Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

In this section we look to build on what we have learned in the previous barrier option sections by seeking to gain some barrier option intuition. To get the most from this section you should first have covered the sections on reverse knockout options, reverse knockin options, binary options and double knockout options, knockout options and knockout option risk management considerations.

The value of a standard option is dependent on the probability of spot finishing beyond the strike at expiration. The probability underlying a barrier option is a conditional probability such that the probability of finishing beyond strike at expiration is conditional upon having either touched or not touched the barrier level at any time prior to expiration.

The value of a knockout option depends on the conditional probability of finishing beyond strike having not touched the outstrike prior to expiration.

As spot moves closer to the barrier:

As spot moves away from the barrier:

The value of a knockin option depends on the probability of finishing beyond strike having touched the instrike prior to expiration. Therefore, in order for the knockin option to be triggered and then finish In-The-Money, spot has to first go in the direction of the barrier, trigger the barrier and then trade in the opposite direction until it has moved beyond strike.

As spot moves closer to the barrier:

As spot moves away from the barrier:

The value of a reverse knockout option depends on the probability of finishing beyond strike having not touched the outstrike prior to expiration.

As spot moves closer to the barrier:

In trying to understand the value of a barrier option it is often useful to refer back to the options boundary condition.

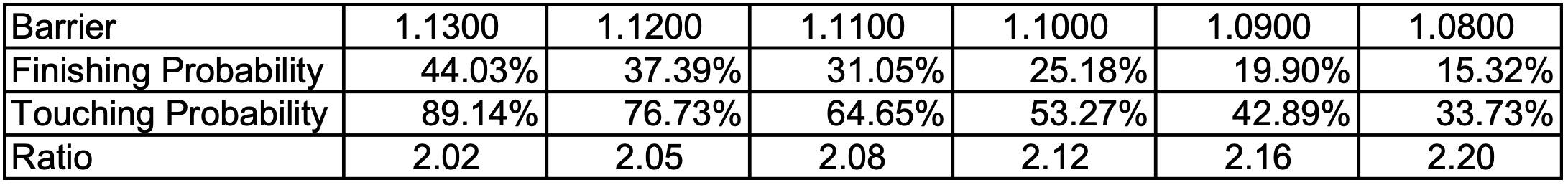

Clearly, the price of a knockout option is dependent on the probability of touching the barrier. For a standard option, intuition comes from the relationship between delta and the probability of finishing beyond strike. Delta (N(d1) in the Black-Scholes formula) is the hedge ratio of the option but is close enough to the probability of finishing beyond strike for intuition purposes (should really be looking at the strike delta N(d2) in the Blck-Scholes formula).

Consider the following example: EUR/USD, Maturity 3m, Spot 1.1400

When asking for a price for a knockout option you need all the information you would normally need for a standard option and additionally you need to ask for the outstrike price. So you need to ask the client for:

The knockout option can then be priced. The price will normally be quoted in terms of a percentage of one of the face amounts, or in terms of the amount of currency per one unit of the other currency. Unlike standard options, the price cannot be quoted in terms of volatility as unlike standard options there is no one pricing model that everybody uses. If the price was quoted in volatility terms the absolute currency amount of premiums would not always agree. Quotations are always in terms of the actual price.

The price that you receive will be based on the spot price entered into the pricing tool. The price will only be good whilst that spot price can be traded on, as the knockout option will need to be delta hedged. Therefore, the knockout option price can only be held out as long as the spot price can be held out. Normally, an indicative price on a particular spot reference will be given, and then if the client is interested, a firm price will be given based on a live spot price.

Once a trade is completed a confirmation will be faxed to the counterparty within twenty-four hours of the trade. The terms and conditions of the trade will be those of the price maker, in keeping with market convention.

In the next section we continue our introduction to barrier options by looking at barrier option risk characteristics and market impact.