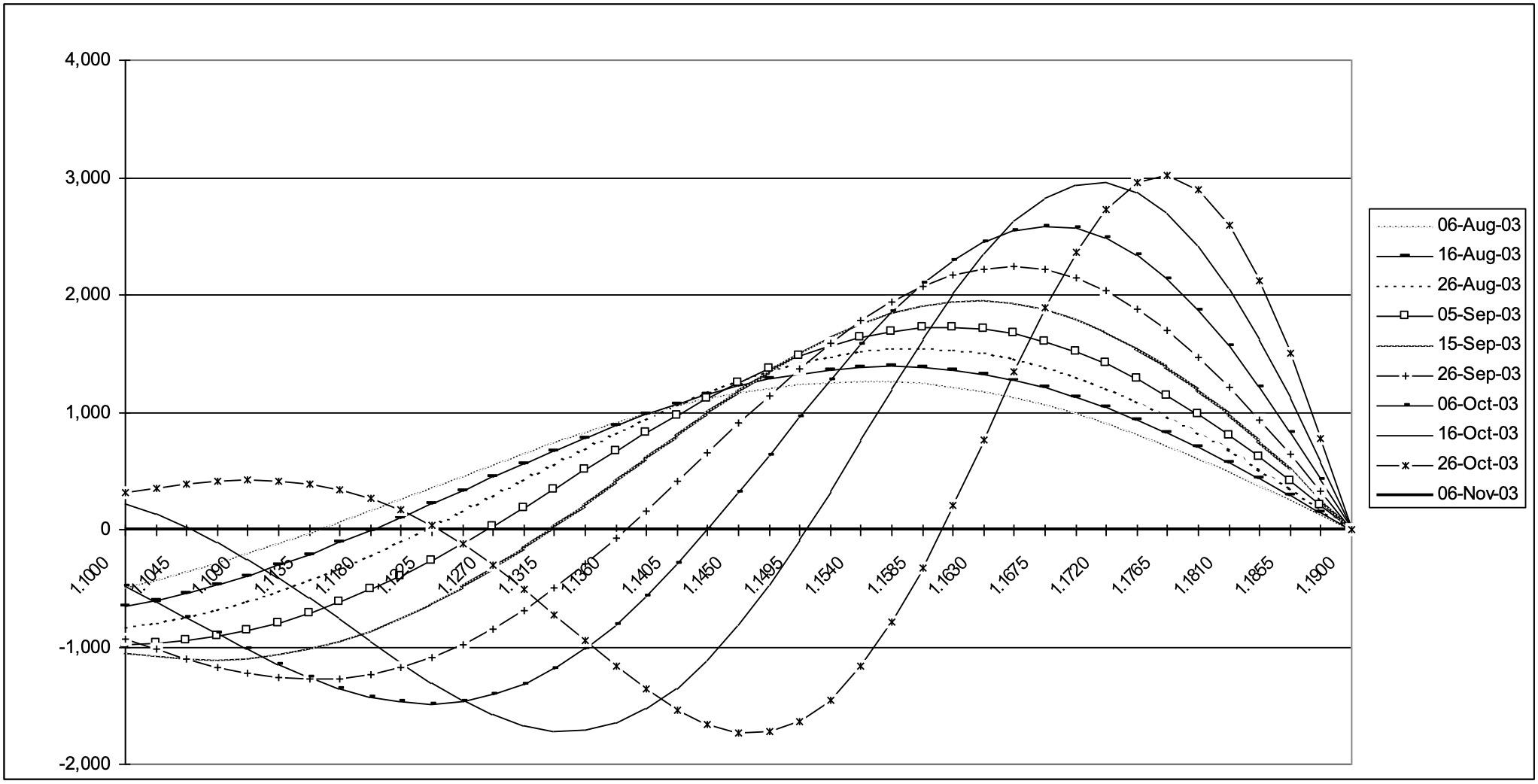

Reverse Knockout Option: dVega/dVol

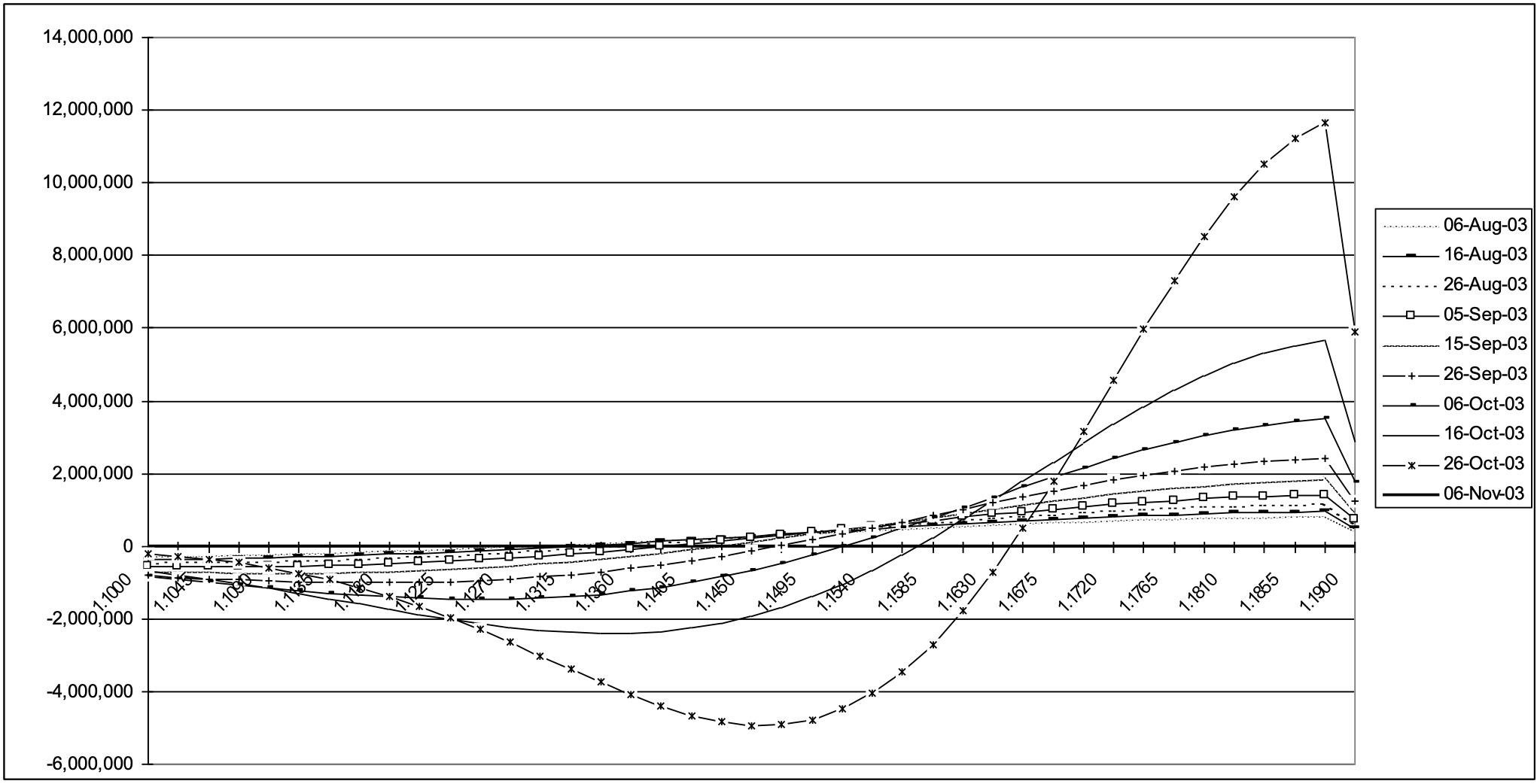

Reverse Knockout Option: dVega/dSpot

Traders get long vega from selling RKO’s, DKO’s and Range Binaries. Historically, many traders sold straddles to neutralise the vega. Others traded spreads of varying types. Some claim to use static replication techniques. There are a number of problems from simply selling straddles against exotic option positions. Hedging with straddles is dangerous as it only neutralises the instantaneous vega position. As spot approaches the barrier the long vega position from the exotic disappears. When spot hits the barrier the trader is left short OTM options in a moving market. In a moving market there is a reasonable expectation that vols would be well bid. So being short OTM options in a moving market is highly likely to lead to hedging losses.

Also, as volatilities change, the straddle fails to match the performance of the exotic. There is a vega mismatch between straddles and exotic options. As volatilities increase, exotic option vega decreases, causing the trader to have to buy volatility at higher levels. As volatilities decrease, exotic option vega increases, causing the trader to have to sell volatility at lower levels. This increases the cost of hedging the exotic vega position and needs to be accounted for in the initial price.

In the next section we extend our introduction to non-vanilla FX options by looking at the average rate option.