Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

Take Your Learning to the Next Level! See More Content Like This On The New Version Of Perxeive.

Get Early Access And Exclusive Updates: Join the Waitlist Now!

In this section we take a look at the average rate option, a different type of non-vanilla option that is not a barrier option. To get the most from this section you should first have covered the foundational FX options knowledge including the terminology of FX options, looked at some common option strategies and how options are funded and how these funding techniques are used when combining options. It would also be helpful to have covered the sections on knockout options and reverse knockout options.

The average rate option differs from a standard option in the way that the pay-off at expiration is determined. The value of a standard option is determined at expiration by comparing the spot rate to the strike price. The value of an average rate option is determined at expiration by comparing the strike price to an average of spot rates observed over the life of the option. The ARO is cash settled.

ARO spot observations used to determine the average at expiration can be taken on any business day during the life of the option. Observations are taken at pre-specified time on the observation days. Observations are typically taken from reliable Reuters sources such as Federal Reserve page FEDSPOT or the European Central Bank euro FX reference rates page ECB37.

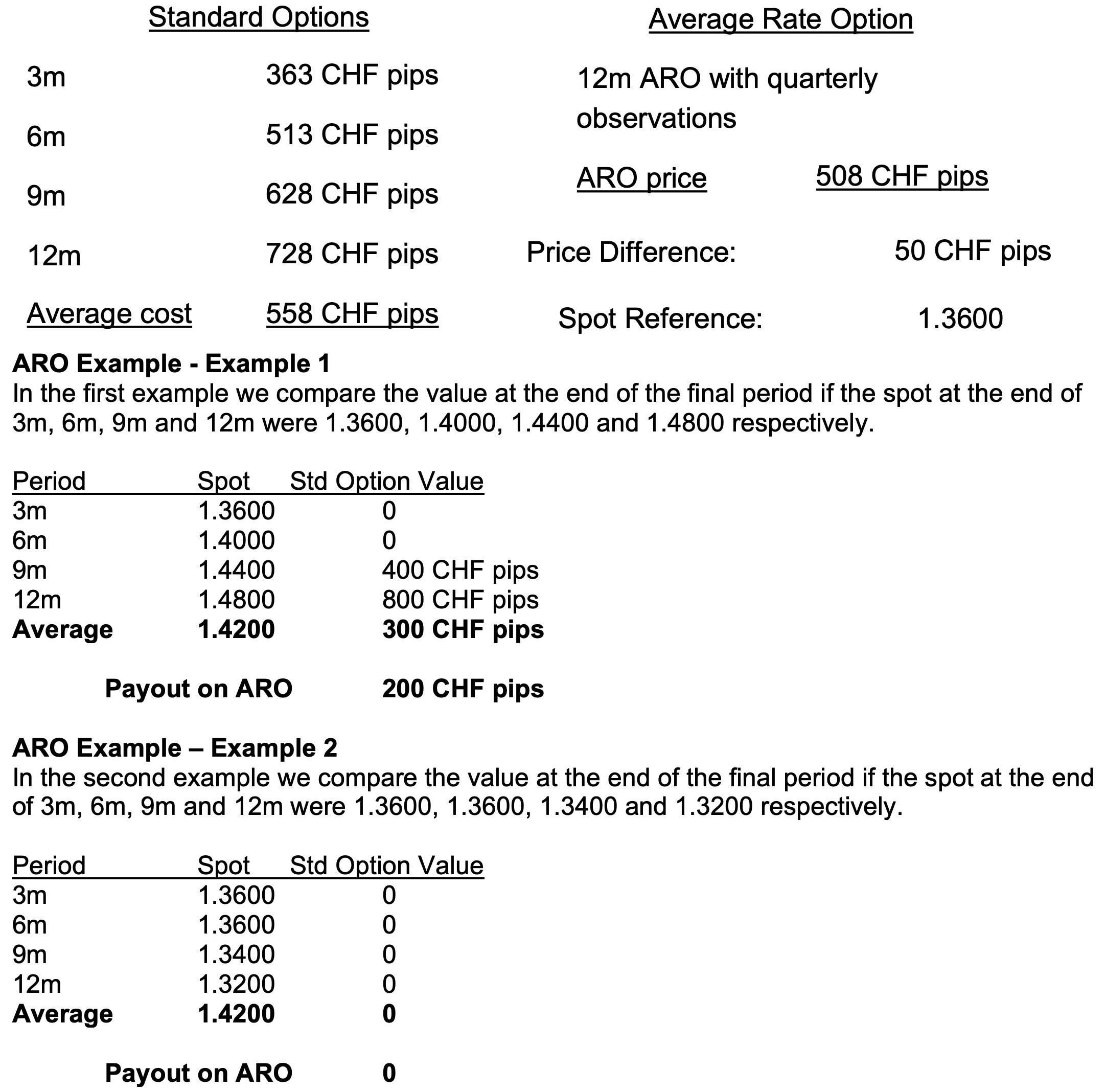

The cost and performance of the ARO should be compared to the performance of a strip of options with the same strike as the ARO. To compare the ARO to a strip of European options the ARO observation dates would coincide with the expiration dates of the strip of European options. The ARO is cash settled into the clients’ currency of account.

A risk manager who has periodic exposures to a particular currency has traditionally hedged using either a strip of forwards, or a strip of options. By the end of the period, the hedging process should have resulted in a certain minimum domestic currency amount being realised. The choice of hedging instrument will depend on the level of protection the strategy provides versus the cost of the strategy. The Average Rate Option exploits the fact that the risk is distributed over time to enable the risk manager to achieve a cost-effective hedge.

Consider a situation where a USD based risk manager has identified a series of quarterly CHF revenues. A rate of 1.4000 has been decided as the required protection level. The choice of hedge has been narrowed down to either a strip of USD call / CHF put options or an ARO.

In the first example the strip of standard options results in a higher return. However, the payout from the ARO exactly off-sets the risk, and meets the required protection level. In the second example, where both the ARO and the strip of options expire worthless, the additional premium paid for the strip has resulted in no greater return. The additional premium paid for the strip of standard options represents the cost of trying to outperform the exposure.

In the next section we continue our introduction to non-vanilla FX options by looking at the basket option.